A deductible is the amount you pay out-of-pocket before insurance coverage begins, while a copay is a fixed fee you pay for specific medical services after meeting your deductible. Learn more about how deductibles and copays affect your healthcare costs in this article.

Table of Comparison

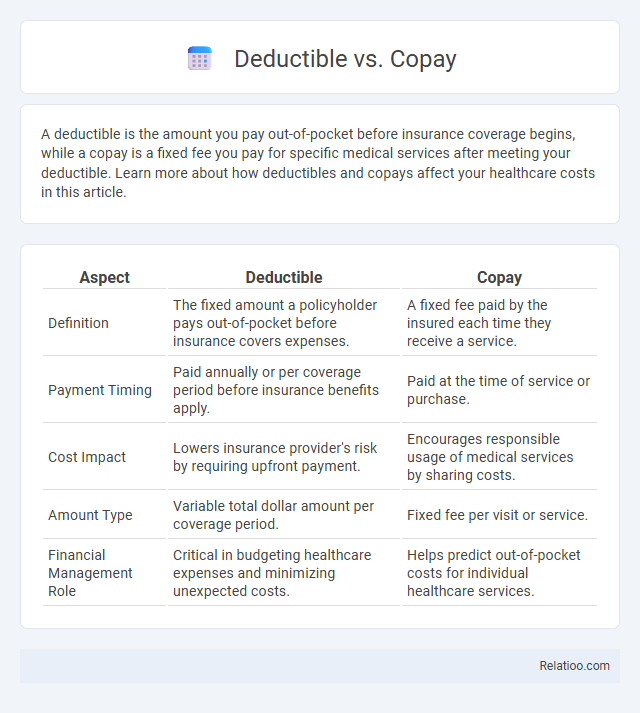

| Aspect | Deductible | Copay |

|---|---|---|

| Definition | The fixed amount a policyholder pays out-of-pocket before insurance covers expenses. | A fixed fee paid by the insured each time they receive a service. |

| Payment Timing | Paid annually or per coverage period before insurance benefits apply. | Paid at the time of service or purchase. |

| Cost Impact | Lowers insurance provider's risk by requiring upfront payment. | Encourages responsible usage of medical services by sharing costs. |

| Amount Type | Variable total dollar amount per coverage period. | Fixed fee per visit or service. |

| Financial Management Role | Critical in budgeting healthcare expenses and minimizing unexpected costs. | Helps predict out-of-pocket costs for individual healthcare services. |

Understanding Health Insurance Basics

Understanding health insurance basics requires distinguishing between deductible, copay, and coinsurance. Your deductible is the amount you pay out-of-pocket before your insurance starts covering expenses, while a copay is a fixed fee you pay for specific services, like doctor visits or prescriptions. Coinsurance represents the percentage of costs you share with your insurer after meeting the deductible, impacting your overall healthcare expenses.

What is a Deductible?

A deductible is the amount you pay out-of-pocket for covered healthcare services before your insurance plan starts to pay. Unlike a copay, which is a fixed fee for specific services, the deductible accumulates annually and must be met before benefits kick in. Understanding your deductible helps you manage your healthcare expenses effectively and avoid unexpected costs.

What is a Copay?

A copay is a fixed amount you pay for a covered healthcare service at the time of receiving care, such as a doctor's visit or prescription medication. Unlike a deductible, which is the total amount you pay out-of-pocket before insurance starts covering expenses, a copay is typically a set fee defined by your insurance plan. Understanding the difference between a copay, deductible, and coinsurance helps you manage your medical costs effectively.

How Deductibles Work in Health Plans

Deductibles in health plans represent the amount a policyholder must pay out-of-pocket for covered medical services before insurance begins to share costs. Unlike copays, which are fixed fees for specific services, deductibles reset annually and can vary widely depending on the plan type, such as HMOs, PPOs, or HDHPs. Understanding how deductibles function is crucial for managing healthcare expenses and choosing the right insurance coverage.

How Copays Work in Health Plans

Copays are fixed amounts paid by insured individuals at the time of receiving medical services, such as doctor visits or prescription medications, designed to share the cost with the insurance provider. Unlike deductibles, which must be fully paid out-of-pocket before insurance coverage begins, copays provide predictable, smaller payments for specific services, often varying by the type of care or provider. Understanding how copays function in health plans helps policyholders manage routine healthcare expenses without depleting their deductible amounts.

Key Differences Between Deductible and Copay

A deductible is the amount You pay out-of-pocket for covered healthcare services before your insurance begins to pay, while a copay is a fixed fee You pay for specific services like doctor visits or prescriptions. Deductibles reset annually and typically apply to a range of medical expenses, whereas copays are consistent fees due at the time of service. Understanding these key differences helps You manage healthcare costs and choose the right insurance plan.

Real-Life Examples: Deductible vs Copay

A deductible is the amount you pay out-of-pocket before your insurance begins to cover expenses, such as paying $1,500 annually for medical services before coverage kicks in, while a copay is a fixed fee you pay per visit or prescription, like a $25 copay for a doctor's appointment. For example, if your plan has a $1,000 deductible and a $20 copay, you pay the full amount for medical bills until the deductible is met, but only the $20 copay for specialist visits afterward. Understanding these costs helps manage healthcare budgets effectively, preventing unexpected bills and ensuring timely medical care.

Which Costs More: Deductible or Copay?

Deductibles typically cost more than copays because they require you to pay a set amount out-of-pocket before insurance coverage begins, often ranging from hundreds to thousands of dollars annually. Copays are fixed fees paid for specific services, usually between $10 and $50, making them more predictable and generally less expensive per visit. Understanding the difference helps manage healthcare expenses effectively, with deductibles impacting overall annual costs while copays affect individual service payments.

Tips for Choosing the Best Health Plan

When choosing the best health plan, carefully compare deductible amounts, copay rates, and coinsurance percentages to match your medical needs and budget. Opt for a plan with a manageable deductible if you anticipate frequent medical visits, and consider lower copays for specialist consultations and prescriptions. Evaluate total out-of-pocket maximums to avoid unexpected expenses and prioritize plans offering wider network coverage and preventive care benefits.

Frequently Asked Questions: Deductible vs Copay

Understanding the difference between deductible and copay is essential for managing your healthcare costs effectively. A deductible is the amount you pay out-of-pocket for covered services before your insurance starts to pay, while a copay is a fixed fee you pay for specific services, such as doctor visits or prescriptions, after meeting your deductible. You can reduce surprise expenses by knowing when each applies and how they impact your total healthcare spending.

Infographic: Deductible vs Copay

relatioo.com

relatioo.com