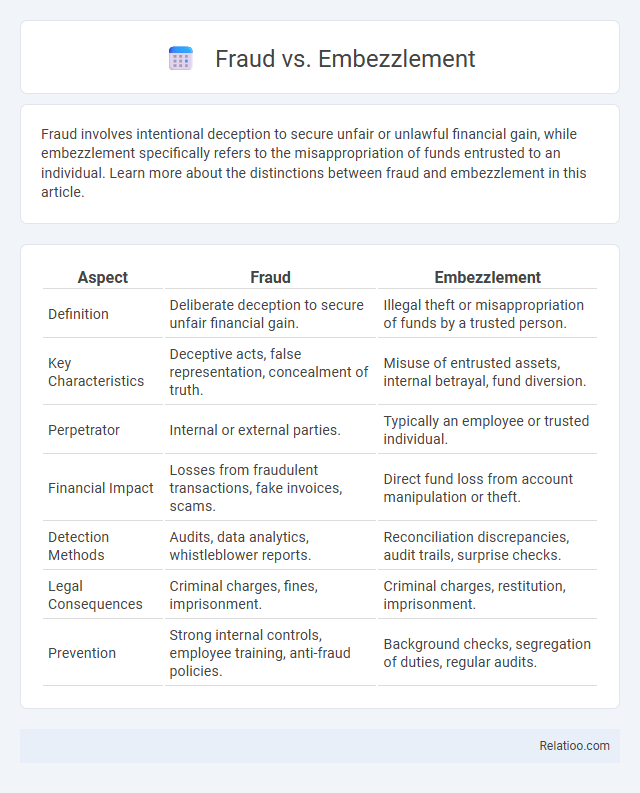

Fraud involves intentional deception to secure unfair or unlawful financial gain, while embezzlement specifically refers to the misappropriation of funds entrusted to an individual. Learn more about the distinctions between fraud and embezzlement in this article.

Table of Comparison

| Aspect | Fraud | Embezzlement |

|---|---|---|

| Definition | Deliberate deception to secure unfair financial gain. | Illegal theft or misappropriation of funds by a trusted person. |

| Key Characteristics | Deceptive acts, false representation, concealment of truth. | Misuse of entrusted assets, internal betrayal, fund diversion. |

| Perpetrator | Internal or external parties. | Typically an employee or trusted individual. |

| Financial Impact | Losses from fraudulent transactions, fake invoices, scams. | Direct fund loss from account manipulation or theft. |

| Detection Methods | Audits, data analytics, whistleblower reports. | Reconciliation discrepancies, audit trails, surprise checks. |

| Legal Consequences | Criminal charges, fines, imprisonment. | Criminal charges, restitution, imprisonment. |

| Prevention | Strong internal controls, employee training, anti-fraud policies. | Background checks, segregation of duties, regular audits. |

Understanding Fraud: Definition and Key Concepts

Fraud involves intentional deception to secure unfair or unlawful financial gain, encompassing a broad range of dishonest activities such as false representation and concealment of facts. Embezzlement is a specific type of fraud where an individual unlawfully takes assets entrusted to them, typically within an organizational context. Understanding fraud requires recognizing its elements: misrepresentation, intent to deceive, reliance by the victim, and resulting damages.

What Is Embezzlement? Scope and Meaning

Embezzlement is a specific type of financial fraud involving the illegal misappropriation or theft of funds placed in one's trust or belonging to an employer or organization. Its scope primarily includes employees, executives, or public officials who divert money or property for personal gain without authorization. Unlike general fraud, which encompasses a wider range of deceptive practices, embezzlement focuses strictly on the breach of fiduciary duty and the conversion of entrusted assets.

Comparing Fraud and Embezzlement: Core Differences

Fraud involves intentional deception to secure unfair or unlawful gain, often affecting multiple victims or organizations through false representations. Embezzlement is a specific type of fraud characterized by the misappropriation or theft of funds entrusted to an individual's care, typically within an employment or fiduciary relationship. The core difference lies in embezzlement's nature of internal trust violation, whereas fraud encompasses a broader spectrum of deceitful activities targeting diverse victims.

Types of Fraud: Common Methods and Examples

Common methods of fraud include identity theft, credit card scams, and insurance fraud, where perpetrators manipulate information for financial gain. Embezzlement involves the misappropriation of funds by individuals in positions of trust, such as employees or executives diverting company assets for personal use. Other types of fraud encompass securities fraud, mortgage fraud, and healthcare fraud, each exploiting specific systems to deceive victims and unlawfully obtain money.

Types of Embezzlement: Typical Scenarios

Types of embezzlement often involve employees diverting company funds for personal use, such as skimming cash from sales or manipulating payroll records. Common scenarios include executives creating fake vendor accounts to issue payments to themselves or employees abusing expense reimbursements by submitting fraudulent invoices. Understanding these typical cases helps you identify and prevent embezzlement within your organization, distinguishing it clearly from general fraud, which may not necessarily involve a breach of trust by an insider.

Legal Consequences: Fraud vs Embezzlement

Fraud and embezzlement both involve deception, but legal consequences differ significantly: fraud typically results in criminal charges with penalties including fines, restitution, and imprisonment, while embezzlement specifically refers to the fraudulent appropriation of funds entrusted to you, often leading to harsher sentences due to breach of trust. Your legal exposure depends on the severity and specifics of the offense, with embezzlement cases frequently prosecuted under theft statutes carrying enhanced penalties. Understanding these distinctions helps in assessing potential risks and defense strategies for either charge.

Signs and Red Flags of Fraud and Embezzlement

Signs of fraud include discrepancies in financial records, unexplained accounting errors, and unusual transactions that lack proper authorization, while embezzlement often involves the misappropriation of funds by employees trusted with access to company assets. Red flags of embezzlement encompass missing or altered documents, sudden lifestyle changes of employees, and frequent overrides of internal controls. Identifying inconsistencies in expense reports, unauthorized wire transfers, and recurring cash shortages are critical indicators that warrant deeper investigation into potential fraudulent or embezzlement activities.

Prevention Strategies for Organizations

Effective prevention strategies for organizations include implementing robust internal controls, such as segregation of duties and regular financial audits, to detect and deter both fraud and embezzlement. Employee training programs focused on ethical behavior and fraud awareness increase vigilance and reduce risk by promoting a culture of accountability. Leveraging advanced data analytics and fraud detection software helps identify suspicious transactions early, mitigating losses across fraud, embezzlement, and related financial crimes.

Notable Cases: Fraud and Embezzlement in the News

Notable cases of fraud often involve large-scale corporate scandals, such as the Enron collapse where executives manipulated financial statements to deceive investors. Embezzlement cases frequently feature trusted employees siphoning funds, exemplified by the scandal involving a city treasurer who diverted millions from public funds for personal use. Your awareness of these high-profile incidents highlights the importance of vigilance in financial oversight to prevent such unlawful activities.

Protecting Your Business from Financial Crimes

Fraud involves intentional deception to secure unfair financial gain, while embezzlement specifically refers to the misappropriation of funds entrusted to you, often by employees or associates. Protecting your business from these financial crimes requires implementing robust internal controls, regular audits, and employee training to detect and prevent suspicious activities. Prioritizing cybersecurity measures and developing a clear reporting system can significantly reduce the risk of both fraud and embezzlement impacting your operations.

Infographic: Fraud vs Embezzlement

relatioo.com

relatioo.com