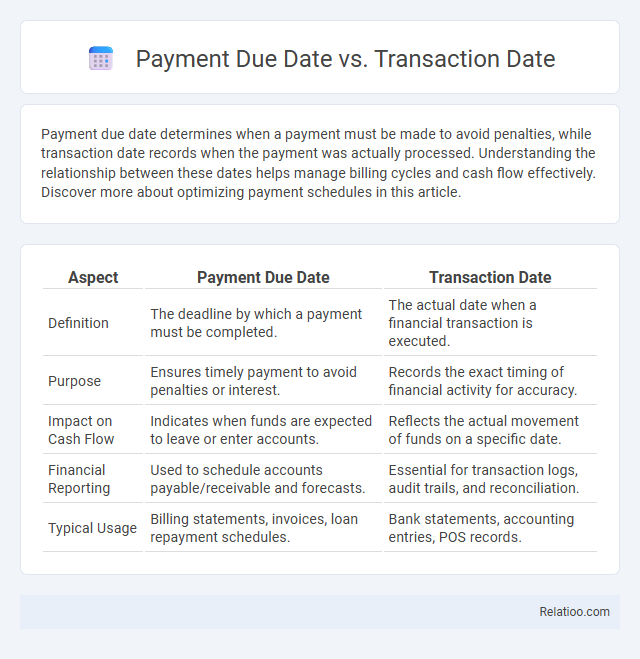

Payment due date determines when a payment must be made to avoid penalties, while transaction date records when the payment was actually processed. Understanding the relationship between these dates helps manage billing cycles and cash flow effectively. Discover more about optimizing payment schedules in this article.

Table of Comparison

| Aspect | Payment Due Date | Transaction Date |

|---|---|---|

| Definition | The deadline by which a payment must be completed. | The actual date when a financial transaction is executed. |

| Purpose | Ensures timely payment to avoid penalties or interest. | Records the exact timing of financial activity for accuracy. |

| Impact on Cash Flow | Indicates when funds are expected to leave or enter accounts. | Reflects the actual movement of funds on a specific date. |

| Financial Reporting | Used to schedule accounts payable/receivable and forecasts. | Essential for transaction logs, audit trails, and reconciliation. |

| Typical Usage | Billing statements, invoices, loan repayment schedules. | Bank statements, accounting entries, POS records. |

Understanding Payment Due Date

The Payment Due Date is the specific deadline by which Your payment must be received to avoid penalties or interest charges, distinguishing it from the Transaction Date, which marks when the purchase was made. Unlike Payment Due, which can refer to the amount owed, the Payment Due Date solely defines the time frame for settling that amount. Understanding the Payment Due Date is crucial for maintaining good credit standing and managing cash flow effectively.

Defining Transaction Date

The transaction date refers to the exact day when a financial operation, such as a purchase or payment, is initiated and recorded. Payment due date indicates the deadline by which your payment must be completed to avoid penalties or interest charges. Understanding the transaction date helps you track expenses precisely and align them with your payment due schedule for accurate budget management.

Key Differences Between Payment Due Date and Transaction Date

The Payment Due Date is the deadline by which a payment must be made to avoid penalties or interest charges, reflecting the contractual obligation between payer and creditor. The Transaction Date marks the exact day when a purchase or financial operation is executed, serving as the reference point for recording and processing the transaction. Unlike the Payment Due Date, which impacts cash flow management and credit standing, the Transaction Date primarily records the timing of the expenditure or income event.

Importance of Payment Due Date in Financial Management

The Payment Due Date is a critical financial metric that determines when a payment must be completed to avoid penalties or interest charges, directly impacting cash flow management and credit standing. Unlike the Transaction Date, which records when the payment was initiated or a purchase was made, the Payment Due Date sets the deadline for fulfilling financial obligations, ensuring timely budget planning and debt management. Effective monitoring of the Payment Due Date helps businesses and individuals maintain financial discipline, prevent late fees, and optimize overall financial health.

How Transaction Date Affects Account Balances

Transaction Date directly impacts your account balances by determining when funds are either credited or debited, reflecting real-time financial activity. Unlike Payment Due Date or Payment Due, the Transaction Date marks the actual moment a transaction is recorded, influencing your current available balance and overall cash flow. Accurate tracking of transaction dates ensures effective management of funds and prevents overdrafts or delayed payments.

Common Confusions: Payment Due Date vs Transaction Date

Payment Due Date refers to the deadline by which a payment must be made to avoid penalties, while Transaction Date is the actual date when a payment or purchase occurs. Common confusions arise because Transaction Date records when a charge is posted, but the Payment Due Date is set by the billing cycle and may be weeks later. Understanding these distinct dates is crucial for managing credit card balances and avoiding late fees.

Implications for Credit Card Holders

Payment Due Date represents the deadline by which credit card holders must make at least the minimum payment to avoid late fees and negative impacts on credit scores. Transaction Date reflects the exact day purchases or payments are recorded but does not affect the timing for required payments. Understanding the difference is crucial for managing cash flow, preventing interest charges, and maintaining a positive credit history.

Impact on Bank Statements and Records

The Payment Due Date determines when the payment must be received to avoid penalties, impacting how banks record overdue statuses on statements. The Transaction Date reflects when the payment was initiated, influencing the posting date on bank records and affecting daily balance calculations. Payment Due indicates the deadline for settling balances but may not coincide with the transaction date, causing discrepancies between expected and actual account activity in bank statements.

Tips for Managing Payment Due Dates

Understanding the difference between Payment Due Date, Transaction Date, and Payment Due can help you effectively manage your finances. The Payment Due Date is the deadline by which your payment must be received to avoid penalties, while the Transaction Date refers to when a purchase or charge was made. To manage your Payment Due Dates efficiently, you can set reminders aligned with your billing cycle and prioritize payments based on their due dates to maintain a positive credit score and avoid late fees.

Frequently Asked Questions about Payment and Transaction Dates

Payment Due Date is the deadline by which Your payment must be received to avoid late fees, while Transaction Date refers to the actual day the payment or purchase was processed. Payment Due represents the amount owed on Your billing statement that must be paid by the Due Date. Frequently asked questions often revolve around how these dates impact account balances and the timing of payments to maintain good credit standing.

Infographic: Payment Due Date vs Transaction Date

relatioo.com

relatioo.com