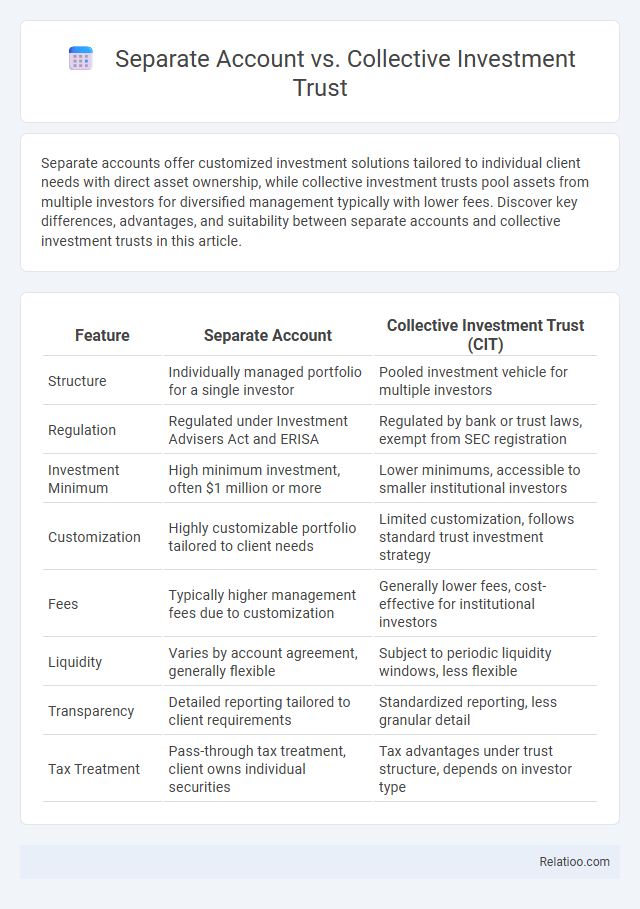

Separate accounts offer customized investment solutions tailored to individual client needs with direct asset ownership, while collective investment trusts pool assets from multiple investors for diversified management typically with lower fees. Discover key differences, advantages, and suitability between separate accounts and collective investment trusts in this article.

Table of Comparison

| Feature | Separate Account | Collective Investment Trust (CIT) |

|---|---|---|

| Structure | Individually managed portfolio for a single investor | Pooled investment vehicle for multiple investors |

| Regulation | Regulated under Investment Advisers Act and ERISA | Regulated by bank or trust laws, exempt from SEC registration |

| Investment Minimum | High minimum investment, often $1 million or more | Lower minimums, accessible to smaller institutional investors |

| Customization | Highly customizable portfolio tailored to client needs | Limited customization, follows standard trust investment strategy |

| Fees | Typically higher management fees due to customization | Generally lower fees, cost-effective for institutional investors |

| Liquidity | Varies by account agreement, generally flexible | Subject to periodic liquidity windows, less flexible |

| Transparency | Detailed reporting tailored to client requirements | Standardized reporting, less granular detail |

| Tax Treatment | Pass-through tax treatment, client owns individual securities | Tax advantages under trust structure, depends on investor type |

Introduction to Separate Accounts and Collective Investment Trusts

Separate accounts provide individualized investment portfolios managed exclusively for a single client, offering tailored asset allocation and personalized tax benefits. Collective investment trusts pool assets from multiple investors into a single trust, managed by a bank or trust company, often featuring lower fees and streamlined regulatory oversight compared to mutual funds. Both structures serve institutional investors, but separate accounts offer greater customization while collective investment trusts emphasize cost efficiency and simplicity.

Key Features of Separate Accounts

Separate accounts offer personalized investment management tailored to an individual investor's specific goals and risk tolerance, distinct from pooled assets found in collective investment trusts or mutual funds. They provide greater transparency and control over holdings, allowing investors to customize portfolio allocations and avoid unwanted securities. Unlike collective investment trusts, separate accounts often feature direct ownership of underlying assets and potentially lower fees due to the absence of intermediary management layers.

Key Features of Collective Investment Trusts

Collective Investment Trusts (CITs) are pooled investment vehicles typically offered by banks or trust companies, featuring lower fees and less regulatory oversight compared to mutual funds or separate accounts, which can benefit Your retirement plan by reducing costs. CITs provide access to institutional-quality investment strategies with flexible investment options and are only available to qualified retirement plans, unlike separate accounts that serve individual investors with customized portfolios. Their key features include collective pooling of assets, cost efficiency, and regulatory exemption under ERISA, making them an attractive option for large plan sponsors seeking tailored investment solutions.

Regulatory Framework Comparison

Separate Accounts operate under the Investment Advisers Act of 1940, offering individualized portfolio management tailored to specific client mandates, with regulatory oversight emphasizing fiduciary duty and transparency. Collective Investment Trusts (CITs) are regulated primarily by the Office of the Comptroller of the Currency (OCC) and are exempt from the Investment Company Act of 1940, allowing for reduced regulatory burdens and operational flexibility within tax-qualified retirement plans. Separate Accounts under insurance companies fall under state insurance regulations, governed by state insurance departments, providing distinct regulatory requirements focused on solvency and fiduciary responsibilities specific to insurance products.

Investment Customization: Separate Account vs CIT

Separate accounts offer high investment customization, allowing investors to tailor portfolios with specific securities and strategies aligned to individual goals and risk tolerance. Collective Investment Trusts (CITs) provide pooled investment vehicles with limited customization, focusing on economies of scale and cost efficiency rather than personalized asset selection. Separate accounts excel in flexibility and bespoke management, whereas CITs prioritize standardized investment options suitable for larger groups with uniform requirements.

Cost Structure Differences

Separate accounts typically involve higher management fees due to personalized portfolio customization and direct ownership of assets, leading to increased administrative costs. Collective Investment Trusts (CITs) generally offer lower expense ratios by pooling assets within a bank-trusteed fund, benefiting from economies of scale and reduced regulatory burdens compared to mutual funds. Mutual funds often have higher costs than CITs but can be more expensive than separate accounts for large, customized portfolios, as they include marketing and distribution expenses alongside management fees.

Transparency and Reporting

Separate accounts offer greater transparency and detailed reporting by providing clients with direct ownership of underlying assets and customized portfolio disclosures. Collective Investment Trusts (CITs) typically provide less granular reporting, relying on pooled asset summaries and standardized statements, which may limit detailed transparency. While separate accounts enable tailored, frequent performance and holdings reports, CITs' reporting is more aggregated, influencing investors' ability to monitor specific asset-level details.

Suitability for Institutional Investors

Separate accounts offer institutional investors customized investment strategies with full transparency and direct ownership of securities, making them highly suitable for tailored risk and return objectives. Collective Investment Trusts provide cost-effective pooled investment options with lower fees and regulatory requirements but less customization, appealing to institutions seeking efficiency and broad diversification. Your choice depends on the need for control versus cost savings, with separate accounts best for personalized management and CITs suitable for scalable, standardized investment solutions.

Performance Considerations

Separate accounts typically offer customized investment strategies tailored to individual client goals, often resulting in potentially higher performance aligned with specific risk tolerance. Collective Investment Trusts (CITs) provide cost-efficient access to diversified portfolios managed by institutional managers but may lack the personalization found in separate accounts, which can impact performance outcomes. Comparing performance, separate accounts often outperform CITs due to customization and direct management, while collective investment trusts benefit from economies of scale that can enhance net returns through lower fees.

Choosing Between Separate Account and Collective Investment Trust

Choosing between a Separate Account and a Collective Investment Trust hinges on customization, cost, and regulatory oversight. Separate Accounts offer tailored investment strategies with direct ownership, ideal for institutional investors seeking control and transparency, while Collective Investment Trusts pool assets from multiple investors, providing lower fees and exemption from SEC registration but with less individual customization. Evaluating fiduciary preferences and investment goals ensures the optimal alignment between personalized management and cost-efficiency in selecting the appropriate investment vehicle.

Infographic: Separate Account vs Collective Investment Trust

relatioo.com

relatioo.com