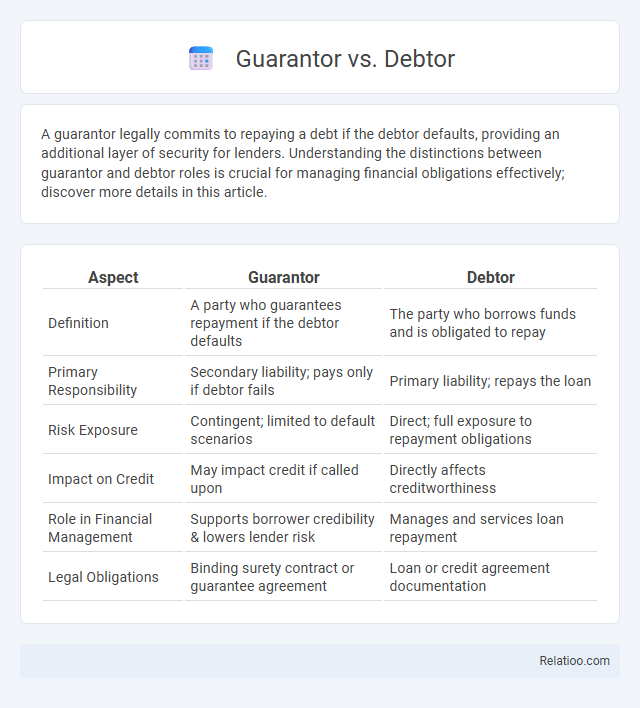

A guarantor legally commits to repaying a debt if the debtor defaults, providing an additional layer of security for lenders. Understanding the distinctions between guarantor and debtor roles is crucial for managing financial obligations effectively; discover more details in this article.

Table of Comparison

| Aspect | Guarantor | Debtor |

|---|---|---|

| Definition | A party who guarantees repayment if the debtor defaults | The party who borrows funds and is obligated to repay |

| Primary Responsibility | Secondary liability; pays only if debtor fails | Primary liability; repays the loan |

| Risk Exposure | Contingent; limited to default scenarios | Direct; full exposure to repayment obligations |

| Impact on Credit | May impact credit if called upon | Directly affects creditworthiness |

| Role in Financial Management | Supports borrower credibility & lowers lender risk | Manages and services loan repayment |

| Legal Obligations | Binding surety contract or guarantee agreement | Loan or credit agreement documentation |

Understanding the Roles: Guarantor vs Debtor

Understanding the roles of guarantor and debtor is crucial in financial agreements where the debtor is primarily responsible for repaying the loan, while the guarantor provides a secondary promise to pay if the debtor defaults. Your role as a guarantor involves assuming liability only when the debtor fails to meet payment obligations, thereby reducing the lender's risk and increasing loan approval chances. Clear distinctions between these roles protect your financial interests and define each party's responsibilities in the lending process.

Legal Definitions: Who is a Guarantor? Who is a Debtor?

A Guarantor is a person or entity legally obligated to fulfill the debt repayment if the primary Debtor defaults. The Debtor is the individual or organization that initially borrows money or incurs a debt under a contract or loan agreement. Legal frameworks define the Guarantor's role as a secondary liable party, ensuring creditor protection by providing a guarantee for the Debtor's financial obligations.

Key Differences Between Guarantor and Debtor

The debtor is the primary party responsible for repaying a loan or fulfilling an obligation, while the guarantor provides a secondary promise to pay if the debtor defaults. The guarantor's liability is contingent, meaning they only become liable after the debtor fails to meet the terms of the agreement. Unlike the debtor, whose creditworthiness is evaluated directly by lenders, the guarantor's role is to provide additional security without inital financial responsibility.

Responsibilities and Obligations of a Debtor

The debtor holds the primary responsibility of repaying the loan or fulfilling the financial obligation as stipulated in the contract. Your obligation includes making timely payments and adhering to the terms agreed upon with the creditor, ensuring the debt does not default. In contrast, the guarantor acts as a backup payer, only responsible if the debtor fails to meet these obligations.

Duties and Liabilities of a Guarantor

The guarantor assumes responsibility to fulfill the debtor's obligation if the debtor defaults, making their duties contingent yet critical in securing the debt. Your primary liability as a guarantor includes settling the debt upon the debtor's failure, potentially exposing you to the full financial obligation without direct benefit. Unlike debtors who owe the principal debt, guarantors act as secondary obligors, ensuring the creditor is protected through a legally binding guarantee.

Legal Rights: Guarantor’s Protections vs Debtor’s Rights

Legal rights differ significantly between guarantors and debtors, with guarantors protected under laws that require clear notification and the opportunity to contest claims before their credit or assets are affected. Your rights as a debtor include defenses such as challenging the validity of the debt, requesting fair repayment terms, and protection against unfair collection practices. Guarantors typically benefit from subrogation rights, allowing them to seek reimbursement from the debtor once they fulfill the debt obligation.

Financial Impact: Risks for Guarantors and Debtors

Guarantors face significant financial risks as they become liable for the debtor's obligations if payments default, potentially impacting their credit score and financial stability. Debtors carry the primary responsibility for loan repayment, with default leading to direct consequences such as penalties, increased interest rates, and damage to credit history. Understanding your role in these agreements is critical, as the financial impact on guarantors can be severe, often requiring repayment of full debt amounts while debtors manage ongoing loan terms and risks.

Common Scenarios Requiring a Guarantor

Common scenarios requiring a guarantor include securing rental agreements, obtaining student loans, and qualifying for personal or business loans when the debtor lacks sufficient credit history or income stability. A guarantor legally agrees to repay the debt if the debtor defaults, providing lenders or landlords with added financial security. Unlike the debtor, who is the primary borrower responsible for the loan, the guarantor acts as a backup payer to mitigate risk in credit or lease agreements.

Termination of Liability: Guarantor vs Debtor

Termination of liability for a debtor occurs when the principal obligation is fully discharged through payment or fulfillment of contractual terms. For a guarantor, liability ends only after the principal debtor's obligation is completely satisfied or the guarantee contract is lawfully revoked. You should understand that a guarantor's termination of liability depends on the debtor's default status and adherence to the specific terms outlined in the guarantee agreement.

Choosing Wisely: Should You Be a Guarantor or a Debtor?

Choosing wisely between being a guarantor or a debtor involves understanding your financial responsibilities and risks. As a guarantor, you promise to repay a loan if the debtor defaults, which can impact your credit and assets, while as a debtor, you are directly responsible for the loan repayment and managing your credit score. Your decision should factor in your financial stability, trust in the debtor, and ability to bear potential liabilities to avoid jeopardizing your financial future.

Infographic: Guarantor vs Debtor

relatioo.com

relatioo.com