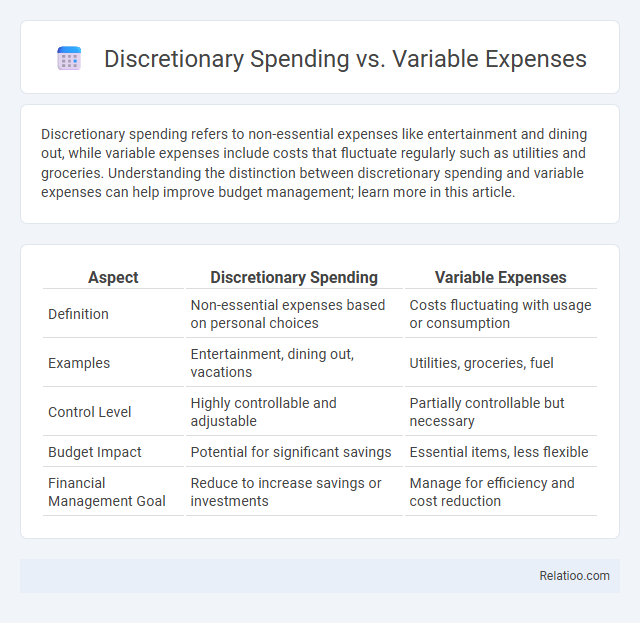

Discretionary spending refers to non-essential expenses like entertainment and dining out, while variable expenses include costs that fluctuate regularly such as utilities and groceries. Understanding the distinction between discretionary spending and variable expenses can help improve budget management; learn more in this article.

Table of Comparison

| Aspect | Discretionary Spending | Variable Expenses |

|---|---|---|

| Definition | Non-essential expenses based on personal choices | Costs fluctuating with usage or consumption |

| Examples | Entertainment, dining out, vacations | Utilities, groceries, fuel |

| Control Level | Highly controllable and adjustable | Partially controllable but necessary |

| Budget Impact | Potential for significant savings | Essential items, less flexible |

| Financial Management Goal | Reduce to increase savings or investments | Manage for efficiency and cost reduction |

Understanding Discretionary Spending

Discretionary spending refers to non-essential expenses that individuals or households choose based on personal preferences, such as dining out, entertainment, and vacations, distinguishing it from variable expenses that fluctuate monthly but are necessary, like groceries and utilities. Understanding discretionary spending is crucial for effective budgeting because it highlights areas where one can cut costs without impacting basic living standards. Managing this type of spending helps increase savings and control debt by prioritizing needs over wants.

Defining Variable Expenses

Variable expenses fluctuate based on consumption and usage, such as utilities, groceries, and fuel costs, which differ each month depending on lifestyle and needs. Discretionary spending refers specifically to non-essential purchases like entertainment, dining out, and luxury items, whereas fixed expenses remain constant, including rent and insurance premiums. Understanding the distinction between variable expenses and discretionary spending is crucial for effective budgeting and financial planning.

Key Differences Between Discretionary and Variable Expenses

Discretionary spending refers to non-essential expenses like entertainment or dining out, which you can adjust based on your budget. Variable expenses fluctuate monthly but include necessary costs such as utilities, groceries, and transportation, tied directly to your lifestyle and consumption. Understanding the key differences helps you prioritize mandatory variable costs while managing discretionary spending to optimize your financial health.

Common Examples of Discretionary Spending

Common examples of discretionary spending include dining out, entertainment, hobbies, vacations, and luxury purchases, which differ from variable expenses that fluctuate monthly but are often essential, such as groceries, utilities, and transportation. Discretionary spending is distinct from fixed expenses because it is non-essential and can be adjusted or eliminated to meet budgetary goals. Understanding these distinctions helps in effective financial planning and expense management.

Typical Variable Expenses in a Household Budget

Typical variable expenses in a household budget include utility bills, groceries, transportation costs, and entertainment, which fluctuate monthly based on usage and lifestyle choices. Discretionary spending refers to non-essential expenses such as dining out, vacations, and hobbies, allowing you greater control over your budget flexibility. Understanding these categories helps you manage your finances effectively by distinguishing necessary variable costs from optional discretionary expenditures.

The Role of Discretionary Spending in Financial Planning

Discretionary spending plays a crucial role in financial planning by allowing you to allocate funds for non-essential items, distinguishing it from variable expenses that cover necessary but fluctuating costs like utilities or groceries. Understanding the difference helps optimize your budget, ensuring essential needs are met while managing lifestyle choices effectively. Balancing discretionary spending with fixed and variable expenses supports long-term financial goals and emergency savings.

How Variable Expenses Impact Monthly Budgets

Variable expenses, such as utility bills, groceries, and transportation costs, fluctuate monthly and directly influence the flexibility of a monthly budget. Unlike fixed discretionary spending, which is planned and consistent, variable expenses require continuous monitoring to avoid overspending. Managing variable expenses effectively helps maintain financial stability by aligning spending with income changes and unexpected costs.

Strategies to Manage Discretionary Spending

Effective management of discretionary spending involves creating a detailed budget that distinguishes it from variable expenses, such as utilities or groceries, which fluctuate but are necessary. You can implement strategies like setting spending limits, prioritizing wants versus needs, and tracking purchases to prevent overspending on non-essential items. Utilizing apps or financial tools to monitor your discretionary expenses helps maintain control over your budget and promotes better saving habits.

Tips for Tracking and Reducing Variable Expenses

Tracking and reducing variable expenses requires detailed budgeting and regular expense categorization to identify patterns and areas for adjustment. Utilize tools like expense tracking apps or spreadsheets to monitor fluctuations in costs related to utilities, groceries, and entertainment, enabling targeted spending cuts. Prioritize setting monthly limits and distinguishing non-essential variable expenses from discretionary spending to optimize financial control and maximize savings.

Balancing Discretionary Spending and Variable Expenses for Financial Health

Balancing discretionary spending and variable expenses is crucial for maintaining financial health by ensuring that flexible costs like entertainment and dining out do not exceed essential fluctuating expenses such as utilities and groceries. Monitoring discretionary spending allows for better control over non-essential purchases, while managing variable expenses helps accommodate unavoidable monthly changes without compromising savings goals. Effective budgeting techniques that differentiate and prioritize these expenses can optimize cash flow and enhance overall financial stability.

Infographic: Discretionary Spending vs Variable Expenses

relatioo.com

relatioo.com