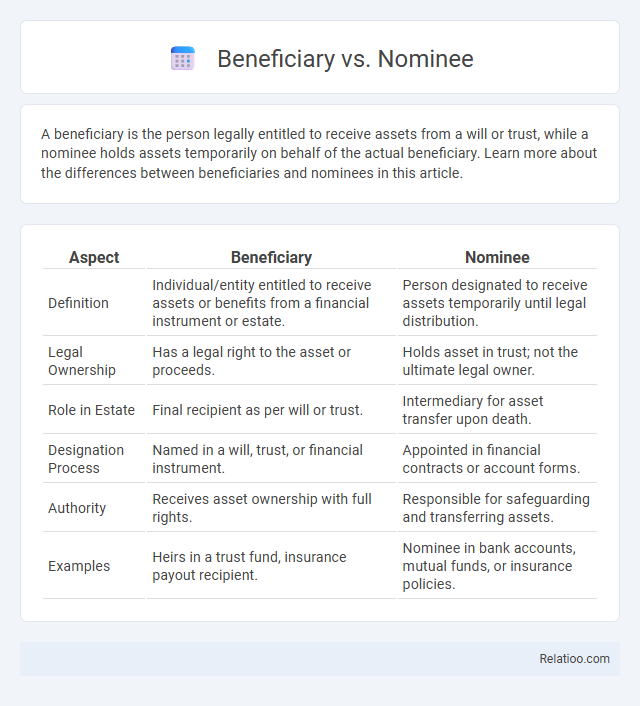

A beneficiary is the person legally entitled to receive assets from a will or trust, while a nominee holds assets temporarily on behalf of the actual beneficiary. Learn more about the differences between beneficiaries and nominees in this article.

Table of Comparison

| Aspect | Beneficiary | Nominee |

|---|---|---|

| Definition | Individual/entity entitled to receive assets or benefits from a financial instrument or estate. | Person designated to receive assets temporarily until legal distribution. |

| Legal Ownership | Has a legal right to the asset or proceeds. | Holds asset in trust; not the ultimate legal owner. |

| Role in Estate | Final recipient as per will or trust. | Intermediary for asset transfer upon death. |

| Designation Process | Named in a will, trust, or financial instrument. | Appointed in financial contracts or account forms. |

| Authority | Receives asset ownership with full rights. | Responsible for safeguarding and transferring assets. |

| Examples | Heirs in a trust fund, insurance payout recipient. | Nominee in bank accounts, mutual funds, or insurance policies. |

Understanding the Concepts: Beneficiary vs Nominee

A beneficiary is an individual or entity legally entitled to receive assets or benefits from a will, trust, or insurance policy, while a nominee is appointed to act on behalf of the beneficiary, often holding assets temporarily or facilitating the transfers. Understanding the distinction is crucial since the nominee does not have ownership rights but serves as a trustee or representative until the beneficiary claims the assets. Your clarity on these roles ensures proper estate planning and smooth asset distribution.

Key Differences Between a Beneficiary and a Nominee

A beneficiary is the person legally entitled to receive assets from a will, trust, or insurance policy upon the grantor's death, while a nominee is appointed to temporarily hold or manage assets on behalf of the actual beneficiary until formal transfer can occur. Key differences between a beneficiary and a nominee include legal ownership rights, with beneficiaries having direct ownership claims and nominees acting merely as custodians without claiming ownership. Nominees often serve administrative or procedural purposes, whereas beneficiaries have a substantive entitlement to the benefits or property.

Legal Rights: Beneficiary vs Nominee Explained

A beneficiary holds a legally enforceable right to claim assets or benefits from a will, trust, or insurance policy upon the grantor's death, while a nominee primarily acts as a custodian or trustee without ownership rights, often appointed for administrative convenience. Your legal standing as a beneficiary ensures direct entitlement to inheritances, whereas nominees facilitate smooth asset transfer but do not have personal claims. Understanding these distinctions is crucial for estate planning, as beneficiaries possess enforceable legal rights, unlike nominees who serve more as intermediaries.

Role of a Beneficiary in Financial Instruments

The role of a beneficiary in financial instruments involves receiving assets, proceeds, or benefits specified in legal documents like wills, trusts, or insurance policies upon the grantor's death or contract maturity. Unlike a nominee who merely holds assets temporarily or acts as a representative, the beneficiary has the legal right to claim ownership or benefits definitively. Clarifying the distinction between beneficiary and nominee is crucial for effective estate planning and asset management to ensure proper transfer and protection of financial interests.

Responsibilities and Limitations of a Nominee

A nominee acts as a custodian or trustee to hold assets on behalf of the beneficiary but does not have ownership rights or the ability to claim the assets personally. Your nominee's responsibility is limited to safeguarding and transferring the assets efficiently to the rightful beneficiary upon your demise or specified event. Unlike beneficiaries, nominees cannot assert any legal claims over the asset and are bound by the terms set out in the will or legal documentation.

Importance of Correctly Designating Beneficiaries and Nominees

Correctly designating beneficiaries and nominees ensures that Your assets and insurance proceeds are distributed according to Your wishes, minimizing legal disputes and delays. Beneficiaries hold the right to receive benefits directly, while nominees act as custodians or representatives to claim assets on behalf of the actual beneficiaries, making accurate designation vital to avoid confusion. Proper designation safeguards Your loved ones' financial security and streamlines the claim process with financial institutions and legal entities.

Common Myths About Nominees and Beneficiaries

Nominees and beneficiaries differ significantly in legal terms, with beneficiaries holding ownership rights over assets, while nominees act merely as custodians until the asset is transferred. A common myth is that nominees inherit assets directly, but your legal claim depends on the beneficiary designation, not just the nominee appointment. Clarity in documentation is essential to ensure your intended beneficiaries receive the rightful benefits without legal disputes.

Implications in Life Insurance: Beneficiary vs Nominee

In life insurance, the beneficiary is the individual or entity entitled to receive the policy proceeds upon the insured's death, holding full legal rights to claim the amount. The nominee acts as a custodian appointed to receive the insurance claim amount on behalf of the beneficiary, often without ownership or direct entitlement to the funds. Understanding the difference is crucial, as beneficiaries have enforceable rights over the payout, whereas nominees function primarily as intermediaries in claim distribution.

Estate Planning: Impact of Beneficiary and Nominee Designation

In estate planning, the designation of beneficiaries and nominees determines the distribution of your assets upon death, with beneficiaries having a direct claim to the property, while nominees typically act as custodians until the formal transfer is completed. Beneficiary designations override wills for accounts like insurance policies and retirement funds, ensuring a faster transfer, whereas nominees may not have ownership rights but facilitate asset management during probate. Understanding the distinctions helps you minimize legal complications and ensures your estate is allocated according to your intentions.

How to Update Beneficiary and Nominee Details Properly

To update beneficiary and nominee details properly, you must first contact your insurance company or financial institution directly, either through their official website, customer service, or by submitting a physical form. Ensure all required identification documents and consent forms are accurately completed and signed to avoid any processing delays. You should review these details periodically to keep your nominations current and reflective of your latest intentions.

Infographic: Beneficiary vs Nominee

relatioo.com

relatioo.com