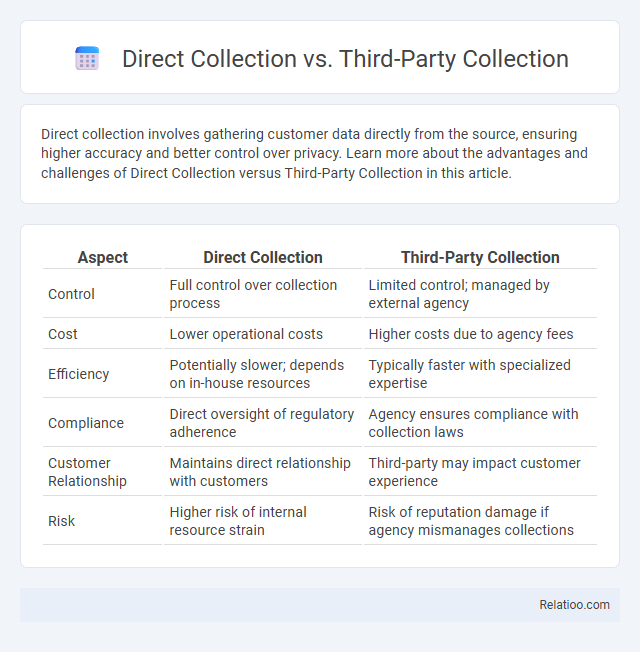

Direct collection involves gathering customer data directly from the source, ensuring higher accuracy and better control over privacy. Learn more about the advantages and challenges of Direct Collection versus Third-Party Collection in this article.

Table of Comparison

| Aspect | Direct Collection | Third-Party Collection |

|---|---|---|

| Control | Full control over collection process | Limited control; managed by external agency |

| Cost | Lower operational costs | Higher costs due to agency fees |

| Efficiency | Potentially slower; depends on in-house resources | Typically faster with specialized expertise |

| Compliance | Direct oversight of regulatory adherence | Agency ensures compliance with collection laws |

| Customer Relationship | Maintains direct relationship with customers | Third-party may impact customer experience |

| Risk | Higher risk of internal resource strain | Risk of reputation damage if agency mismanages collections |

Introduction to Debt Collection Methods

Direct Collection involves your internal team managing debt recovery, offering personalized communication and immediate control over the process. Third-Party Collection employs external agencies specializing in debt recovery, leveraging their expertise and resources to improve collection rates while reducing your operational burden. Collection strategies vary based on the debtor's profile, outstanding amount, and business policies, ensuring tailored approaches for effective debt resolution.

What is Direct Collection?

Direct Collection involves your organization managing the entire debt recovery process internally, allowing for greater control over communication and client relationships. This method enhances transparency and reduces reliance on external agencies, leading to potentially lower costs and personalized negotiation strategies. Choosing Direct Collection ensures you maintain direct oversight of your accounts receivable and customer interactions.

What is Third-Party Collection?

Third-party collection involves outsourcing debt recovery to an external agency specializing in collecting overdue payments on behalf of creditors. Unlike direct collection, where the original creditor pursues payment, third-party collectors operate independently to contact debtors and negotiate settlements. This method helps businesses reduce internal costs and improve recovery rates while maintaining regulatory compliance.

Key Differences Between Direct and Third-Party Collection

Direct collection involves businesses managing their own debt recovery process, allowing for greater control over customer communication and brand reputation. Third-party collection uses external agencies to recover debts, often resulting in faster collections but less control and potential risks to customer relationships. Key differences include cost structure, level of control, and impact on customer experience, with direct collection favoring personalized engagement and third-party collection prioritizing efficiency.

Pros and Cons of Direct Collection

Direct collection offers you full control over customer interactions and payment processing, enhancing personalized service and faster dispute resolution. However, it requires significant internal resources, including trained staff and compliant infrastructure, which can increase operational costs. Compared to third-party collection, direct collection reduces dependency but may face challenges in scaling and managing complex delinquency cases.

Pros and Cons of Third-Party Collection

Third-party collection agencies offer specialized expertise and can improve recovery rates by leveraging established networks, reducing your administrative burden and allowing you to focus on core business activities. However, outsourcing collections may lead to less control over customer interactions and potential reputational risks if the agency uses aggressive tactics. Balancing cost-effectiveness with the need to maintain positive customer relationships is crucial when deciding whether third-party collection services align with your business goals.

Legal and Compliance Considerations

Direct collection involves organizations obtaining data directly from individuals, ensuring full compliance with data protection regulations such as GDPR and CCPA by maintaining transparent consent mechanisms and secure data handling practices. Third-party collection introduces added risk factors related to data privacy and regulatory oversight, requiring stringent vetting of external vendors to comply with legal standards like the Fair Debt Collection Practices Act (FDCPA) and adherence to cross-border data transfer laws. Collection activities must prioritize documented consent, accurate record-keeping, and adherence to jurisdiction-specific compliance mandates to mitigate liability and safeguard consumer rights.

Cost Comparison: Direct vs Third-Party Collection

Direct collection minimizes intermediary fees, resulting in lower overall costs for businesses compared to third-party collection agencies. Third-party collections often incur higher expenses due to commission-based fees, which can range from 20% to 50% of the recovered amount. Companies should weigh immediate cost savings from direct collection against the potentially higher recovery rates and operational efficiencies offered by third-party services.

Choosing the Right Collection Approach

Choosing the right collection approach depends on your business goals, resources, and customer relationship priorities. Direct collection allows you to maintain control over communication and data, enhancing personalization and brand loyalty, while third-party collection agencies offer expertise and efficiency in recovering overdue accounts with less internal effort. Evaluating the cost-effectiveness, compliance requirements, and potential impact on customer experience will help you determine whether direct collection, third-party collection, or a hybrid strategy is best for your debt recovery process.

Conclusion: Which Collection Method is Best?

Direct collection offers greater control and faster resolution by handling payments in-house, making it ideal for businesses prioritizing customer relationships. Third-party collection agencies bring expertise and resources for difficult accounts but may impact customer goodwill. Your best choice depends on balancing cost, control, and customer experience to optimize cash flow and maintain long-term client trust.

Infographic: Direct Collection vs Third-Party Collection

relatioo.com

relatioo.com