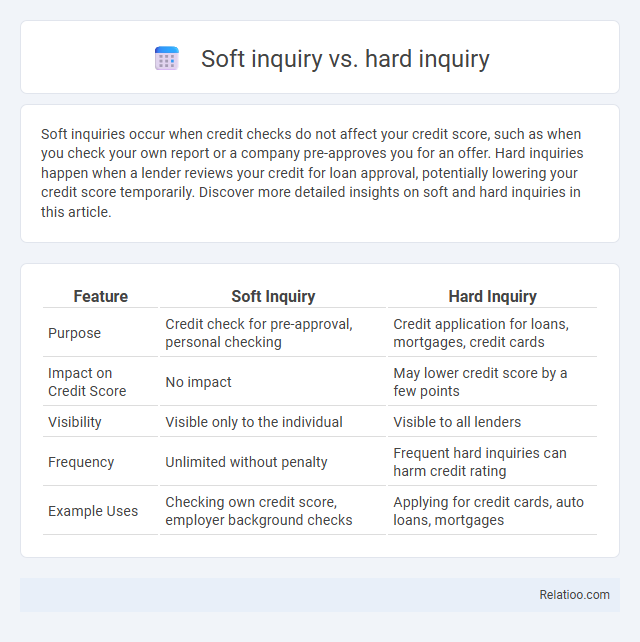

Soft inquiries occur when credit checks do not affect your credit score, such as when you check your own report or a company pre-approves you for an offer. Hard inquiries happen when a lender reviews your credit for loan approval, potentially lowering your credit score temporarily. Discover more detailed insights on soft and hard inquiries in this article.

Table of Comparison

| Feature | Soft Inquiry | Hard Inquiry |

|---|---|---|

| Purpose | Credit check for pre-approval, personal checking | Credit application for loans, mortgages, credit cards |

| Impact on Credit Score | No impact | May lower credit score by a few points |

| Visibility | Visible only to the individual | Visible to all lenders |

| Frequency | Unlimited without penalty | Frequent hard inquiries can harm credit rating |

| Example Uses | Checking own credit score, employer background checks | Applying for credit cards, auto loans, mortgages |

Introduction to Credit Inquiries

Credit inquiries are requests made by lenders or financial institutions to review an individual's credit report. Soft inquiries occur when a credit check is performed without impacting the credit score, such as pre-approved offers or personal credit monitoring. Hard inquiries happen when a consumer actively applies for credit, like a mortgage or credit card, and these can temporarily lower the credit score.

What is a Soft Inquiry?

A soft inquiry occurs when your credit report is checked without impacting your credit score, commonly used for pre-approval offers or background checks. Unlike hard inquiries that happen when you apply for credit and can lower your score, soft inquiries do not affect your creditworthiness or appear to lenders checking your credit. You can review your own credit report anytime without generating a soft inquiry, making it a safe way to monitor your financial health.

What is a Hard Inquiry?

A hard inquiry occurs when a lender or creditor reviews your credit report as part of a loan or credit application, impacting your credit score. This type of inquiry is a signal that you are seeking new credit and can remain on your credit report for up to two years. Hard inquiries differ from soft inquiries, which do not affect your credit score and typically occur during background checks or pre-approved offers.

Key Differences Between Soft and Hard Inquiries

Soft inquiries occur when a person or company checks your credit report as a background check without impacting your credit score, such as pre-approved credit offers or employer screenings. Hard inquiries happen when you apply for new credit, including loans, credit cards, or mortgages, causing a temporary drop in your credit score due to the lender's review of your creditworthiness. The key difference lies in their effect on your credit score: soft inquiries do not affect your score, while hard inquiries can lower it slightly and remain on your credit report for up to two years.

Common Examples of Soft Inquiries

Soft inquiries are credit checks that do not impact Your credit score and often occur during background checks for job applications, pre-approved credit offers, and personal credit monitoring. Unlike hard inquiries, which happen when You apply for new credit like loans, mortgages, or credit cards and can lower Your credit score, soft inquiries are purely informational. Common examples include checking Your own credit report, employer credit checks, and credit card companies reviewing Your account for promotional offers.

Common Examples of Hard Inquiries

Common examples of hard inquiries include applying for a mortgage, auto loan, credit card, or personal loan, where lenders assess your creditworthiness to decide on approval. These inquiries can slightly lower your credit score and remain on your credit report for up to two years. Understanding the impact of hard inquiries helps you manage your credit applications and maintain your financial health.

How Each Inquiry Type Impacts Your Credit Score

Soft inquiries occur when you check your own credit or when lenders pre-approve you, causing no impact on your credit score. Hard inquiries happen when a lender reviews your credit for a loan or credit card application, potentially lowering your score by a few points for up to 12 months. Understanding the difference between soft and hard inquiries helps you manage your credit use strategically to maintain a healthy credit score.

How to Check Your Credit Without Harming Your Score

Soft inquiries occur when you check your own credit or when lenders pre-approve offers, and these do not affect your credit score. Hard inquiries happen when a lender reviews your credit for lending decisions, potentially lowering your score slightly for a short period. To check your credit without harming your score, ensure you request only soft inquiries by accessing your credit report directly from authorized agencies or services designed for consumer use.

Managing and Minimizing Hard Inquiries

Hard inquiries occur when lenders check your credit report for loan or credit card applications, potentially lowering your credit score. You can manage and minimize hard inquiries by limiting new credit applications, spacing out requests, and proactively monitoring your credit report for unauthorized inquiries. Soft inquiries, unlike hard inquiries, do not impact your score and include activities such as checking your own credit or pre-approved credit offers.

Frequently Asked Questions About Credit Inquiries

Soft inquiries occur when your credit is checked without affecting your credit score, such as by companies reviewing your own report or during pre-approved offers. Hard inquiries happen when you apply for new credit, like a loan or credit card, potentially lowering your credit score temporarily. Understanding the difference between these credit inquiries helps you manage your credit report effectively and protects your financial health.

Infographic: Soft inquiry vs Hard inquiry

relatioo.com

relatioo.com