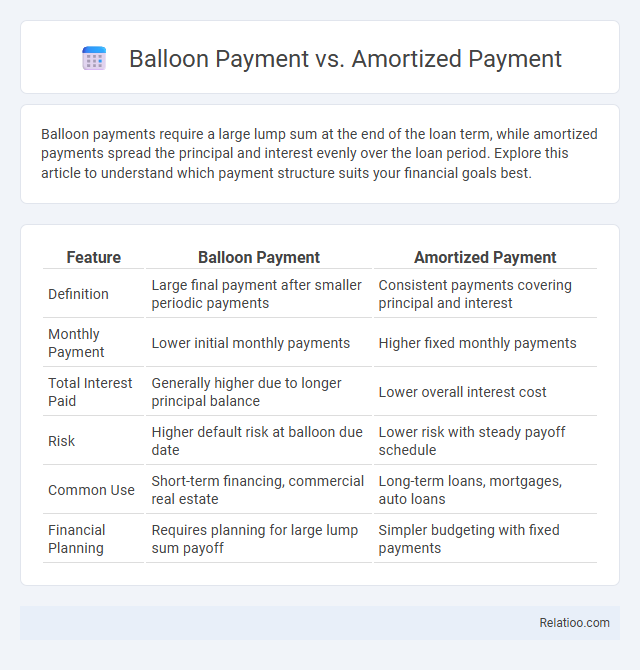

Balloon payments require a large lump sum at the end of the loan term, while amortized payments spread the principal and interest evenly over the loan period. Explore this article to understand which payment structure suits your financial goals best.

Table of Comparison

| Feature | Balloon Payment | Amortized Payment |

|---|---|---|

| Definition | Large final payment after smaller periodic payments | Consistent payments covering principal and interest |

| Monthly Payment | Lower initial monthly payments | Higher fixed monthly payments |

| Total Interest Paid | Generally higher due to longer principal balance | Lower overall interest cost |

| Risk | Higher default risk at balloon due date | Lower risk with steady payoff schedule |

| Common Use | Short-term financing, commercial real estate | Long-term loans, mortgages, auto loans |

| Financial Planning | Requires planning for large lump sum payoff | Simpler budgeting with fixed payments |

Introduction to Loan Payment Structures

Loan payment structures define how borrowers repay their debts, influencing financial planning and cash flow management. Balloon payments involve low initial installments followed by a large lump sum at the end, offering lower monthly expenses but higher risk at maturity. Amortized payments spread principal and interest evenly over the loan term, ensuring consistent payments, while payment plans vary based on agreement, balancing flexibility and repayment speed.

What is a Balloon Payment?

A balloon payment is a large, lump-sum payment due at the end of a loan term after a series of smaller periodic payments, often used in mortgages and auto loans. Unlike amortized payments, which gradually reduce the principal through consistent installments over time, balloon payments require borrowers to pay off the remaining balance in one significant payment. Payment plans vary but typically involve spreading the loan repayment evenly, whereas balloon payments concentrate a substantial debt repayment in a final installment.

Understanding Amortized Payments

Amortized payments consist of fixed installments that cover both principal and interest over a set loan term, ensuring the loan is fully paid off by maturity. Unlike balloon payments, which require a large lump sum at the end, amortized payments provide predictable budgeting and reduce interest costs over time. Payment plans can vary but amortized structures are preferred for clarity and gradual debt reduction.

Key Differences Between Balloon and Amortized Payments

Balloon payments involve a large lump sum due at the end of the loan term, while amortized payments evenly distribute principal and interest throughout the loan period. Amortized loans reduce the principal balance gradually, resulting in fully paid-off loans at maturity, unlike balloon loans which require refinancing or a significant final payment. Payment plans vary widely but typically refer to structured schedules for repaying debt, contrasting with the fixed structures of balloon and amortized payments.

Pros and Cons of Balloon Payment Loans

Balloon payment loans offer lower initial monthly payments by deferring a large lump-sum payment at the end, which can improve short-term cash flow but poses risks if the borrower cannot refinance or pay the balloon amount. Amortized payments spread principal and interest evenly over the loan term, providing predictable budgeting but usually higher initial payments compared to balloon loans. Payment plans vary, offering flexibility in repayment schedules, yet balloon loans stand out for their potential financial strain due to the sizable final payment.

Advantages and Disadvantages of Amortized Loans

Amortized loans spread your payments evenly over the loan term, ensuring predictable monthly amounts that cover both principal and interest, which helps in consistent budgeting and reducing long-term interest costs. However, the disadvantage lies in potentially higher monthly payments compared to balloon payments, which can strain your cash flow early in the loan period. Unlike payment plans that might offer more flexibility, amortized loans provide structured repayment, but with less opportunity for early payoff without penalties.

Impact on Borrowers’ Financial Planning

Balloon payments require borrowers to prepare for a large lump-sum payment at the end of the loan term, which can strain your financial resources if not planned properly. Amortized payments are structured to evenly distribute principal and interest over the loan period, providing predictable monthly expenses that simplify budgeting. Payment plans often offer customizable schedules, allowing borrowers to align repayments with their cash flow, improving financial stability and reducing the risk of default.

Industries and Situations Suited for Each Payment Type

Balloon payments are commonly used in real estate and auto financing where borrowers prefer lower initial payments and anticipate refinancing or asset sale at the end of the term. Amortized payments suit industries like mortgages and personal loans, providing predictable, evenly spread payments over the loan term which supports budgeting and cash flow management. Payment plans are widely adopted in retail, healthcare, and education sectors, allowing customers to split costs into manageable installments, enhancing access and affordability.

Risks and Considerations for Lenders and Borrowers

Balloon payments pose significant default risks for borrowers due to large lump-sum demands at loan maturity, while lenders face potential loss if borrowers cannot refinance or repay; amortized payments reduce risk by spreading principal and interest evenly, ensuring predictable cash flow but may increase total interest paid. Payment plans offer flexibility for borrowers but can lead to prolonged debt cycles and administrative challenges for lenders managing varied schedules. Both parties must carefully assess creditworthiness, cash flow stability, and market conditions to mitigate financial strain and contract breaches.

Making the Right Choice: Balloon vs. Amortized Payments

Choosing between balloon payments and amortized payments depends on your cash flow and financial goals. Balloon payments require a large lump sum at the end of the loan term, ideal for borrowers expecting a significant future income or refinancing options, while amortized payments spread principal and interest evenly over the loan period, providing predictable monthly expenses. Understanding your financial stability and risk tolerance ensures you make the right choice for your payment plan and long-term savings.

Infographic: Balloon Payment vs Amortized Payment

relatioo.com

relatioo.com