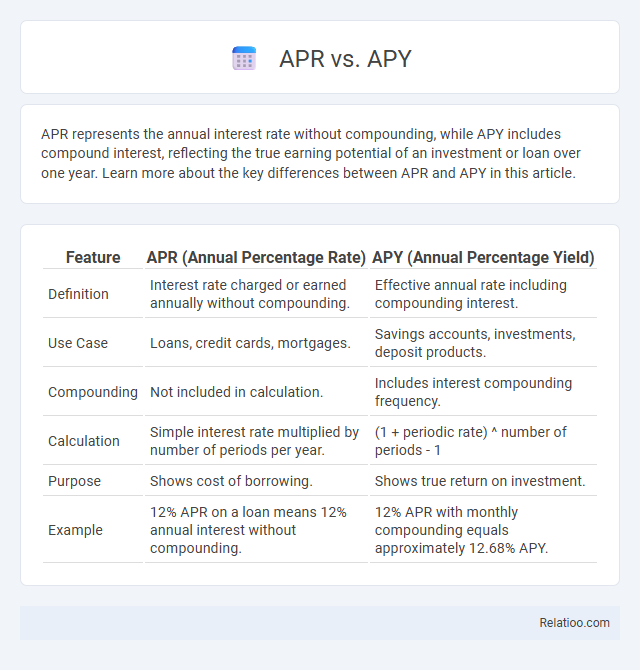

APR represents the annual interest rate without compounding, while APY includes compound interest, reflecting the true earning potential of an investment or loan over one year. Learn more about the key differences between APR and APY in this article.

Table of Comparison

| Feature | APR (Annual Percentage Rate) | APY (Annual Percentage Yield) |

|---|---|---|

| Definition | Interest rate charged or earned annually without compounding. | Effective annual rate including compounding interest. |

| Use Case | Loans, credit cards, mortgages. | Savings accounts, investments, deposit products. |

| Compounding | Not included in calculation. | Includes interest compounding frequency. |

| Calculation | Simple interest rate multiplied by number of periods per year. | (1 + periodic rate) ^ number of periods - 1 |

| Purpose | Shows cost of borrowing. | Shows true return on investment. |

| Example | 12% APR on a loan means 12% annual interest without compounding. | 12% APR with monthly compounding equals approximately 12.68% APY. |

Understanding the Basics: What Are APR and APY?

APR (Annual Percentage Rate) represents the yearly cost of borrowing or the yearly return on an investment without accounting for compound interest. APY (Annual Percentage Yield) includes compound interest, reflecting the true annual rate of return on your savings or investment. Understanding these differences helps you evaluate loan costs and investment growth more accurately, ensuring smarter financial decisions.

Key Differences Between APR and APY

APR (Annual Percentage Rate) represents the yearly cost of borrowing without accounting for compounding interest, making it ideal for understanding loan expenses. APY (Annual Percentage Yield) includes the effect of compounding, showing the real rate of return on investments or savings over a year. Interest refers to the cost or earnings from borrowed or invested money, but APR vs APY specifically highlights how compounding impacts the actual financial outcome.

How APR Is Calculated

APR (Annual Percentage Rate) is calculated by taking the nominal interest rate and adding any additional fees or costs associated with the loan or credit, then expressing this total as an annual rate. This calculation reflects the true yearly cost of borrowing, excluding the effects of compounding that APY (Annual Percentage Yield) includes. APR is distinct from APY, which accounts for interest compounding periods, while interest itself refers solely to the nominal rate charged or earned without fees or compounding factored in.

How APY Is Calculated

APR represents the annual interest rate without compounding, while APY accounts for compound interest, reflecting the real return on an investment or loan over a year. APY is calculated using the formula APY = (1 + r/n)^n - 1, where r is the nominal interest rate and n is the number of compounding periods per year, showing how frequently interest is applied. When evaluating your savings or loan options, understanding APY helps you compare products more accurately by incorporating the effect of compounding on your earnings or costs.

Why Do APR and APY Matter?

APR (Annual Percentage Rate) measures the yearly cost of borrowing excluding compounding, while APY (Annual Percentage Yield) accounts for compound interest, reflecting total annual earnings on investments or savings. Understanding the difference helps borrowers compare loan costs accurately and helps investors evaluate the true return on deposits or investments. APR and APY matter because they provide transparency and enable informed financial decisions, ensuring consumers select options that align with their goals and maximize value.

APR vs APY in Loans and Credit Cards

APR (Annual Percentage Rate) represents the yearly cost of borrowing, including interest and fees, while APY (Annual Percentage Yield) reflects the total interest earned or paid, accounting for compounding. In loans and credit cards, APR is crucial as it indicates the true cost of the credit, helping borrowers compare offers, whereas APY is more relevant for savings and investment products. Understanding the distinction between APR and APY ensures accurate evaluation of loan expenses and financing charges.

APR vs APY in Savings and Investments

APR (Annual Percentage Rate) represents the yearly cost of borrowing or the annual return on an investment without considering compound interest, while APY (Annual Percentage Yield) includes compound interest, showing the true annual earning potential. In savings and investments, APY provides a more accurate measure of growth since it accounts for interest-on-interest effects, unlike APR which is typically used for loans and credit. Comparing APY versus APR helps investors assess real returns and make informed decisions about savings accounts, certificates of deposit, and investment products.

Common Misconceptions About APR and APY

APR (Annual Percentage Rate) represents the yearly cost of borrowing without compounding, while APY (Annual Percentage Yield) reflects the total earnings including compound interest. A common misconception is that APR and APY are interchangeable; however, APY always accounts for compounding, making it higher than APR for the same nominal interest rate. Interest alone refers to the cost or earnings from lending or borrowing money, but it often lacks clarity on whether compounding is considered, leading to confusion between APR and APY.

Tips to Compare APR and APY Effectively

When comparing APR and APY, understand that APR (Annual Percentage Rate) reflects the yearly interest cost without compounding, while APY (Annual Percentage Yield) includes compounding effects, showing your true earning or cost potential. Focus on APY for savings or investment accounts to gauge real returns and on APR for loans to assess actual borrowing costs. Use consistent time periods and consider compounding frequency to make accurate comparisons and choose the best financial option for your goals.

Choosing the Best Option: APR or APY for Your Needs

APR (Annual Percentage Rate) reflects the yearly cost of borrowing without compounding, while APY (Annual Percentage Yield) includes compound interest, showing the real return on investment. When choosing between APR and APY, consider whether you're borrowing or investing: APR suits loan comparisons, as it highlights total interest costs, whereas APY benefits savers by revealing true earnings including compounding effects. Understanding the distinction helps you select financial products--loans or savings accounts--that align best with your financial goals and maximize value.

Infographic: APR vs APY

relatioo.com

relatioo.com