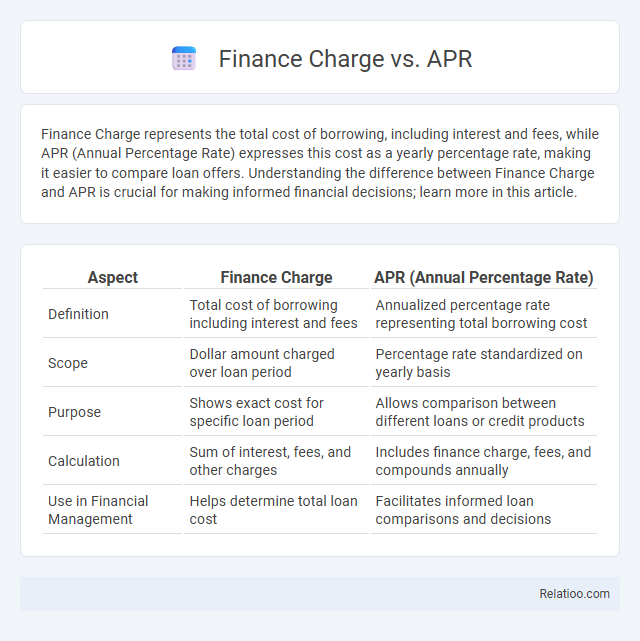

Finance Charge represents the total cost of borrowing, including interest and fees, while APR (Annual Percentage Rate) expresses this cost as a yearly percentage rate, making it easier to compare loan offers. Understanding the difference between Finance Charge and APR is crucial for making informed financial decisions; learn more in this article.

Table of Comparison

| Aspect | Finance Charge | APR (Annual Percentage Rate) |

|---|---|---|

| Definition | Total cost of borrowing including interest and fees | Annualized percentage rate representing total borrowing cost |

| Scope | Dollar amount charged over loan period | Percentage rate standardized on yearly basis |

| Purpose | Shows exact cost for specific loan period | Allows comparison between different loans or credit products |

| Calculation | Sum of interest, fees, and other charges | Includes finance charge, fees, and compounds annually |

| Use in Financial Management | Helps determine total loan cost | Facilitates informed loan comparisons and decisions |

Understanding Finance Charge: Definition and Components

Finance charge represents the total cost of borrowing, including interest and all associated fees, measured in currency rather than as a percentage. It encompasses components such as interest rates, loan origination fees, service charges, and any other costs required to obtain credit. Understanding your finance charge helps you accurately evaluate the true expense of a loan beyond the APR, ensuring informed financial decisions.

What Is APR (Annual Percentage Rate)?

APR (Annual Percentage Rate) represents the total annual cost of borrowing, including interest and fees, expressed as a percentage. Unlike the finance charge, which is a dollar amount representing the cost of credit, APR provides a standardized rate to compare different loan offers effectively. Understanding APR helps consumers evaluate the true cost of loans and credit cards over a year.

Key Differences Between Finance Charge and APR

Finance Charge represents the total cost of borrowing, including interest, fees, and other charges, while APR (Annual Percentage Rate) expresses this cost as a yearly percentage rate to help compare loan offers consistently. Your decision should weigh Finance Charge for exact dollar amounts over the loan's life, whereas APR provides a standardized rate reflecting the annual cost of credit. Understanding these key differences enables you to evaluate loan options accurately and avoid hidden costs.

Why Finance Charges Matter in Borrowing

Finance charges represent the total cost of borrowing, including interest and fees, and directly impact the amount you repay over the loan term. Understanding the difference between finance charges and APR, which encompasses finance charges plus other costs, helps you compare loan offers accurately. Your awareness of finance charges is crucial because it determines the true expense of credit and influences your financial decisions when borrowing.

How APR Reflects the True Cost of Credit

APR (Annual Percentage Rate) provides a comprehensive measure of the true cost of credit by including not only the interest rate but also any additional fees or finance charges associated with a loan or credit card. Unlike the finance charge alone, which represents only the dollar amount of interest and fees over a billing period, APR standardizes these costs into an annual rate, making it easier for you to compare different credit offers effectively. Understanding APR helps you make informed financial decisions by revealing the actual expense of borrowing beyond just the nominal interest rate.

Calculating Finance Charge: Step-by-Step Guide

Calculating the finance charge involves determining the total cost of borrowing, including interest and fees over the loan period. To accurately calculate your finance charge, multiply the loan balance by the periodic interest rate, then add any applicable fees, ensuring you track the payment schedule and compounding periods. Understanding this process allows you to compare finance charges with APR, which represents the annualized cost of credit including fees, helping you make informed financial decisions.

How Lenders Use APR to Present Loan Offers

Lenders use APR to present loan offers because it reflects the true cost of borrowing by including both the interest rate and associated fees, providing a standardized measure for comparison. The finance charge represents the total dollar amount paid over the life of the loan, encompassing interest and fees, but does not account for loan term variations like APR does. Using APR allows borrowers to evaluate different loan products on an equal footing, ensuring transparency and informed financial decisions.

Hidden Costs: What APR May Not Include

Finance charges encompass the total cost of borrowing, including interest and fees, while APR (Annual Percentage Rate) represents the yearly interest rate plus certain fees, offering a broader snapshot of loan expense but may exclude hidden costs like late fees or prepayment penalties. Your understanding of these distinctions is crucial because APR might not account for variable fees or other charges that increase the actual borrowing cost. Evaluating both finance charges and APR carefully helps avoid surprises from undisclosed fees that can affect your loan affordability.

Comparing Loans: Using Finance Charge vs APR

When comparing loans, the finance charge represents the total dollar amount you will pay for borrowing, including interest and fees, while the Annual Percentage Rate (APR) expresses this cost as a yearly rate incorporating both interest and certain fees. Understanding the finance charge gives you a clear picture of your out-of-pocket costs, whereas the APR allows you to compare loan options on an equal basis regardless of term length. Your best option depends on analyzing finance charges for short-term loans and APR for long-term or varying loan structures.

Tips for Minimizing Finance Charges and APR

Minimizing finance charges and APR starts with understanding your loan terms and maintaining a high credit score, which directly impacts interest rates offered by lenders. Opt for shorter loan terms and make payments on time to reduce the total interest paid over the life of the loan. Comparing offers from multiple lenders based on APR, not just the loan amount, ensures you choose the most cost-effective financing option.

Infographic: Finance Charge vs APR

relatioo.com

relatioo.com