A beneficiary is the person designated to receive assets or benefits from a will or trust, while an executor is responsible for managing the estate, ensuring debts are paid, and distributing assets according to the will. Discover the key distinctions and responsibilities of beneficiaries and executors in this article.

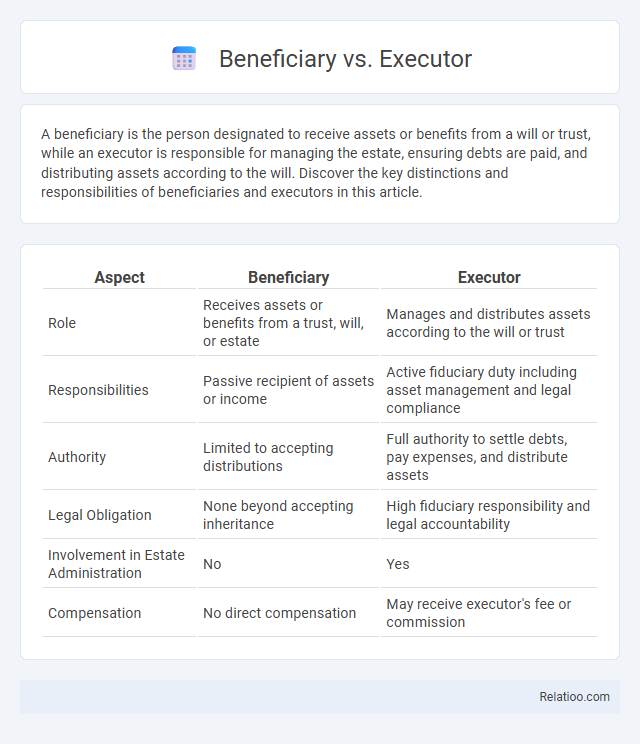

Table of Comparison

| Aspect | Beneficiary | Executor |

|---|---|---|

| Role | Receives assets or benefits from a trust, will, or estate | Manages and distributes assets according to the will or trust |

| Responsibilities | Passive recipient of assets or income | Active fiduciary duty including asset management and legal compliance |

| Authority | Limited to accepting distributions | Full authority to settle debts, pay expenses, and distribute assets |

| Legal Obligation | None beyond accepting inheritance | High fiduciary responsibility and legal accountability |

| Involvement in Estate Administration | No | Yes |

| Compensation | No direct compensation | May receive executor's fee or commission |

Definition of Beneficiary

A beneficiary is an individual or entity legally entitled to receive assets or benefits from a will, trust, insurance policy, or retirement account upon the grantor's death. Unlike an executor, who manages the distribution of the estate and ensures the deceased's wishes are fulfilled, a beneficiary primarily benefits from the estate without handling administrative duties. Your understanding of these roles is crucial for effective estate planning and ensuring clear asset distribution.

Definition of Executor

An executor is a legally appointed individual responsible for managing and distributing a deceased person's estate according to their will. Beneficiaries are those who receive assets or benefits from the estate, while the executor ensures the estate is settled, debts are paid, and assets are properly transferred. Understanding the distinct roles of executor and beneficiary helps you navigate estate planning and probate efficiently.

Key Responsibilities of a Beneficiary

A beneficiary is an individual or entity entitled to receive assets or benefits from a trust, will, or insurance policy, responsible for understanding the terms of the document to claim their inheritance properly. An executor administers the estate, manages assets, pays debts, and distributes property according to the will, acting as the legal representative of the deceased. Key responsibilities of a beneficiary include notifying the executor of their interest, providing necessary documents to prove identity, and claiming the inheritance within statutory timeframes.

Key Duties of an Executor

The key duties of an executor include managing the deceased's estate by identifying assets, paying debts and taxes, and distributing the remaining property to beneficiaries according to the will. Executors must file court documents, keep accurate records, and communicate with heirs and creditors throughout the probate process. Unlike beneficiaries who receive the estate's assets, executors have a fiduciary responsibility to ensure the estate is settled properly and legally.

Differences Between Beneficiary and Executor

The key difference between a beneficiary and an executor lies in their roles within an estate plan: the executor is responsible for managing and distributing the estate according to the will, while the beneficiary is the individual or entity entitled to receive assets from the estate. Your executor handles tasks such as paying debts, filing taxes, and ensuring the proper transfer of property, whereas beneficiaries receive the final inheritances or benefits specified in the will. Understanding these distinct responsibilities ensures clarity in estate administration and protects your intentions.

Legal Rights of Beneficiaries

Beneficiaries possess legal rights to receive assets or benefits as designated in a will or trust, ensuring their entitlement to inheritance according to the decedent's intentions. Executors, appointed by the court or named in the will, have fiduciary duties to administer the estate, pay debts, and distribute assets to beneficiaries lawfully. Unlike beneficiaries, executors do not inherit property but have the responsibility to uphold the estate's legal process, protecting beneficiary rights throughout probate or trust administration.

Legal Obligations of Executors

Executors have legally binding duties including identifying and authenticating the will, managing and protecting estate assets, paying debts and taxes, and distributing the remaining property according to the decedent's instructions. Beneficiaries receive assets or benefits from the estate but bear no responsibility for managing estate affairs. The executor's fiduciary responsibility ensures all legal and financial obligations are met, safeguarding beneficiaries' interests and preventing legal disputes.

Beneficiary vs Executor: Common Misconceptions

Beneficiaries and executors play distinct roles in estate planning, often confused despite their separate functions. Beneficiaries receive assets or benefits from a will or trust, while executors are responsible for managing the estate, settling debts, and ensuring the deceased's wishes are fulfilled. Misconceptions arise when people assume beneficiaries control the estate distribution, though only executors have the legal authority to administer the estate.

Choosing the Right Executor

Choosing the right executor is crucial for ensuring your estate is managed efficiently and according to your wishes; this individual is responsible for handling legal and financial duties, unlike a beneficiary who solely inherits assets. Your executor should possess strong organizational skills, trustworthiness, and the ability to navigate probate processes, especially if multiple beneficiaries are involved. Selecting an executor familiar with your estate's complexities minimizes conflicts and helps secure a smooth distribution of your assets.

Frequently Asked Questions: Beneficiary and Executor

A beneficiary is an individual or entity designated to receive benefits from a will, trust, or insurance policy, while an executor is appointed to administer the deceased's estate according to the will. Frequently asked questions about beneficiaries often involve their rights to inherit assets and how disputes are resolved, whereas questions about executors focus on their responsibilities, legal duties, and the probate process. Understanding the distinct roles clarifies that beneficiaries receive assets, whereas executors manage the estate's distribution and ensure legal compliance.

Infographic: Beneficiary vs Executor

relatioo.com

relatioo.com