Overdraft provides short-term access to funds linked to your bank account with typically higher interest rates, while credit cards offer revolving credit with rewards and purchase protections. Discover key differences, benefits, and costs in this article to make informed financial decisions.

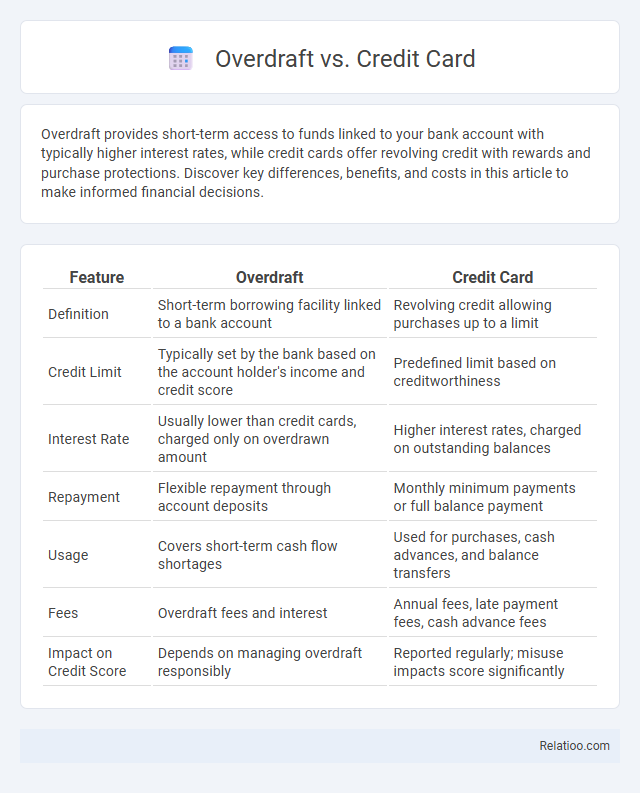

Table of Comparison

| Feature | Overdraft | Credit Card |

|---|---|---|

| Definition | Short-term borrowing facility linked to a bank account | Revolving credit allowing purchases up to a limit |

| Credit Limit | Typically set by the bank based on the account holder's income and credit score | Predefined limit based on creditworthiness |

| Interest Rate | Usually lower than credit cards, charged only on overdrawn amount | Higher interest rates, charged on outstanding balances |

| Repayment | Flexible repayment through account deposits | Monthly minimum payments or full balance payment |

| Usage | Covers short-term cash flow shortages | Used for purchases, cash advances, and balance transfers |

| Fees | Overdraft fees and interest | Annual fees, late payment fees, cash advance fees |

| Impact on Credit Score | Depends on managing overdraft responsibly | Reported regularly; misuse impacts score significantly |

Understanding Overdrafts: Definition and Function

Overdrafts allow account holders to withdraw more money than their current balance up to an approved limit, providing short-term liquidity without needing a separate loan. Unlike credit cards, which extend a revolving line of credit with separate billing cycles and interest calculations, overdrafts are linked directly to a checking account and often incur lower fees and interest rates. Understanding the function of overdrafts is essential for managing unexpected expenses and avoiding costly penalties, as they serve as a safety net by covering transactions that exceed available funds.

What is a Credit Card? Key Features Explained

A credit card is a financial tool that allows users to borrow funds up to a preset limit for purchases or cash advances, requiring repayment either in full or over time with interest. Key features include a revolving credit line, grace periods on payments, rewards programs, and fraud protection. Unlike overdrafts, which are linked to bank accounts and limit temporary negative balances, credit cards offer broader spending flexibility and separate billing cycles.

Overdraft vs Credit Card: Core Differences

Overdraft allows account holders to withdraw more money than their current bank balance up to an approved limit, typically with lower interest rates and fees compared to credit cards. Credit cards offer a revolving line of credit with higher interest rates, rewards programs, and the flexibility to pay over time or in full each month. Key differences include the source of funds--bank account overdraft versus credit issuer--and the cost structure, where overdrafts often incur daily fees, while credit cards charge monthly interest on outstanding balances.

Eligibility Criteria for Overdrafts and Credit Cards

Eligibility for overdrafts typically depends on your banking history, credit score, and relationship with the financial institution, with many banks requiring a minimum period of account activity and proof of steady income. Credit card eligibility heavily relies on your credit score, income level, and existing debt-to-income ratio, with issuers assessing your capacity to repay based on application details and credit reports. Both overdrafts and credit cards require you to meet specific criteria regarding financial stability, but overdrafts are often easier to obtain for established bank customers due to the secured nature of linked accounts.

Interest Rates: Overdrafts Compared to Credit Cards

Overdraft interest rates typically range from 15% to 25% annually, often higher than credit card rates, which average between 12% and 20%. Credit cards may offer introductory 0% APR periods, making them more cost-effective for short-term borrowing compared to overdrafts. Overdrafts usually incur daily fees or fixed charges in addition to interest, increasing the overall cost of borrowing relative to credit cards.

Fees and Hidden Charges: What to Expect

Overdraft fees typically include daily or monthly charges and high interest rates on the overdrawn amount, while credit cards may incur annual fees, cash advance fees, and high interest rates if balances are not paid in full. Hidden charges such as penalty fees for exceeding credit limits or late payments can apply to both overdrafts and credit cards, potentially increasing your overall cost significantly. Understanding these fees helps you manage your finances effectively and avoid unexpected expenses from overdrafts or credit card usage.

Repayment Flexibility: Overdrafts versus Credit Cards

Overdrafts offer flexible repayment options, allowing you to pay back the borrowed amount as and when funds become available, often without a fixed schedule. Credit cards typically require a minimum monthly payment, with interest accruing on the outstanding balance if not paid in full. This repayment flexibility of overdrafts can ease short-term cash flow management compared to the structured yet revolving credit of credit cards.

Impact on Credit Score: Overdrafts and Credit Cards

Overdrafts typically have a minimal impact on your credit score unless the overdraft is unpaid for an extended period, while credit card usage and payment history significantly influence your credit rating. Maintaining low credit card balances and making timely payments contribute positively to your credit score, whereas frequent or prolonged overdrafts might signal financial distress to lenders. Understanding these differences helps you manage your financial products effectively to protect and enhance your creditworthiness.

Best Use Cases: When to Choose Overdraft or Credit Card

Overdraft is best used for short-term, unexpected cash flow needs, providing immediate access to funds linked to your checking account without applying for a new credit line. Credit cards are ideal for planned purchases, offering rewards, purchase protection, and interest-free grace periods if paid on time. Choosing overdraft is preferable for emergency or occasional small withdrawals, while credit cards suit ongoing spending and building credit history.

Tips for Managing Overdrafts and Credit Cards Responsibly

To manage overdrafts and credit cards responsibly, always monitor your account balances regularly to avoid unexpected fees and interest charges. Set up alerts for low balances and payment due dates to maintain control over your spending and prevent overdue payments. Establish a budget that prioritizes paying off high-interest credit card debt while limiting overdraft reliance to emergency situations only.

Infographic: Overdraft vs Credit Card

relatioo.com

relatioo.com