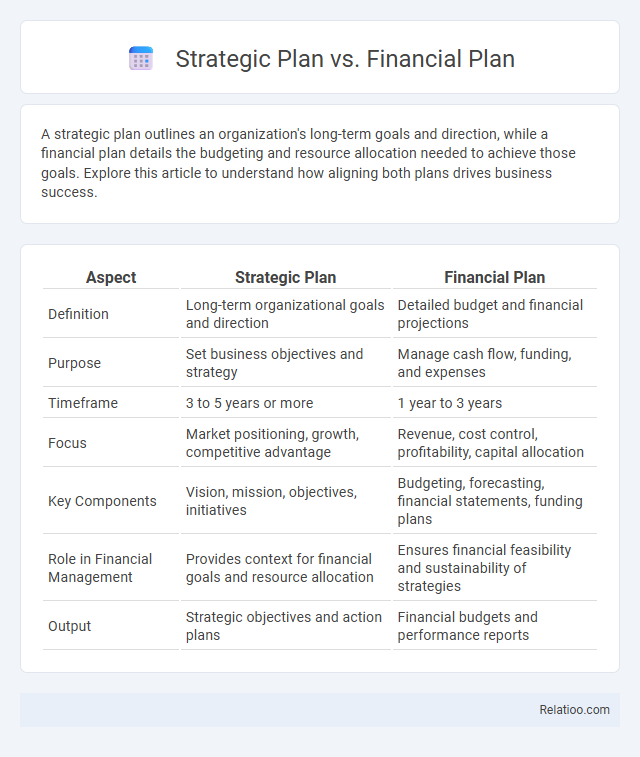

A strategic plan outlines an organization's long-term goals and direction, while a financial plan details the budgeting and resource allocation needed to achieve those goals. Explore this article to understand how aligning both plans drives business success.

Table of Comparison

| Aspect | Strategic Plan | Financial Plan |

|---|---|---|

| Definition | Long-term organizational goals and direction | Detailed budget and financial projections |

| Purpose | Set business objectives and strategy | Manage cash flow, funding, and expenses |

| Timeframe | 3 to 5 years or more | 1 year to 3 years |

| Focus | Market positioning, growth, competitive advantage | Revenue, cost control, profitability, capital allocation |

| Key Components | Vision, mission, objectives, initiatives | Budgeting, forecasting, financial statements, funding plans |

| Role in Financial Management | Provides context for financial goals and resource allocation | Ensures financial feasibility and sustainability of strategies |

| Output | Strategic objectives and action plans | Financial budgets and performance reports |

Introduction to Strategic and Financial Planning

Strategic planning defines an organization's long-term vision, setting goals and outlining the steps to achieve competitive advantage and sustainable growth. Financial planning translates these strategic objectives into detailed budgets, forecasts, and resource allocations to ensure financial feasibility and support operational execution. Aligning strategic plans with financial plans enhances decision-making, risk management, and the efficient use of capital to drive business success.

Defining a Strategic Plan

A strategic plan outlines an organization's long-term vision, goals, and the roadmap to achieve competitive advantage by aligning resources and capabilities with market opportunities. Unlike a financial plan, which concentrates on budgeting, cash flow projections, and funding strategies to ensure financial stability, the strategic plan provides a broader framework integrating both financial and operational objectives. Defining a strategic plan involves setting measurable targets, analyzing internal and external environments, and prioritizing initiatives that drive sustainable growth.

Understanding a Financial Plan

A Financial Plan outlines an individual's or organization's strategy for managing income, expenses, investments, and savings to meet long-term financial goals, distinct from a Strategic Plan that defines broader organizational objectives and initiatives. Understanding a Financial Plan involves analyzing detailed budgeting, cash flow projections, risk management, and investment strategies to ensure financial stability and growth. Effective financial planning integrates tax planning, retirement funding, and emergency reserves to create a comprehensive roadmap for sustainable wealth management.

Key Differences Between Strategic and Financial Plans

A strategic plan outlines an organization's long-term goals, vision, and the overall direction for growth over several years, focusing on competitive positioning and market opportunities. A financial plan concentrates on budgeting, forecasting revenues and expenses, cash flow management, and ensuring resources are allocated to achieve the strategic objectives. Key differences include that strategic plans define what to achieve and why, while financial plans detail how to allocate funds and manage finances to support those strategic goals effectively.

Importance of Strategic Planning in Business

Strategic planning establishes long-term goals and direction, serving as a roadmap for business growth and competitive advantage. Financial planning focuses on budgeting, forecasting, and managing resources to ensure operational viability, while tactical plans address short-term actions to implement strategies effectively. Prioritizing strategic planning enables businesses to align financial decisions with overarching objectives, ensuring sustainable success and adaptability in dynamic markets.

Role of Financial Planning in Organizational Success

Financial planning plays a pivotal role in organizational success by aligning financial resources with strategic objectives, ensuring sustainable growth and efficient capital allocation. Strategic plans outline long-term goals and competitive positioning, while financial plans translate these goals into detailed budgets, cash flow forecasts, and investment strategies that support operational execution. Effective financial planning mitigates risks, optimizes profitability, and enables informed decision-making to achieve organizational resilience and market adaptability.

How Strategic and Financial Plans Interact

Strategic plans outline your organization's long-term goals and the roadmap to achieve them, while financial plans allocate resources and set budgets to support those objectives effectively. Your financial plan translates the strategic goals into actionable fiscal targets, ensuring adequate funding for projects and operational needs. This interaction enables informed decision-making, aligning financial resources with strategic priorities to drive sustained growth and success.

Common Misconceptions About Planning

Common misconceptions about planning often confuse a Strategic Plan with a Financial Plan, leading to unclear business objectives and resource allocation. Your Strategic Plan outlines long-term goals and direction, while the Financial Plan details budgets, forecasts, and funding strategies to support those goals. Understanding the distinct purpose of each plan prevents overlap and ensures focused, effective decision-making.

Best Practices for Aligning Strategic and Financial Plans

Aligning your strategic plan with your financial plan requires integrating clear, measurable goals that link long-term objectives to specific budget allocations and financial forecasts. Best practices include using data-driven performance indicators to track progress, fostering regular communication between strategy and finance teams, and maintaining flexibility to adjust financial resources in response to strategic priorities. Ensuring both plans share common metrics fosters coherence and drives informed decision-making for sustainable growth.

Conclusion: Integrating Planning for Long-Term Success

Strategic plans outline your organization's long-term goals and the roadmap to achieve them, while financial plans focus on budgeting, forecasting, and managing resources to support these goals. Integrating strategic and financial plans ensures alignment between vision and resource allocation, enhancing decision-making and sustainability. Your ability to harmonize both planning types drives long-term success and adaptive growth in a competitive environment.

Infographic: Strategic Plan vs Financial Plan

relatioo.com

relatioo.com