Choosing between a personal loan and a business loan depends on your financial needs, credit profile, and loan purpose, with personal loans typically offering faster approval for smaller amounts and business loans providing larger funds with tailored repayment options. Explore this article to understand key differences, eligibility criteria, and which loan best suits your financial goals.

Table of Comparison

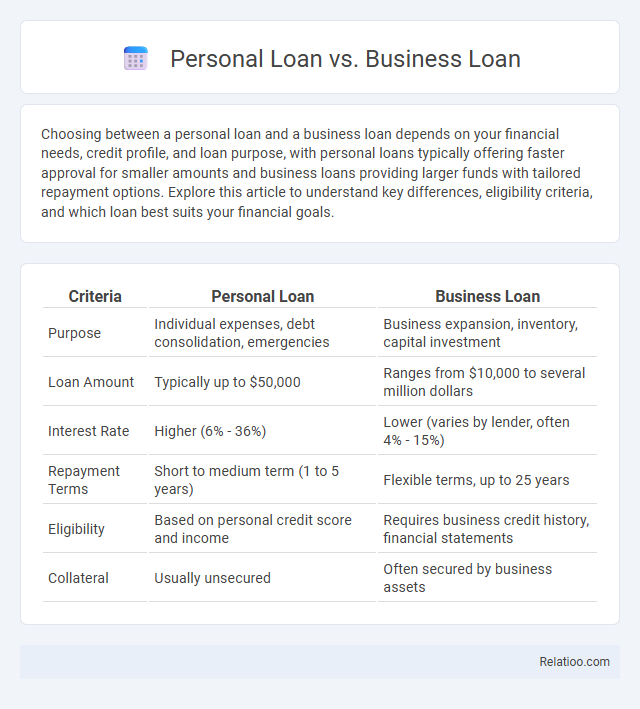

| Criteria | Personal Loan | Business Loan |

|---|---|---|

| Purpose | Individual expenses, debt consolidation, emergencies | Business expansion, inventory, capital investment |

| Loan Amount | Typically up to $50,000 | Ranges from $10,000 to several million dollars |

| Interest Rate | Higher (6% - 36%) | Lower (varies by lender, often 4% - 15%) |

| Repayment Terms | Short to medium term (1 to 5 years) | Flexible terms, up to 25 years |

| Eligibility | Based on personal credit score and income | Requires business credit history, financial statements |

| Collateral | Usually unsecured | Often secured by business assets |

Understanding Personal Loans

Personal loans offer unsecured funds based on creditworthiness, typically used for personal expenses like debt consolidation or emergencies. Unlike business loans, which require detailed financial documentation and are designed to support business operations or growth, personal loans have lower borrowing limits and shorter repayment terms. Understanding interest rates, fees, and eligibility criteria is crucial for selecting a personal loan that aligns with individual financial needs and goals.

What is a Business Loan?

A business loan is a type of financing specifically designed to support the operations, growth, or capital needs of a company, distinct from personal loans which are intended for individual expenses. Unlike general loans that may cover various purposes, business loans often require detailed financial documentation and offer terms tailored to business cash flow and credit profiles. Understanding the unique features of a business loan helps you secure adequate funding that aligns with your company's goals and repayment capacity.

Key Differences: Personal Loan vs Business Loan

Personal loans are typically unsecured loans designed for individual expenses such as medical bills, education, or personal projects, with fixed interest rates and repayment terms. Business loans are secured or unsecured funds aimed at financing business activities, including inventory, equipment, or expansion, often requiring a detailed business plan and credit evaluation. Key differences include purpose, collateral requirements, interest rates, and qualification criteria, with business loans generally offering higher amounts but involving more stringent approval processes compared to personal loans.

Eligibility Criteria Compared

Eligibility criteria for personal loans primarily focus on individual credit scores, income stability, and debt-to-income ratios, typically requiring a credit score of 600 or higher. Business loans demand more stringent documentation such as business financial statements, tax returns, business credit scores, and sometimes a detailed business plan, with eligibility often contingent on the company's operational history and revenue. General loans vary widely but generally balance individual creditworthiness with loan purpose, requiring proof of income and sometimes collateral depending on loan type and lender policies.

Application Process: Personal vs Business Loans

Personal loan applications typically require proof of identity, income verification, and credit history, allowing for a faster approval process with fewer documentation requirements. Business loan applications demand comprehensive financial statements, detailed business plans, cash flow projections, and often collateral or personal guarantees, leading to a more rigorous and lengthier evaluation. Lenders assess personal loans primarily on individual creditworthiness, whereas business loans focus on the viability and financial health of the business entity.

Interest Rates and Repayment Terms

Personal loans typically have higher interest rates compared to business loans due to unsecured collateral and higher risk assessment, while business loans often offer lower rates with variable or fixed terms tailored to business cash flow. Repayment terms for personal loans usually range from one to seven years with fixed monthly payments, whereas business loans provide more flexible terms that can extend up to 25 years, depending on the loan type and lender. Understanding these differences helps you choose the best loan option to align with your financial needs and repayment capabilities.

Collateral Requirements

Personal loans generally require little to no collateral, making them accessible for individuals seeking unsecured credit based on creditworthiness. Business loans often demand substantial collateral, such as property, equipment, or inventory, to secure higher loan amounts and mitigate lender risk. Assessing your financial needs and asset availability helps determine which loan type aligns with your collateral capabilities and borrowing goals.

Pros and Cons of Personal Loans

Personal loans offer quick access to funds with relatively simple application processes and flexible use, making them ideal for personal expenses or debt consolidation. However, they often come with higher interest rates compared to business loans and shorter repayment terms, which can lead to increased monthly payments. Unlike business loans that provide larger amounts tailored for operational growth and may offer tax benefits, personal loans lack those advantages but require less documentation and credit scrutiny.

Pros and Cons of Business Loans

Business loans offer essential capital for growth, equipment purchase, and inventory management, with benefits including potential tax deductions on interest and flexible funding options tailored to business needs. However, business loans often require extensive documentation, higher credit scores, and collateral, presenting challenges for startups or small businesses with limited credit history. Unlike personal loans, which have simpler approval processes but lower limits, business loans provide larger sums with more complex terms and repayment structures.

Which Loan is Right for You?

Choosing the right loan depends on your specific financial needs: a personal loan is ideal for covering individual expenses like medical bills or home improvements, while a business loan supports company growth, inventory, or operational costs. Your credit score, loan amount, repayment terms, and purpose should guide your decision since personal loans often have simpler approval processes, whereas business loans may require detailed financial documentation. Evaluating these factors helps you select the best loan option tailored to your unique requirements.

Infographic: Personal Loan vs Business Loan

relatioo.com

relatioo.com