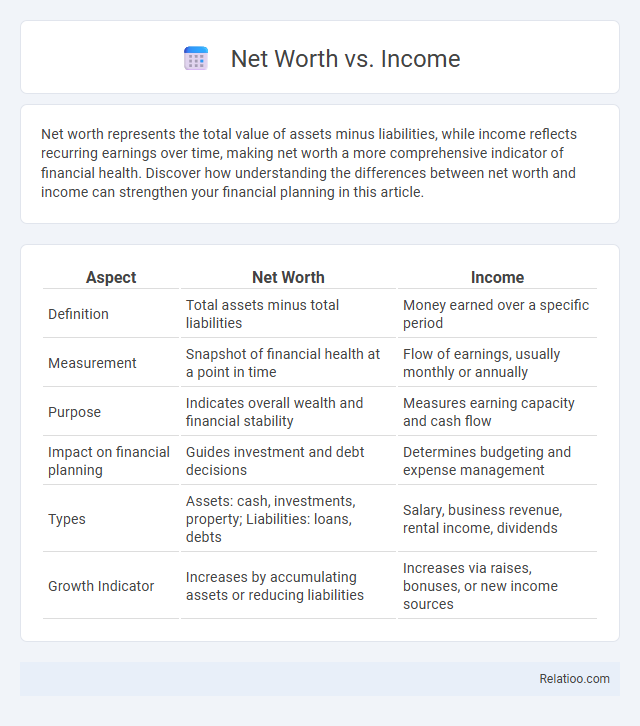

Net worth represents the total value of assets minus liabilities, while income reflects recurring earnings over time, making net worth a more comprehensive indicator of financial health. Discover how understanding the differences between net worth and income can strengthen your financial planning in this article.

Table of Comparison

| Aspect | Net Worth | Income |

|---|---|---|

| Definition | Total assets minus total liabilities | Money earned over a specific period |

| Measurement | Snapshot of financial health at a point in time | Flow of earnings, usually monthly or annually |

| Purpose | Indicates overall wealth and financial stability | Measures earning capacity and cash flow |

| Impact on financial planning | Guides investment and debt decisions | Determines budgeting and expense management |

| Types | Assets: cash, investments, property; Liabilities: loans, debts | Salary, business revenue, rental income, dividends |

| Growth Indicator | Increases by accumulating assets or reducing liabilities | Increases via raises, bonuses, or new income sources |

Understanding Net Worth: What It Really Means

Net worth represents the total value of all assets owned by an individual or entity minus their liabilities, providing a comprehensive snapshot of financial health. Unlike income, which indicates earnings over a specific period, net worth accumulates wealth over time and reflects long-term financial stability. Understanding net worth helps individuals assess their financial progress, plan for future goals, and manage debt effectively.

Defining Income: Types and Sources

Income represents the total earnings an individual or household receives from various sources such as salaries, wages, rental properties, investments, and business activities. Your income differs from net worth, which calculates the total value of assets minus liabilities, reflecting financial health over time rather than immediate cash flow. Understanding different income types--earned, passive, and portfolio--helps clarify how money is generated and influences your overall net worth.

Key Differences Between Net Worth and Income

Net worth represents the total value of an individual's assets minus liabilities, reflecting their overall financial health at a specific point in time. Income refers to the money earned over a period, such as salaries, wages, or business profits, indicating cash flow rather than wealth accumulation. Unlike income, which measures financial inflow, net worth encapsulates accumulated wealth and long-term financial stability.

Why Net Worth Matters More Than Income

Net worth provides a comprehensive measure of financial health by accounting for total assets minus liabilities, offering a clearer picture of long-term wealth than income alone. Unlike income, which reflects only earnings over a period, net worth indicates the ability to withstand financial challenges and build wealth through investments and savings. Focusing on net worth encourages sustainable financial planning and wealth accumulation, crucial for achieving long-term financial independence.

How to Calculate Your Net Worth

Calculating your net worth involves subtracting total liabilities from total assets, where assets include cash, investments, real estate, and personal property, while liabilities cover debts such as loans, credit card balances, and mortgages. Understanding net worth provides a clear picture of financial health beyond just income, which is the money earned during a specific period and does not account for debts or assets. Regularly tracking net worth allows for better financial planning by highlighting areas to increase assets or reduce liabilities effectively.

Common Misconceptions About Net Worth and Income

Net worth represents the total value of assets minus liabilities, whereas income reflects earnings over a specific period, often leading to confusion between the two. Many mistakenly equate high income with high net worth, overlooking debt levels and savings rates that critically impact overall financial health. Understanding the distinct roles of net worth and income is essential for accurate personal finance assessments and long-term wealth planning.

The Role of Assets and Liabilities in Net Worth

Net worth is calculated by subtracting total liabilities from total assets, providing a clear picture of an individual's or company's financial health. Income represents the flow of money earned over time, while net worth reflects accumulated wealth at a specific point. The role of assets, such as cash, property, and investments, combined with liabilities like loans and debts, directly influences net worth, highlighting the importance of managing both to build true financial stability.

Strategies to Grow Your Net Worth Over Time

Building net worth over time requires strategic asset accumulation and debt management. Investing in diversified portfolios and real estate can generate passive income streams, boosting overall wealth. Regularly increasing savings rates and minimizing high-interest liabilities ensures steady net worth growth through compound interest and capital appreciation.

Income Stability vs. Wealth Accumulation

Income stability provides a consistent cash flow essential for meeting daily expenses and managing short-term financial obligations, while wealth accumulation reflects the total value of owned assets and investments, indicating long-term financial security and growth potential. High income stability can support regular savings and investment, leading to increased net worth over time, whereas fluctuating income may hinder wealth building despite potentially high earnings. Prioritizing a balance between steady income and strategic asset growth optimizes financial resilience and overall net worth expansion.

Tracking Net Worth and Income for Financial Success

Tracking your net worth and income is essential for achieving financial success by providing a clear picture of your overall financial health and cash flow. Net worth measures your total assets minus liabilities, reflecting your accumulated wealth, while income represents the money earned over a specific period, indicating your earning capacity. Consistently monitoring both helps you make informed decisions, set realistic financial goals, and adjust spending or saving habits to maximize growth and stability.

Infographic: Net Worth vs Income

relatioo.com

relatioo.com