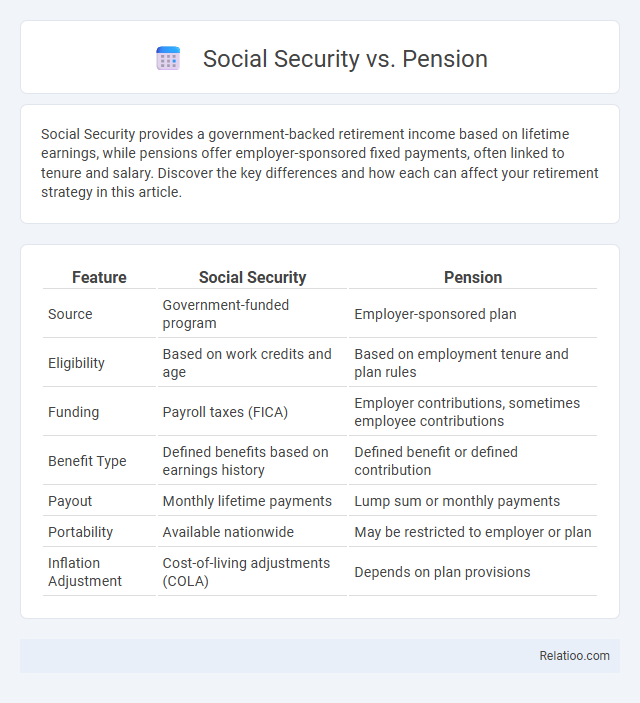

Social Security provides a government-backed retirement income based on lifetime earnings, while pensions offer employer-sponsored fixed payments, often linked to tenure and salary. Discover the key differences and how each can affect your retirement strategy in this article.

Table of Comparison

| Feature | Social Security | Pension |

|---|---|---|

| Source | Government-funded program | Employer-sponsored plan |

| Eligibility | Based on work credits and age | Based on employment tenure and plan rules |

| Funding | Payroll taxes (FICA) | Employer contributions, sometimes employee contributions |

| Benefit Type | Defined benefits based on earnings history | Defined benefit or defined contribution |

| Payout | Monthly lifetime payments | Lump sum or monthly payments |

| Portability | Available nationwide | May be restricted to employer or plan |

| Inflation Adjustment | Cost-of-living adjustments (COLA) | Depends on plan provisions |

Understanding Social Security: An Overview

Social Security provides a government-funded safety net designed to offer retirement, disability, and survivor benefits based on lifetime earnings and work credits. Unlike private pensions, which are employer-sponsored retirement plans with fixed or defined contributions, Social Security benefits adjust for inflation through cost-of-living adjustments (COLAs). Understanding Social Security's funding through payroll taxes (FICA) helps differentiate its guaranteed income structure from the varying payout mechanisms of pensions and private retirement savings.

What Is a Pension Plan?

A pension plan is a retirement savings program typically funded by employers to provide employees with a fixed income after retirement. Unlike Social Security, which is a government-run social insurance program offering benefits based on work credits and earnings history, pension plans offer defined benefits or contributions tailored to individual employment agreements. Understanding the difference between pensions, Social Security, and personal retirement accounts is essential for effective retirement planning and ensuring financial stability in later years.

Key Differences Between Social Security and Pension

Social Security is a government program that provides retirement income based on your work history and contributions to payroll taxes, while a pension is a retirement plan funded by your employer that guarantees a fixed monthly benefit upon retirement. Social Security benefits are calculated using your lifetime earnings and typically adjust with inflation, whereas pension payouts depend on your employer's plan rules and may not increase over time. Understanding these key differences helps you plan for a more secure retirement by balancing public and private income sources.

Eligibility Criteria Compared

Eligibility criteria for Social Security primarily depend on your work credits earned through payroll taxes over at least 10 years, with benefits based on age and employment history. Pension eligibility typically requires a minimum number of years worked at a company and meeting age thresholds set by the employer's retirement plan. Social Security and pension plans differ significantly; Social Security mandates federal qualification rules, while pensions are governed by employer-specific policies, influencing your retirement income stability and access.

Funding Sources for Social Security vs Pension

Social Security is primarily funded through payroll taxes collected under the Federal Insurance Contributions Act (FICA), with employers and employees each contributing a set percentage of wages. Pensions, on the other hand, are typically funded by employer contributions, employee contributions, or a combination of both, often managed through investment funds to ensure long-term sustainability. Your understanding of these funding sources helps evaluate the reliability and benefits of each retirement income option.

Payment Structures and Benefit Amounts

Social Security payments are funded through payroll taxes and provide monthly benefits based on your lifetime earnings record, offering inflation-adjusted income for retirees and disabled workers. Pensions typically involve employer-funded plans delivering fixed monthly benefits determined by salary and years of service, ensuring guaranteed income after retirement. While Social Security offers a standardized national framework, pensions and private retirement savings vary widely in payment structures and benefit amounts, impacting your overall retirement income strategy.

Tax Implications of Social Security and Pension

Understanding the tax implications of Social Security and pension benefits is crucial for effective retirement planning. Social Security benefits may be partially taxable depending on your combined income, with up to 85% subject to federal tax if your income exceeds certain thresholds. Pension distributions are generally taxable as ordinary income in the year received, potentially increasing your taxable income and affecting your tax bracket.

Pros and Cons of Social Security

Social Security offers a reliable source of retirement income funded by payroll taxes, providing you with inflation-adjusted benefits and survivor protections, but it may not fully cover your post-retirement expenses. Unlike pensions, which guarantee fixed payments from employers, Social Security benefits fluctuate based on your earnings history and are subject to potential future policy changes. Social Security's longevity risk protection ensures lifetime payments, but its replacement rate typically results in lower income compared to private pension plans or personal savings.

Advantages and Disadvantages of Pension Plans

Pension plans offer guaranteed retirement income, providing financial security and predictability compared to Social Security's variable benefits based on earnings history. However, pensions carry the risk of underfunding or employer bankruptcy, potentially jeopardizing future payments, unlike Social Security which is government-backed and more stable. While pensions encourage long-term employment with specific employers, they lack portability, limiting flexibility in job changes compared to Social Security benefits.

Choosing Between Social Security and Pension

When choosing between Social Security and a pension, consider factors like your retirement age, expected lifespan, and financial needs. Social Security offers inflation-adjusted benefits based on your earnings history, providing a reliable income stream, while pensions typically provide fixed monthly payments often tied to your years of service and salary. Your decision should weigh the flexibility and inflation protection of Social Security against the potentially higher, but less flexible, income from a pension plan.

Infographic: Social Security vs Pension

relatioo.com

relatioo.com