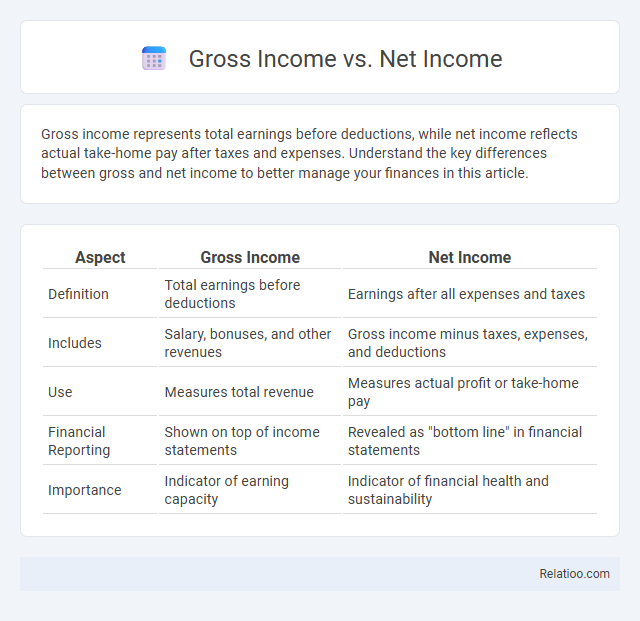

Gross income represents total earnings before deductions, while net income reflects actual take-home pay after taxes and expenses. Understand the key differences between gross and net income to better manage your finances in this article.

Table of Comparison

| Aspect | Gross Income | Net Income |

|---|---|---|

| Definition | Total earnings before deductions | Earnings after all expenses and taxes |

| Includes | Salary, bonuses, and other revenues | Gross income minus taxes, expenses, and deductions |

| Use | Measures total revenue | Measures actual profit or take-home pay |

| Financial Reporting | Shown on top of income statements | Revealed as "bottom line" in financial statements |

| Importance | Indicator of earning capacity | Indicator of financial health and sustainability |

Introduction to Gross Income and Net Income

Gross income represents the total earnings an individual or business receives before any deductions such as taxes or expenses. Net income, also known as profit or take-home pay, is the amount remaining after all deductions, including taxes, operating costs, and other expenses, are subtracted from gross income. Understanding the distinction between gross income and net income is crucial for accurate financial analysis and budgeting.

Defining Gross Income

Gross Income represents the total earnings before any deductions such as taxes, retirement contributions, or healthcare premiums are subtracted. Understanding Gross Income is crucial for evaluating Your overall earning capacity and calculating taxable income. Net Income, in contrast, reflects the actual take-home pay after all applicable deductions are removed.

Understanding Net Income

Net income represents your actual earnings after deducting taxes, expenses, and other costs from your gross income, offering a clear picture of your financial health. Understanding net income is crucial for budgeting, as it reflects the money you truly have available to spend or save. Accurate knowledge of net income helps you make informed decisions about investments, expenses, and financial goals.

Key Differences Between Gross and Net Income

Gross income represents the total earnings before any deductions such as taxes, retirement contributions, or health insurance premiums are subtracted. Net income, often referred to as "take-home pay," is the amount left after all mandatory and voluntary deductions, reflecting Your actual disposable income. Understanding these distinctions is crucial for accurate financial planning, budgeting, and tax reporting.

Calculating Gross Income: Methods and Examples

Calculating gross income involves summing all earnings before any deductions, including wages, salaries, bonuses, and other revenue streams, which provides a comprehensive view of total income. Methods to calculate gross income vary depending on sources, such as adding up pay stubs or business revenues, while examples include tallying monthly salaries plus commissions. Understanding how to accurately calculate your gross income is essential for effective financial planning and assessing your overall earning potential.

Calculating Net Income: Steps and Examples

Calculating net income requires subtracting all expenses, including taxes, operating costs, and interest, from your gross income to determine the actual profit or loss. Start by identifying total revenue or gross income, then deduct direct costs such as cost of goods sold (COGS), followed by operating expenses like rent and salaries. For example, if your gross income is $100,000 and your total expenses amount to $70,000, your net income would be $30,000, representing your true earnings after all obligations.

Importance of Gross and Net Income in Personal Finance

Gross income represents the total earnings before any deductions such as taxes or retirement contributions, providing a clear picture of your overall earning capacity. Net income, also known as take-home pay, reflects the actual amount available for spending or saving after all mandatory deductions, making it crucial for budgeting and financial planning. Understanding the distinction between gross and net income helps you manage your finances effectively, enabling better decisions around expenses, savings, and investments.

Impact of Taxes and Deductions on Income

Gross income represents your total earnings before taxes and deductions, while net income is the amount remaining after subtracting taxes, social security, and other withholdings. The impact of taxes and deductions significantly reduces your gross income, directly influencing your net income and overall financial health. Understanding these differences helps you better manage your budget and plan for expenses, ensuring your income aligns with your financial goals.

Gross vs Net Income in Business Context

Gross income represents the total revenue earned by a business before any expenses, taxes, or deductions are subtracted, serving as a key indicator of overall sales performance. Net income reflects the profit remaining after all operating costs, interest, taxes, and other expenses are deducted, providing a clearer measure of true profitability. Understanding the distinction between gross income and net income is essential for evaluating a company's financial health, operational efficiency, and decision-making strategies.

Conclusion: Choosing the Right Income Metric

Choosing the right income metric depends on Your financial goals and analysis needs; gross income reflects total earnings before deductions, while net income shows actual take-home pay after expenses and taxes. For budgeting and personal finance, net income provides a clearer picture of available funds, whereas gross income is useful for understanding overall earning potential. Evaluating both ensures accurate financial planning and informed decision-making.

Infographic: Gross Income vs Net Income

relatioo.com

relatioo.com