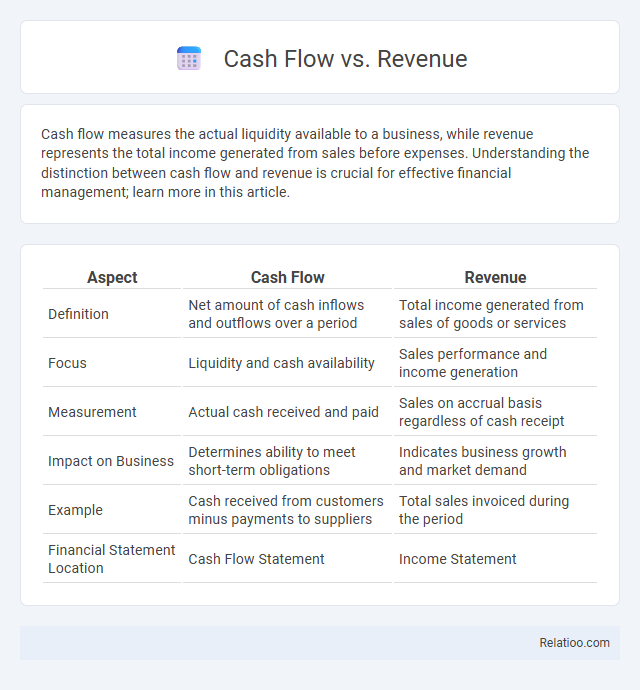

Cash flow measures the actual liquidity available to a business, while revenue represents the total income generated from sales before expenses. Understanding the distinction between cash flow and revenue is crucial for effective financial management; learn more in this article.

Table of Comparison

| Aspect | Cash Flow | Revenue |

|---|---|---|

| Definition | Net amount of cash inflows and outflows over a period | Total income generated from sales of goods or services |

| Focus | Liquidity and cash availability | Sales performance and income generation |

| Measurement | Actual cash received and paid | Sales on accrual basis regardless of cash receipt |

| Impact on Business | Determines ability to meet short-term obligations | Indicates business growth and market demand |

| Example | Cash received from customers minus payments to suppliers | Total sales invoiced during the period |

| Financial Statement Location | Cash Flow Statement | Income Statement |

Introduction to Cash Flow and Revenue

Cash flow represents the actual inflow and outflow of cash in your business, reflecting its liquidity and ability to cover expenses in real time, while revenue indicates the total income generated from sales before any expenses are deducted. Understanding the difference between cash flow and revenue is crucial for managing your financial health, as high revenue does not always mean positive cash flow. Properly tracking both metrics enables better decision-making and ensures your business maintains sufficient cash to operate smoothly.

Defining Cash Flow

Cash flow represents the actual amount of money moving in and out of your business during a specific period, reflecting liquidity and operational health. Unlike revenue, which indicates total sales or income generated before expenses, cash flow accounts for all cash transactions including payments and receipts. Understanding cash flow is essential for managing your finances, ensuring solvency, and making informed investment decisions.

Understanding Revenue

Revenue represents the total income generated from your business activities before expenses are deducted, serving as a key indicator of financial performance. Cash flow, contrastingly, tracks the actual movement of money into and out of your business, highlighting liquidity and operational health. Understanding revenue helps you gauge market demand and sales effectiveness, while cash flow ensures you maintain sufficient funds for daily operations.

Key Differences Between Cash Flow and Revenue

Cash flow refers to the actual inflow and outflow of cash within a business, indicating liquidity and operational efficiency, while revenue represents the total income generated from sales before any expenses are deducted. Understanding the key differences between cash flow and revenue helps you manage your finances more effectively by focusing on cash availability rather than just sales figures. Cash flow emphasizes real-time cash management, whereas revenue shows overall business performance over a period.

Importance of Cash Flow in Business Operations

Cash flow represents the actual inflow and outflow of cash within a business, whereas revenue reflects the total income generated from sales before expenses. Positive cash flow is crucial for maintaining daily operations, meeting financial obligations, and ensuring liquidity, which revenue alone cannot guarantee. Effective cash flow management prevents insolvency and supports sustainable growth by enabling timely payments to suppliers, employees, and creditors.

The Role of Revenue in Business Growth

Revenue represents the total income generated from your business activities, serving as the foundation for cash flow and overall financial health. While cash flow tracks the actual movement of money in and out of your accounts, revenue indicates the potential for growth by reflecting sales performance and market demand. Understanding the role of revenue helps you make informed decisions to drive sustainable business expansion and improve cash flow management.

How Cash Flow and Revenue Impact Financial Health

Cash flow and revenue are critical indicators of a company's financial health, with revenue representing the total income generated from sales and cash flow reflecting the actual liquidity available for operations. Positive cash flow ensures a business can cover expenses, invest in growth, and meet debt obligations, while high revenue may not translate to financial stability if cash flow is insufficient. Evaluating both metrics provides a comprehensive understanding of profitability and operational efficiency.

Common Misconceptions About Cash Flow and Revenue

Cash flow and revenue are often confused, but revenue represents total sales before expenses, while cash flow reflects actual cash moving in and out of a business. A common misconception is assuming high revenue guarantees positive cash flow, disregarding delayed payments or high operational costs that can cause cash shortages. Understanding the distinction helps in accurate financial analysis and maintaining liquidity.

Tips for Managing Both Cash Flow and Revenue

Effective management of cash flow and revenue requires accurate forecasting to ensure sufficient liquidity and maintain operational stability. Implementing a robust invoicing system accelerates receivables, while controlling expenses preserves cash reserves and supports sustainable growth. Regularly analyzing financial statements and key performance indicators enables proactive adjustments to optimize both cash flow and revenue streams.

Conclusion: Balancing Cash Flow and Revenue for Success

Balancing cash flow and revenue is crucial for your business's financial health, as revenue reflects total earnings while cash flow indicates actual liquidity available for operations. Sustainable success depends on managing cash flow effectively to meet expenses and invest in growth, even when revenue fluctuates. Prioritizing cash flow alongside revenue ensures your business remains solvent and poised for long-term profitability.

Infographic: Cash Flow vs Revenue

relatioo.com

relatioo.com