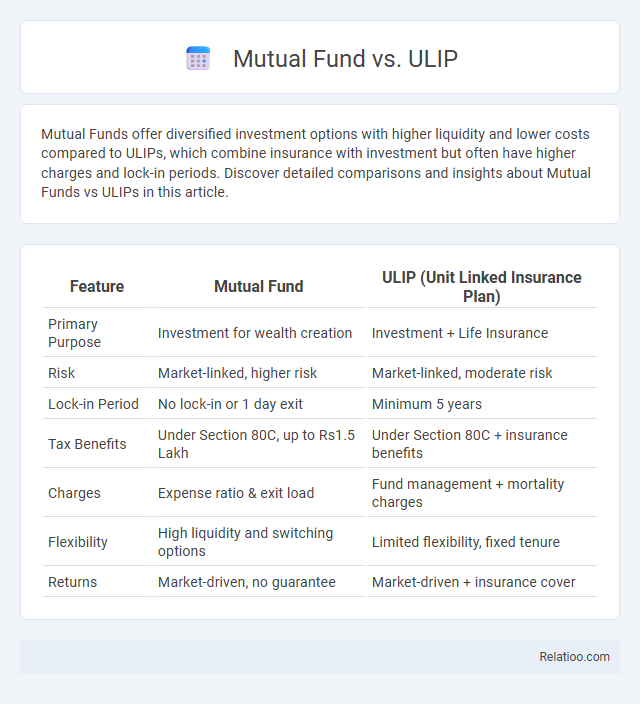

Mutual Funds offer diversified investment options with higher liquidity and lower costs compared to ULIPs, which combine insurance with investment but often have higher charges and lock-in periods. Discover detailed comparisons and insights about Mutual Funds vs ULIPs in this article.

Table of Comparison

| Feature | Mutual Fund | ULIP (Unit Linked Insurance Plan) |

|---|---|---|

| Primary Purpose | Investment for wealth creation | Investment + Life Insurance |

| Risk | Market-linked, higher risk | Market-linked, moderate risk |

| Lock-in Period | No lock-in or 1 day exit | Minimum 5 years |

| Tax Benefits | Under Section 80C, up to Rs1.5 Lakh | Under Section 80C + insurance benefits |

| Charges | Expense ratio & exit load | Fund management + mortality charges |

| Flexibility | High liquidity and switching options | Limited flexibility, fixed tenure |

| Returns | Market-driven, no guarantee | Market-driven + insurance cover |

Introduction to Mutual Funds and ULIPs

Mutual Funds pool money from multiple investors to invest in diversified portfolios of stocks, bonds, or other securities, offering professional management and liquidity. ULIPs (Unit Linked Insurance Plans) combine investment with insurance, allocating premiums into equity or debt funds while providing life cover. Mutual Funds focus primarily on wealth creation through market-linked returns, whereas ULIPs blend investment growth with risk protection, catering to different financial goals and risk appetites.

Key Differences Between Mutual Funds and ULIPs

Mutual Funds primarily invest in equities or debt instruments, offering higher liquidity and transparency, whereas ULIPs combine investment and insurance, providing life coverage alongside market-linked returns. Mutual Funds charge expense ratios based on fund management fees, contrasting with ULIPs that include premium allocation, mortality, and fund management charges. Tax benefits differ as ULIP premiums qualify for deductions under Section 80C, while Mutual Fund investments in Equity Linked Saving Schemes (ELSS) also offer tax advantages but with different lock-in periods.

Investment Objectives: Comparing Mutual Funds and ULIPs

Mutual Funds primarily focus on wealth creation through diversified equity or debt investments aimed at capital appreciation or income generation, catering to investors seeking liquidity and flexibility. ULIPs combine investment and insurance, offering both market-linked returns and life cover, targeting long-term wealth accumulation alongside financial protection. While Mutual Funds emphasize pure investment growth, ULIPs align with dual objectives of risk cover and disciplined savings over a longer tenure.

Risk Factors in Mutual Funds vs ULIPs

Mutual Funds expose you to market risks, including equity volatility and interest rate fluctuations, while ULIPs combine market risk with insurance benefits, with returns linked to fund performance and policy duration. ULIPs typically have higher charges and lock-in periods, which can affect liquidity and overall returns compared to Mutual Funds. Understanding the risk factors in Mutual Funds versus ULIPs helps you make informed investment decisions aligned with your risk tolerance and financial goals.

Returns Potential: Mutual Funds vs ULIPs

Mutual funds typically offer higher returns potential due to their diversified investments in equity, debt, and hybrid assets, allowing your portfolio to benefit from market growth. ULIPs combine investment and insurance, often with higher charges that can reduce overall returns despite offering tax benefits and life cover. Choosing mutual funds for your investments can unlock better wealth creation opportunities with greater flexibility and lower costs.

Tax Benefits: Mutual Funds and ULIPs Compared

Mutual Funds offer tax benefits primarily through Equity Linked Savings Schemes (ELSS), allowing investments up to Rs1.5 lakh under Section 80C with a lock-in period of three years, while ULIPs provide tax deductions on premiums paid under the same limit and tax-free maturity proceeds if held for at least five years. ULIPs combine investment and insurance, making their tax benefits more comprehensive but subject to longer lock-in periods compared to ELSS mutual funds. Understanding these differences helps you optimize your tax savings strategy while balancing risk, liquidity, and investment goals.

Liquidity and Lock-in Period: Mutual Funds vs ULIPs

Mutual funds offer higher liquidity with most open-ended schemes allowing redemption within 1-3 business days, whereas ULIPs impose a mandatory lock-in period of 5 years restricting early withdrawals. This lock-in period significantly affects your ability to access funds quickly in ULIPs compared to the flexibility provided by mutual funds. Understanding these differences helps optimize your investment strategy based on liquidity needs and financial goals.

Cost Structure and Charges in Mutual Funds vs ULIPs

Mutual Funds typically have lower expense ratios, averaging between 0.5% to 2.5%, with costs primarily driven by management fees and operational expenses, whereas ULIPs often involve higher charges including premium allocation, policy administration, fund management, and mortality charges that can cumulatively exceed 3%. Your investment in Mutual Funds benefits from transparent fee structures with exit loads usually applied only if funds are redeemed prematurely, while ULIPs impose lock-in periods and penalties that can significantly impact returns. Understanding these cost differences helps you optimize your portfolio by balancing expense efficiency in Mutual Funds against the insurance benefits embedded in ULIPs.

Suitability: Who Should Invest in Mutual Funds or ULIPs?

Mutual funds are ideal for investors seeking diversified portfolios with flexible investment amounts and liquidity, making them suitable for those focused on wealth creation through equities, debt, or balanced funds. ULIPs combine investment and insurance, fitting individuals who want long-term financial planning with life cover, typically benefiting those with a disciplined savings approach and risk tolerance aligned to market fluctuations. Your choice depends on your investment goals, risk appetite, and the need for life insurance alongside wealth accumulation.

Mutual Fund vs ULIP: Which Is Better for You?

Mutual Funds offer diversified investment portfolios managed by professionals with higher liquidity and lower costs, making them ideal for investors seeking flexibility and transparency. ULIPs combine investment and insurance, providing long-term wealth creation with tax benefits but often involve higher charges and less liquidity compared to Mutual Funds. Your choice between Mutual Fund vs ULIP depends on whether you prioritize pure investment growth with easy access or a dual benefit of insurance and investment with a long-term horizon.

Infographic: Mutual Fund vs ULIP

relatioo.com

relatioo.com