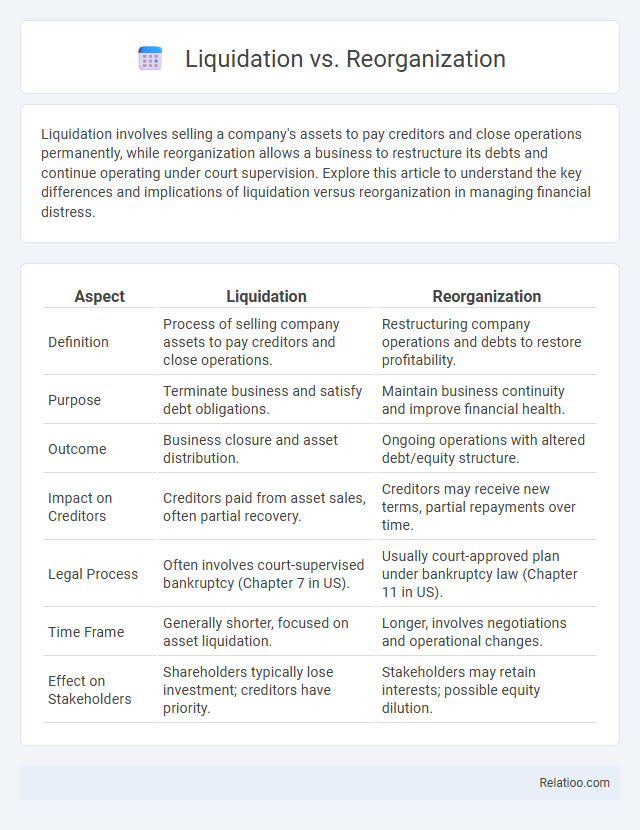

Liquidation involves selling a company's assets to pay creditors and close operations permanently, while reorganization allows a business to restructure its debts and continue operating under court supervision. Explore this article to understand the key differences and implications of liquidation versus reorganization in managing financial distress.

Table of Comparison

| Aspect | Liquidation | Reorganization |

|---|---|---|

| Definition | Process of selling company assets to pay creditors and close operations. | Restructuring company operations and debts to restore profitability. |

| Purpose | Terminate business and satisfy debt obligations. | Maintain business continuity and improve financial health. |

| Outcome | Business closure and asset distribution. | Ongoing operations with altered debt/equity structure. |

| Impact on Creditors | Creditors paid from asset sales, often partial recovery. | Creditors may receive new terms, partial repayments over time. |

| Legal Process | Often involves court-supervised bankruptcy (Chapter 7 in US). | Usually court-approved plan under bankruptcy law (Chapter 11 in US). |

| Time Frame | Generally shorter, focused on asset liquidation. | Longer, involves negotiations and operational changes. |

| Effect on Stakeholders | Shareholders typically lose investment; creditors have priority. | Stakeholders may retain interests; possible equity dilution. |

Understanding Liquidation and Reorganization

Liquidation involves selling a company's assets to pay off creditors, typically resulting in the business ceasing operations. Reorganization allows a financially distressed company to restructure its debts and operational framework, aiming to continue business activities while satisfying creditor claims. Understanding the differences between liquidation and reorganization is crucial for stakeholders assessing the potential outcomes of bankruptcy proceedings.

Key Differences Between Liquidation and Reorganization

Liquidation involves selling off a company's assets to pay creditors, resulting in the business ceasing operations, while reorganization restructures the company's debts and operations to allow it to continue functioning. You should consider that liquidation typically provides immediate creditor repayment through asset distribution, whereas reorganization focuses on long-term viability by adjusting payment terms and business strategy. Understanding these key differences helps determine the best financial strategy based on your business's survival potential and creditor agreements.

Types of Bankruptcy: Chapter 7 vs. Chapter 11

Chapter 7 bankruptcy involves the liquidation of your assets to pay off creditors, resulting in the complete dissolution of the business, while Chapter 11 bankruptcy focuses on reorganization, allowing the business to restructure its debts and continue operating. In a Chapter 7 case, a trustee sells non-exempt property, and the business typically ceases operations, whereas Chapter 11 enables the debtor to propose a plan to repay creditors over time. Choosing between liquidation and reorganization depends on your company's financial health and long-term viability.

Process of Liquidation in Business

Liquidation in business involves selling off a company's assets to pay creditors and dissolve the entity, typically initiated when the company is insolvent or unable to meet its financial obligations. The process starts with appointing a liquidator who assesses assets, negotiates with creditors, and distributes proceeds according to legal priority. Liquidation contrasts with reorganization, where a company restructures debt to continue operations, and bankruptcy, which can encompass both liquidation and reorganization under legal protection.

Steps Involved in Corporate Reorganization

Corporate reorganization involves assessing financial distress, developing a comprehensive restructuring plan, and gaining approval from creditors and stakeholders. Implementation includes renegotiating debts, restructuring operations, and potentially issuing new equity to stabilize the company. Continuous monitoring ensures compliance with the plan and measures progress toward financial recovery.

Impact on Creditors and Stakeholders

Liquidation involves selling a company's assets to pay creditors, often resulting in partial or no recovery for stakeholders, with unsecured creditors typically last in line. Reorganization allows the business to restructure debts while continuing operations, enhancing the likelihood of creditor repayment and preserving stakeholder value. Your involvement in reorganization may protect your interests better compared to liquidation or bankruptcy, where assets are often liquidated under court supervision.

Financial Outcomes of Liquidation vs. Reorganization

Liquidation involves selling all assets to pay creditors, typically resulting in lower recovery rates for Your stakeholders due to asset devaluation during forced sales. Reorganization aims to restructure debts and operations, allowing the business to continue and improve long-term financial stability while offering creditors higher chances of repayment. Bankruptcy encompasses both strategies but often leads to liquidation unless the court approves a viable reorganization plan.

Advantages and Disadvantages of Each Approach

Liquidation involves selling all company assets to pay creditors, offering a straightforward resolution and potential debt relief but often resulting in complete business closure and loss of equity. Reorganization enables restructuring debts and operations to continue business activities, providing a chance to recover and preserve jobs but can be complex, costly, and may not guarantee success. Bankruptcy serves as a legal process to manage insolvency, protecting your interests from creditors while potentially damaging your credit reputation and limiting future financing options.

Choosing the Right Option for Your Business

Choosing the right option for your business involves understanding key differences between liquidation, reorganization, and bankruptcy. Liquidation entails selling assets to pay creditors and ceasing operations, ideal when recovery isn't feasible. Reorganization, typically under Chapter 11 bankruptcy, allows restructuring debts while continuing operations, suitable for businesses aiming to regain profitability.

Long-Term Effects on Business Reputation and Operations

Liquidation often results in a complete loss of business assets and significant damage to brand reputation due to the abrupt cessation of operations. Reorganization allows a company to restructure its debts and operations, preserving its market presence and enhancing long-term viability. Bankruptcy, while legally protecting the business from creditors, can lead to lasting negative perceptions but may also provide a pathway to recovery through financial restructuring.

Infographic: Liquidation vs Reorganization

relatioo.com

relatioo.com