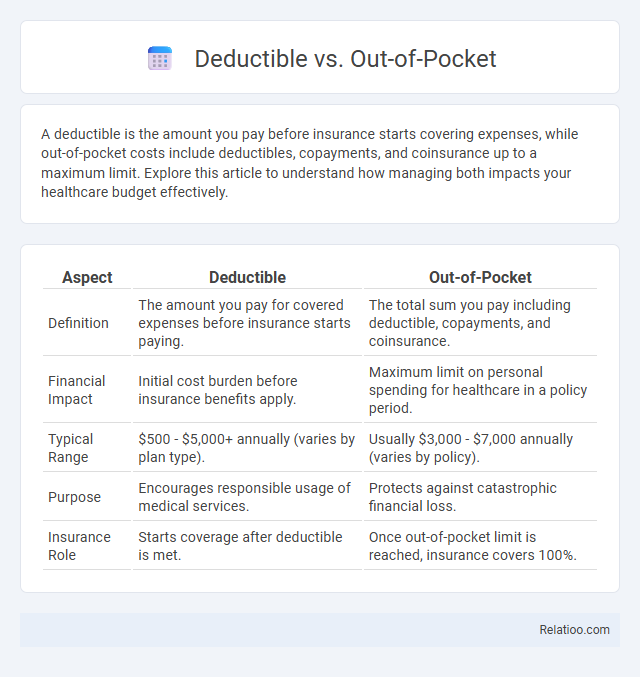

A deductible is the amount you pay before insurance starts covering expenses, while out-of-pocket costs include deductibles, copayments, and coinsurance up to a maximum limit. Explore this article to understand how managing both impacts your healthcare budget effectively.

Table of Comparison

| Aspect | Deductible | Out-of-Pocket |

|---|---|---|

| Definition | The amount you pay for covered expenses before insurance starts paying. | The total sum you pay including deductible, copayments, and coinsurance. |

| Financial Impact | Initial cost burden before insurance benefits apply. | Maximum limit on personal spending for healthcare in a policy period. |

| Typical Range | $500 - $5,000+ annually (varies by plan type). | Usually $3,000 - $7,000 annually (varies by policy). |

| Purpose | Encourages responsible usage of medical services. | Protects against catastrophic financial loss. |

| Insurance Role | Starts coverage after deductible is met. | Once out-of-pocket limit is reached, insurance covers 100%. |

Understanding Health Insurance Terminology

Understanding health insurance terminology is essential for managing your healthcare costs effectively, particularly when distinguishing between deductible, out-of-pocket, and premium expenses. A deductible refers to the amount you must pay before your insurance begins to cover services, whereas out-of-pocket costs include deductibles, copayments, and coinsurance up to a maximum limit set by the plan. Knowing how these terms impact your overall spending helps you make informed decisions about selecting the best health insurance plan for your needs.

What Is a Deductible?

A deductible is the amount a policyholder must pay out-of-pocket for covered healthcare services before the insurance company begins to pay. This fixed sum varies by insurance plan and typically resets annually, influencing the overall cost of premiums and coverage. Understanding the deductible is crucial for managing medical expenses, as it directly affects when out-of-pocket costs start to accumulate.

What Does Out-of-Pocket Mean?

Out-of-pocket refers to the amount you pay directly for healthcare services before your insurance covers the remaining costs. This includes your deductible, copayments, and coinsurance but excludes premiums. Understanding your out-of-pocket expenses helps you manage your healthcare budget more effectively.

How Deductibles Work in Health Plans

Deductibles are the amount you must pay out of pocket for covered healthcare services before your health insurance begins to pay. Unlike out-of-pocket maximums, which cap your total yearly spending on deductibles, copayments, and coinsurance, the deductible specifically applies to initial costs such as doctor visits, hospital stays, or prescription drugs. Understanding how your deductible works helps you manage your medical expenses and maximize your health plan benefits effectively.

Types of Out-of-Pocket Costs

Out-of-pocket costs include deductibles, copayments, and coinsurance, each representing different types of payments you must cover before or after your insurance starts to pay. The deductible is a fixed amount you pay annually before insurance covers most services, while copayments are set fees for specific services, and coinsurance is a percentage of costs you share after meeting the deductible. Understanding these types helps you manage your healthcare expenses and plan your budget effectively.

Key Differences Between Deductible and Out-of-Pocket

Your deductible is the fixed amount you pay for covered healthcare services before your insurance begins to share costs, while out-of-pocket refers to the total expenses you pay annually, including the deductible, copayments, and coinsurance. Key differences lie in the fact that the deductible is a subset of out-of-pocket costs, which have an annual limit defined by your insurance plan. Understanding these distinctions helps you manage healthcare expenses and avoid unexpected financial burdens.

Why Both Amounts Matter

Understanding the difference between deductible and out-of-pocket amounts is crucial for managing your healthcare expenses effectively. The deductible is the amount you pay before insurance begins to cover costs, while out-of-pocket includes the deductible plus co-payments and coinsurance, representing your total financial responsibility. Both amounts matter because the deductible affects when coverage starts, and the out-of-pocket limit defines the maximum you will pay in a policy period, protecting you from excessive medical bills.

How Deductibles and Out-of-Pocket Maximums Relate

Deductibles represent the amount You pay for covered healthcare services before Your insurance begins to pay, while the out-of-pocket maximum is the limit on total expenses You pay within a policy period, including deductibles, copayments, and coinsurance. Once You reach the deductible, Your insurance starts sharing costs, and payments continue until reaching the out-of-pocket maximum, after which insurance covers 100% of covered expenses. Understanding how deductibles and out-of-pocket maximums interact helps manage Your healthcare costs effectively and avoid unexpected financial burdens.

Common Misconceptions About Deductibles and Out-of-Pocket

Deductibles and out-of-pocket costs are often misunderstood in health insurance, with many assuming deductibles represent the total amount paid before coverage kicks in, while out-of-pocket limits cap the total personal spending on covered services. Common misconceptions include confusing the deductible with the out-of-pocket maximum, leading to unexpected expenses when coinsurance and copayments apply after the deductible is met. Understanding that deductibles are just one component of total out-of-pocket costs, which also include copays and coinsurance, is crucial for accurately assessing healthcare expenses.

Tips for Managing Your Health Care Expenses

Understanding the differences between deductible, out-of-pocket costs, and copayments can help you manage your health care expenses more effectively. Prioritize selecting insurance plans with reasonable deductibles and out-of-pocket maximums to avoid unexpected financial burdens. You can reduce expenses by using preventive care services and keeping track of all medical bills to ensure accurate insurance claims.

Infographic: Deductible vs Out-of-Pocket

relatioo.com

relatioo.com