Discretionary spending refers to non-essential expenses like entertainment and dining out, while essential spending covers necessities such as housing, utilities, and groceries. Understanding how to balance these can improve financial stability and relationship harmony; discover more insights in this article.

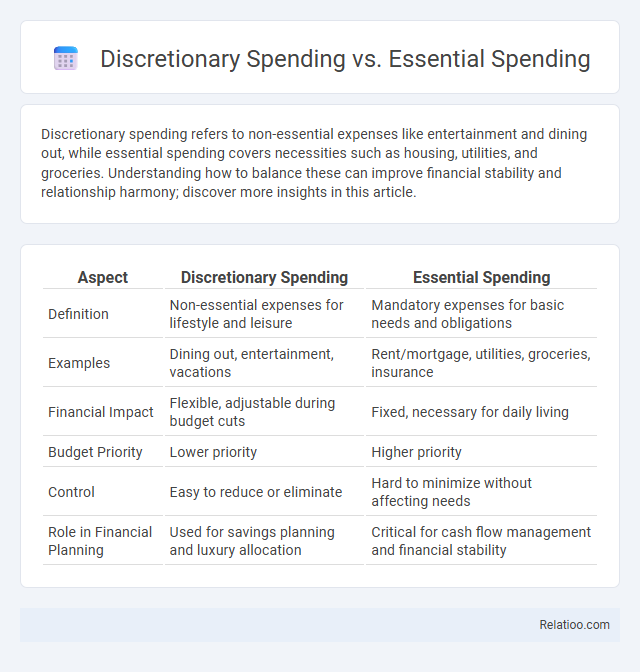

Table of Comparison

| Aspect | Discretionary Spending | Essential Spending |

|---|---|---|

| Definition | Non-essential expenses for lifestyle and leisure | Mandatory expenses for basic needs and obligations |

| Examples | Dining out, entertainment, vacations | Rent/mortgage, utilities, groceries, insurance |

| Financial Impact | Flexible, adjustable during budget cuts | Fixed, necessary for daily living |

| Budget Priority | Lower priority | Higher priority |

| Control | Easy to reduce or eliminate | Hard to minimize without affecting needs |

| Role in Financial Planning | Used for savings planning and luxury allocation | Critical for cash flow management and financial stability |

Understanding Discretionary vs Essential Spending

Discretionary spending refers to non-essential expenses such as entertainment, dining out, and luxury items, while essential spending covers necessities like housing, utilities, groceries, and healthcare. Understanding the difference helps you prioritize your budget, ensuring necessary costs are covered before allocating funds to discretionary purchases. Properly managing both types of spending promotes financial stability and effective money management.

What Qualifies as Essential Spending?

Essential spending includes necessary expenses critical for basic living standards, such as housing costs (rent or mortgage), utilities, groceries, healthcare, and transportation. This category typically covers mandatory bills and services that ensure safety, health, and well-being. Differentiating essential from discretionary spending helps manage budgets by prioritizing fundamental needs over non-essential purchases like entertainment or luxury items.

Common Examples of Discretionary Expenses

Common examples of discretionary expenses include dining out, entertainment such as movies and concerts, travel, and luxury items like designer clothing and gadgets. These costs are flexible and can be adjusted or eliminated based on financial priorities, unlike essential spending which covers necessities like housing, groceries, utilities, and healthcare. Managing discretionary spending effectively helps improve savings rates and maintain a balanced budget.

Key Differences Between Discretionary and Essential Spending

Discretionary spending involves non-essential expenses like entertainment, dining out, and vacations, which you can adjust or eliminate without impacting your basic living needs. Essential spending covers necessities such as housing, utilities, groceries, and healthcare, which are critical for your daily living and financial stability. Understanding these key differences helps you prioritize your budget, ensuring your essential expenses are met before allocating funds to discretionary purchases.

The Impact of Discretionary Spending on Financial Health

Discretionary spending, which includes non-essential expenses such as entertainment, dining out, and luxury items, plays a crucial role in shaping an individual's financial health by influencing savings rates and debt levels. Excessive discretionary spending can undermine financial stability, increasing reliance on credit and reducing funds available for essential needs like housing, utilities, and healthcare. Balanced management of discretionary expenses promotes financial resilience, enabling better cash flow management, improved emergency savings, and long-term wealth accumulation.

Strategies for Managing Essential Expenses

Effective strategies for managing essential expenses include prioritizing monthly bills such as housing, utilities, and groceries to ensure consistent payment and avoid financial penalties. Tracking your essential spending through budgeting apps or spreadsheets helps identify patterns and areas where costs can be minimized without compromising necessary needs. You can also negotiate fixed bills like insurance or phone plans to secure better rates, maximizing your financial stability and freeing up funds for discretionary spending.

How to Reduce Unnecessary Discretionary Costs

Reducing unnecessary discretionary spending involves identifying non-essential expenses such as dining out, entertainment subscriptions, and impulse purchases, then setting clear budgets for these categories. Tracking monthly discretionary expenses using apps or spreadsheets helps reveal spending patterns, enabling informed decisions to cut back on avoidable costs. Prioritizing essential spending on housing, utilities, and groceries ensures financial stability while minimizing unnecessary discretionary expenditures promotes savings growth.

Budgeting Tips: Balancing Discretionary and Essential Spending

Balancing discretionary and essential spending is crucial for effective budgeting, ensuring that your financial priorities are met without sacrificing flexibility. Essential spending covers necessities like housing, utilities, and groceries, while discretionary spending includes non-essential items such as entertainment and dining out. By tracking both types of expenses carefully and setting clear limits, you can achieve a sustainable budget that supports both your needs and personal goals.

The Role of Income in Determining Spending Categories

Income plays a crucial role in categorizing spending into discretionary and essential expenses, as it directly influences the allocation of funds towards necessary needs and optional wants. Your essential spending covers fundamental costs such as rent, utilities, and groceries, while discretionary spending includes non-essential items like entertainment and dining out, which fluctuate based on income levels. Higher income generally allows more flexibility in discretionary spending, whereas limited income necessitates prioritizing essential expenses to maintain financial stability.

Frequently Asked Questions About Discretionary vs Essential Spending

Discretionary spending refers to non-essential expenses like entertainment and dining out, while essential spending covers necessities such as housing, utilities, and groceries. Frequently asked questions about discretionary vs essential spending often focus on how to prioritize your budget, manage financial stability, and identify areas where you can cut back without impacting your basic needs. Understanding these distinctions helps you make informed decisions to balance saving and spending effectively.

Infographic: Discretionary Spending vs Essential Spending

relatioo.com

relatioo.com