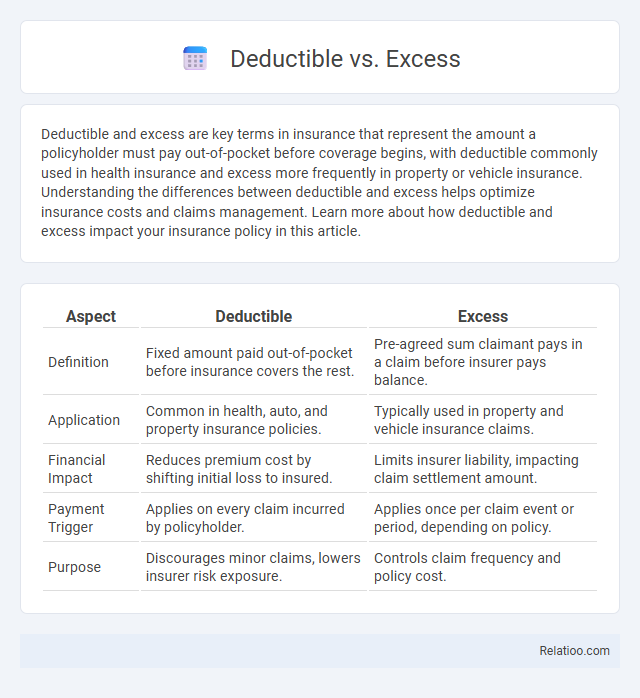

Deductible and excess are key terms in insurance that represent the amount a policyholder must pay out-of-pocket before coverage begins, with deductible commonly used in health insurance and excess more frequently in property or vehicle insurance. Understanding the differences between deductible and excess helps optimize insurance costs and claims management. Learn more about how deductible and excess impact your insurance policy in this article.

Table of Comparison

| Aspect | Deductible | Excess |

|---|---|---|

| Definition | Fixed amount paid out-of-pocket before insurance covers the rest. | Pre-agreed sum claimant pays in a claim before insurer pays balance. |

| Application | Common in health, auto, and property insurance policies. | Typically used in property and vehicle insurance claims. |

| Financial Impact | Reduces premium cost by shifting initial loss to insured. | Limits insurer liability, impacting claim settlement amount. |

| Payment Trigger | Applies on every claim incurred by policyholder. | Applies once per claim event or period, depending on policy. |

| Purpose | Discourages minor claims, lowers insurer risk exposure. | Controls claim frequency and policy cost. |

Understanding Deductible and Excess: Key Definitions

Deductible refers to the fixed amount a policyholder must pay out-of-pocket before insurance coverage begins, commonly used in health and auto insurance. Excess represents the portion of a claim that the insured agrees to pay, often applied in property and vehicle insurance policies, sometimes varying by claim type. Both deductible and excess reduce the insurer's liability and influence premium costs, but deductible usually denotes a predetermined cost, whereas excess can be adjustable or linked to claim frequency.

Purpose of Deductible and Excess in Insurance

Deductible and excess both refer to the amount you pay out of pocket before your insurance coverage begins, serving to reduce the insurer's risk and keep premiums affordable. Your deductible is the fixed sum specified in the policy that you must cover in a claim, while excess often represents an additional charge applied under certain conditions, such as after a claim. Understanding the purpose of deductible and excess helps you manage your financial responsibility and better navigate insurance claims.

Types of Deductibles: Fixed, Percentage, and More

Types of deductibles in insurance include fixed, percentage, and variable options that directly impact your claims and premiums. A fixed deductible requires you to pay a set dollar amount before coverage kicks in, while a percentage deductible is calculated as a proportion of the insured value or claim amount. Understanding these types helps you choose the right balance between upfront costs and long-term financial protection tailored to your needs.

How Excess Works in Insurance Policies

Excess in insurance policies refers to the amount You agree to pay out of pocket before the insurer covers the remaining claim costs. Unlike a deductible, which is a fixed amount subtracted from the claim, excess can sometimes be a percentage of the claim or policy limit, impacting how much You pay during a claim. Understanding the specific excess terms in Your policy helps manage claim expenses and premiums effectively.

Deductible vs Excess: Main Differences

Deductible and excess both refer to the amount a policyholder must pay out-of-pocket before insurance coverage kicks in, but deductible is commonly used in health and auto insurance while excess is more prevalent in property and vehicle insurance contexts. The deductible amount is typically fixed and agreed upon when purchasing the policy, whereas excess can sometimes include both compulsory and voluntary components that affect premium costs. Understanding the key difference involves recognizing that deductible reduces the insurer's payout directly, while excess may influence the overall claim process and premium calculations differently depending on the policy terms.

Impact on Premiums: Choosing the Right Amount

Selecting the appropriate deductible directly influences insurance premiums, with higher deductibles generally reducing premium costs due to lower insurer risk exposure. Excess, often synonymous with deductible in many regions, refers to the amount a policyholder pays out-of-pocket before insurance coverage begins, impacting out-of-pocket expenses rather than premium amounts. Understanding the distinction and balancing deductible levels ensures optimal premium savings while managing potential out-of-pocket financial burdens effectively.

Claim Scenarios: Deductible vs Excess in Action

In insurance claim scenarios, a deductible represents the fixed amount a policyholder must pay out-of-pocket before the insurer covers the remaining loss, while excess refers to the portion of a claim the insured must bear, often varying based on the claim type or policy terms. For example, if a car repair costs $2,000 and the deductible is $500, the insurer pays $1,500; with excess, if set at $300, the policyholder pays that first before any claim reimbursement. Understanding the distinction between deductible and excess is crucial for accurately assessing financial responsibility during claim settlements and optimizing policy choices.

Pros and Cons: High vs Low Deductible/Excess

Choosing a high deductible or excess reduces your premium costs but increases your out-of-pocket expenses during a claim, offering potential savings if you rarely file. A low deductible or excess means higher premiums but less financial burden when making a claim, providing peace of mind for frequent or higher-risk claimants. Your decision should balance your risk tolerance and financial readiness to cover the deductible, optimizing both affordability and coverage.

Tips for Deciding Between Deductible and Excess

When choosing between deductible and excess, evaluate your financial ability to cover out-of-pocket costs during a claim, as deductibles are fixed amounts you pay first and excess can vary with claims frequency. Consider your risk tolerance and claim history to determine whether a lower deductible with higher premiums or a higher excess that reduces your premium suits your budget. Reviewing policy terms and consulting with insurance advisors helps optimize coverage while managing potential expenses effectively.

Frequently Asked Questions About Deductible and Excess

Deductible and excess both refer to the amount a policyholder pays out-of-pocket before an insurance company covers a claim, but terminology varies by region: "deductible" is commonly used in the US, while "excess" is more frequent in the UK and Australia. Frequently asked questions often address how choosing a higher deductible or excess impacts premium costs, the difference between compulsory and voluntary excess, and whether these amounts apply per claim or annually. Understanding these distinctions helps policyholders optimize coverage and manage claim expenses effectively.

Infographic: Deductible vs Excess

relatioo.com

relatioo.com