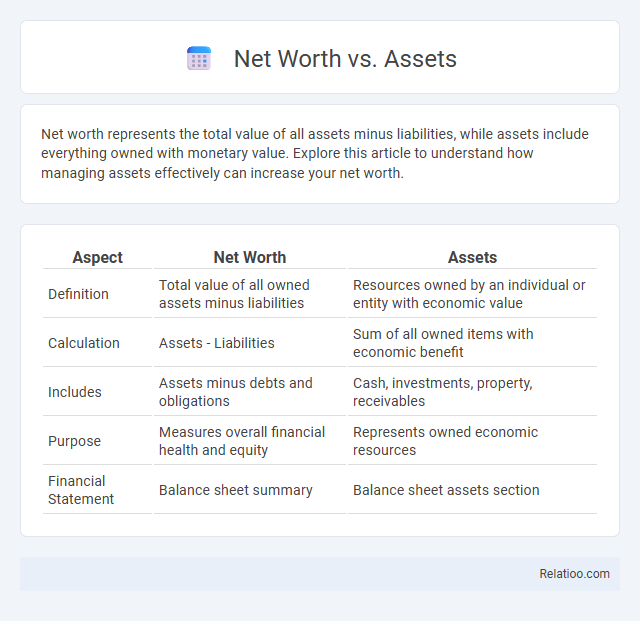

Net worth represents the total value of all assets minus liabilities, while assets include everything owned with monetary value. Explore this article to understand how managing assets effectively can increase your net worth.

Table of Comparison

| Aspect | Net Worth | Assets |

|---|---|---|

| Definition | Total value of all owned assets minus liabilities | Resources owned by an individual or entity with economic value |

| Calculation | Assets - Liabilities | Sum of all owned items with economic benefit |

| Includes | Assets minus debts and obligations | Cash, investments, property, receivables |

| Purpose | Measures overall financial health and equity | Represents owned economic resources |

| Financial Statement | Balance sheet summary | Balance sheet assets section |

Understanding Net Worth: Definition and Importance

Net worth represents the total value of Your assets minus liabilities, reflecting your overall financial health. Assets include everything you own of value, such as cash, investments, property, and personal possessions, while liabilities are debts or obligations owed. Understanding net worth is crucial for assessing financial progress, making informed decisions, and planning for future financial goals.

What Are Assets? Types and Examples

Assets represent valuable resources owned by individuals or businesses, categorized into tangible assets like real estate, machinery, and cash, and intangible assets such as patents, trademarks, and goodwill. Financial assets include stocks, bonds, and bank deposits that generate income or appreciate over time. Understanding asset types is essential for evaluating net worth, which is the difference between total assets and liabilities, reflecting overall financial health.

Key Differences Between Net Worth and Assets

Net worth represents the total value of an individual's or company's assets minus liabilities, reflecting overall financial health. Assets encompass everything owned with monetary value, such as cash, property, investments, and equipment, but do not account for debts or obligations. The key difference lies in net worth providing a comprehensive financial snapshot by subtracting liabilities from total assets, while assets alone show only the total owned resources.

How to Calculate Your Net Worth

To calculate your net worth, list all your assets such as cash, investments, real estate, and personal property, then total their current market values. Next, subtract your liabilities, including mortgages, loans, credit card debt, and other obligations, from the sum of your assets. Your net worth represents the difference, showing the true financial value of everything you own after debts are accounted for.

Why Assets Alone Don’t Reflect Financial Health

Assets alone don't reflect financial health because they fail to account for liabilities, which directly impact net worth--a critical measure of true financial stability. Net worth, calculated as total assets minus total liabilities, provides a clearer picture of an individual's or company's financial position by showing the actual value owned after debts are settled. Relying solely on asset values can be misleading, as high asset figures may be accompanied by equally high liabilities, resulting in a low or even negative net worth.

The Role of Liabilities in Net Worth Calculation

Liabilities play a critical role in calculating your net worth by representing the total debts or financial obligations you owe, which directly reduce your overall financial value. While assets reflect everything you own, net worth is derived by subtracting liabilities from your total assets, providing a clear picture of your true financial standing. Understanding how liabilities impact net worth helps you better manage debt and improve your financial health.

Common Misconceptions About Net Worth vs Assets

Common misconceptions about net worth versus assets often confuse the terms as synonymous, but net worth is calculated by subtracting liabilities from total assets, reflecting true financial health. Many individuals mistakenly believe owning high-value assets alone equates to positive net worth, ignoring outstanding debts that reduce overall equity. Understanding these distinctions is crucial for accurate personal financial assessment and strategic wealth management.

Asset Growth Strategies for Increasing Net Worth

Asset growth strategies are essential for increasing net worth by expanding the total value of owned resources such as investments, real estate, and business holdings. Focusing on high-yield investments, diversifying asset portfolios, and reinvesting returns accelerates asset appreciation and contributes to overall net worth enhancement. Continuous monitoring of asset performance and leveraging tax-advantaged accounts optimize long-term wealth accumulation and financial stability.

Net Worth Benchmarks by Age and Income

Net worth represents the total value of your assets minus liabilities, serving as a crucial financial health indicator, while assets include everything you own with monetary value. Net worth benchmarks by age and income help you understand if your savings and investments align with typical financial goals at various life stages. Tracking your net worth relative to peers can guide better financial decisions and highlight areas for growth based on average benchmarks for your demographic.

Practical Tips to Improve Net Worth Over Time

Improving net worth over time involves increasing assets such as investments, real estate, and savings while minimizing liabilities like debt and expenses. Regularly tracking and budgeting finances enables better allocation of income toward asset accumulation and debt reduction. Diversifying income streams and reinvesting returns help build sustainable wealth and enhance overall financial health.

Infographic: Net Worth vs Assets

relatioo.com

relatioo.com