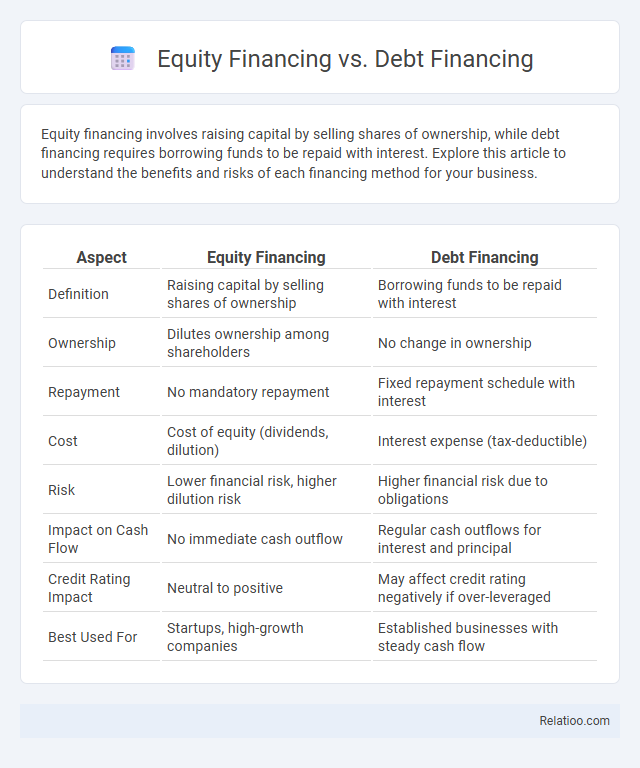

Equity financing involves raising capital by selling shares of ownership, while debt financing requires borrowing funds to be repaid with interest. Explore this article to understand the benefits and risks of each financing method for your business.

Table of Comparison

| Aspect | Equity Financing | Debt Financing |

|---|---|---|

| Definition | Raising capital by selling shares of ownership | Borrowing funds to be repaid with interest |

| Ownership | Dilutes ownership among shareholders | No change in ownership |

| Repayment | No mandatory repayment | Fixed repayment schedule with interest |

| Cost | Cost of equity (dividends, dilution) | Interest expense (tax-deductible) |

| Risk | Lower financial risk, higher dilution risk | Higher financial risk due to obligations |

| Impact on Cash Flow | No immediate cash outflow | Regular cash outflows for interest and principal |

| Credit Rating Impact | Neutral to positive | May affect credit rating negatively if over-leveraged |

| Best Used For | Startups, high-growth companies | Established businesses with steady cash flow |

Introduction to Equity and Debt Financing

Equity financing involves raising capital by selling shares of ownership in your company, allowing investors to gain a stake in future profits and decision-making. Debt financing requires borrowing funds that must be repaid over time with interest, maintaining full ownership but creating a financial obligation. Understanding the distinctions between these financing methods is essential for selecting the optimal strategy tailored to your business growth and risk tolerance.

Key Differences Between Equity and Debt Financing

Equity financing involves selling shares of your company to raise capital, giving investors ownership stakes, while debt financing requires borrowing funds that must be repaid with interest without diluting ownership. Key differences include control implications, as equity financing shares decision-making power with investors, whereas debt financing maintains your full control but adds repayment obligations. Understanding these distinctions helps you choose the right financial agreement based on your business goals and risk tolerance.

Pros and Cons of Equity Financing

Equity financing provides businesses with capital without the obligation to repay, reducing financial risk and improving cash flow but dilutes ownership and control. Investors expect returns through dividends or capital gains, which can be costly if the company performs well. Unlike debt financing, equity imposes no fixed repayment schedule or interest burden, but may result in loss of autonomy for original owners through shared decision-making.

Pros and Cons of Debt Financing

Debt financing offers the advantage of retaining full ownership and control of your business since no equity is surrendered, allowing you to maintain decision-making power. It often provides predictable repayment schedules and potential tax benefits through interest deductions. However, the obligation to make regular payments regardless of business performance can strain cash flow, and excessive debt increases financial risk, potentially leading to solvency issues.

Impact on Ownership and Control

Equity financing involves raising capital by selling shares, which dilutes Your ownership and reduces control as investors gain voting rights. Debt financing requires borrowing funds that must be repaid with interest, preserving Your ownership but imposing financial obligations and potential risk if repayments are missed. Financial agreements, such as convertible notes, blend elements of both, initially limiting control impact but potentially leading to ownership dilution upon conversion to equity.

Financial Risk and Return Considerations

Equity financing involves raising capital by selling ownership stakes, which reduces financial risk since there are no mandatory repayments, but it dilutes control and potential returns for existing shareholders. Debt financing requires borrowing funds that must be repaid with interest, increasing financial risk due to fixed obligations but offering tax advantages and the potential for higher returns on equity through leverage. Financial agreements outline the specific terms for either equity or debt arrangements, crucially defining risk exposure, repayment schedules, interest rates, and covenants that impact both financial risk and expected returns.

Suitable Business Scenarios for Each Financing Option

Equity financing suits startups and high-growth companies seeking capital without immediate repayment obligations, allowing investors to share ownership and risk. Debt financing is ideal for established businesses with steady cash flow that can manage fixed interest payments without diluting ownership. Financial agreements, such as leases or factoring, provide flexible funding solutions tailored to operational needs, often used by companies aiming to optimize cash flow without long-term debt or equity dilution.

Cost Implications: Interest vs. Equity Dilution

Equity financing involves raising capital by selling shares, leading to ownership dilution but no mandatory interest payments, which can preserve cash flow during growth phases. Debt financing requires borrowing funds that must be repaid with interest, increasing fixed financial obligations but retaining full ownership and control. Financial agreements outline the terms between parties, balancing cost implications such as interest rates in debt or equity dilution percentages, directly affecting a company's capital structure and long-term financial strategy.

Tax Benefits and Legal Aspects

Equity financing offers potential tax advantages through dividend tax treatments and the absence of mandatory interest payments, while debt financing provides tax-deductible interest expenses that reduce taxable income but imposes fixed repayment obligations. Financial agreements outline the legal frameworks governing these transactions, ensuring compliance with securities regulations, investor rights, and debt covenants. Understanding the interplay between tax benefits and contractual legal obligations is crucial for optimizing capital structure and minimizing fiscal liabilities.

How to Choose Between Equity and Debt Financing

Choosing between equity financing and debt financing depends on your company's financial health, growth potential, and risk tolerance. Equity financing provides capital in exchange for ownership shares, reducing immediate repayment pressure but diluting control, while debt financing involves borrowing funds with fixed repayment schedules, preserving ownership but increasing financial risk. Your decision should balance cash flow stability, cost of capital, and long-term business goals to optimize funding strategy.

Infographic: Equity Financing vs Debt Financing

relatioo.com

relatioo.com