Personal Allowance is the standard tax-free amount individuals can earn annually without paying income tax, while Blind Person's Allowance offers an additional tax-free amount specifically for visually impaired individuals. Explore this article to understand how these allowances impact your tax relief and eligibility.

Table of Comparison

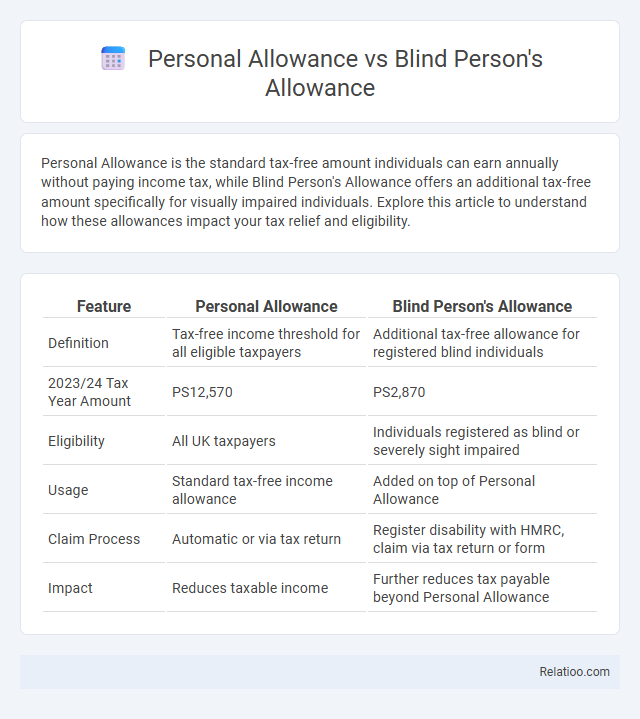

| Feature | Personal Allowance | Blind Person's Allowance |

|---|---|---|

| Definition | Tax-free income threshold for all eligible taxpayers | Additional tax-free allowance for registered blind individuals |

| 2023/24 Tax Year Amount | PS12,570 | PS2,870 |

| Eligibility | All UK taxpayers | Individuals registered as blind or severely sight impaired |

| Usage | Standard tax-free income allowance | Added on top of Personal Allowance |

| Claim Process | Automatic or via tax return | Register disability with HMRC, claim via tax return or form |

| Impact | Reduces taxable income | Further reduces tax payable beyond Personal Allowance |

Understanding Personal Allowance

Personal Allowance is the amount of income you can earn tax-free in a tax year, reducing your overall taxable income. Blind Person's Allowance offers an additional tax-free amount if you are registered as blind, increasing your tax-free threshold beyond the standard Personal Allowance. Understanding your Personal Allowance helps optimize your tax planning and ensures you take full advantage of the income you are allowed to earn without being taxed.

What Is Blind Person’s Allowance?

Blind Person's Allowance is a tax relief provided to individuals certified as blind or severely sight-impaired, allowing them to reduce their taxable income. Unlike the standard Personal Allowance, which applies to all taxpayers up to a certain income threshold, Blind Person's Allowance offers an additional exemption that can be transferred between spouses or civil partners if unused. This allowance effectively lowers the overall income tax liability for eligible individuals, enhancing financial support for the visually impaired.

Eligibility Criteria for Personal Allowance

Personal Allowance eligibility criteria require individuals to be UK residents with an income below a specific threshold, which adjusts annually based on government regulations. Blind Person's Allowance eligibility extends to individuals registered as blind or severely sight-impaired, offering an increased tax exemption compared to the standard Personal Allowance. Your eligibility for Personal Allowance depends primarily on your income level and residency status, distinguishing it from the additional provisions available with Blind Person's Allowance.

Who Qualifies for Blind Person’s Allowance?

Blind Person's Allowance is a specific tax relief available to individuals registered as blind or severely sight impaired with their local authority, providing an additional tax-free amount on top of the standard Personal Allowance. You qualify for this allowance if you have certification from an ophthalmologist confirming blindness or meet the strict legal definition of blindness, which includes limited vision even with corrective lenses. This allowance reduces your overall taxable income, increasing your potential tax savings compared to the standard Personal Allowance alone.

Allowance Amounts for 2024

The Personal Allowance for 2024 is set at PS12,570, while the Blind Person's Allowance provides an additional PS2,870, increasing your total tax-free income if you qualify. These allowances are configured to reduce your taxable income, meaning blind individuals benefit from a higher threshold. Understanding these specific allowance amounts helps you optimize your tax efficiency for the year.

How to Claim Each Allowance

To claim your Personal Allowance, you need to apply through HM Revenue and Customs (HMRC) by notifying them of your income details, often done automatically through your tax code if you're employed. For the Blind Person's Allowance, you must fill out and submit form BD8 with confirmation from a qualified medical professional or registered certifying body; HMRC then adjusts your tax code accordingly. Personal Allowance is generally assigned automatically, but ensuring you report changes in circumstances promptly helps maintain the correct allowance for your tax situation.

Can You Combine Personal Allowance and Blind Person’s Allowance?

Personal Allowance is the standard income tax-free amount available to all taxpayers, while Blind Person's Allowance provides an additional tax-free amount specifically for individuals registered as severely sight impaired. You can combine Personal Allowance and Blind Person's Allowance to increase your total tax-free income, maximizing your tax savings. Combining these allowances is beneficial for eligible blind individuals, effectively raising their threshold before income tax applies.

Tax Implications and Savings

Personal Allowance provides a tax-free income threshold, reducing taxable income by up to PS12,570 annually for most UK taxpayers in the 2023/24 tax year. Blind Person's Allowance offers an additional tax relief of PS2,870, which can be claimed alongside the Personal Allowance, further decreasing taxable income and increasing potential tax savings. Utilizing both allowances effectively lowers tax liability, maximizing after-tax income and providing significant financial relief for eligible individuals.

Common Misconceptions

Personal Allowance, Blind Person's Allowance, and Marriage Allowance are often confused, but they serve distinct purposes in UK tax relief. Personal Allowance applies to most taxpayers, reducing taxable income by a set amount, whereas Blind Person's Allowance offers an additional tax-free amount specifically for visually impaired individuals. Your misunderstanding might lead to missed tax benefits, as these allowances cannot be combined indiscriminately and require proper eligibility verification.

Frequently Asked Questions (FAQs)

Personal Allowance is the amount of income you can earn tax-free each year, while Blind Person's Allowance provides an additional tax-free amount if you are registered as blind; combined, these allowances reduce your taxable income. Your Personal Allowance for the 2023/24 tax year is PS12,570, and the Blind Person's Allowance adds PS2,870, increasing your overall tax relief. Frequently asked questions include eligibility criteria for Blind Person's Allowance, how to claim these allowances on your tax return, and whether unused Personal Allowance can be transferred or carried forward.

Infographic: Personal Allowance vs Blind Person’s Allowance

relatioo.com

relatioo.com