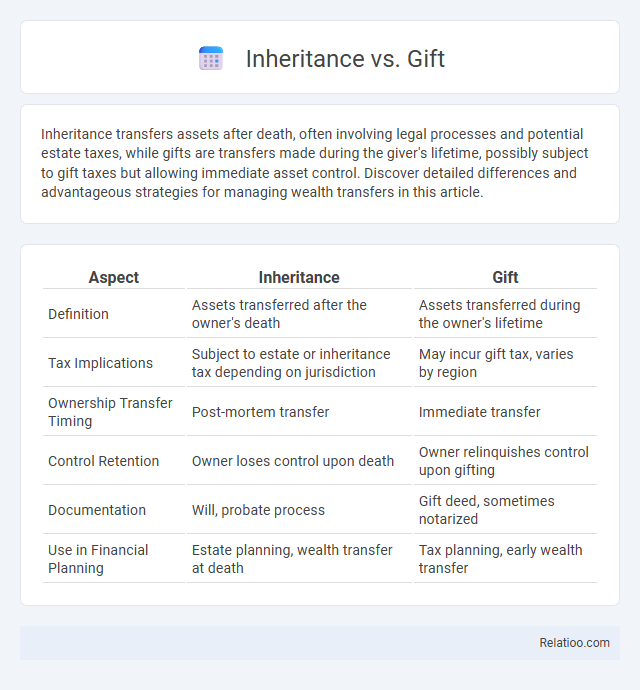

Inheritance transfers assets after death, often involving legal processes and potential estate taxes, while gifts are transfers made during the giver's lifetime, possibly subject to gift taxes but allowing immediate asset control. Discover detailed differences and advantageous strategies for managing wealth transfers in this article.

Table of Comparison

| Aspect | Inheritance | Gift |

|---|---|---|

| Definition | Assets transferred after the owner's death | Assets transferred during the owner's lifetime |

| Tax Implications | Subject to estate or inheritance tax depending on jurisdiction | May incur gift tax, varies by region |

| Ownership Transfer Timing | Post-mortem transfer | Immediate transfer |

| Control Retention | Owner loses control upon death | Owner relinquishes control upon gifting |

| Documentation | Will, probate process | Gift deed, sometimes notarized |

| Use in Financial Planning | Estate planning, wealth transfer at death | Tax planning, early wealth transfer |

Understanding Inheritance and Gift: Key Definitions

Inheritance refers to assets or property transferred to beneficiaries upon the death of an individual, governed by estate laws and wills. A gift involves the voluntary transfer of ownership or assets during the donor's lifetime, often subject to gift tax regulations. Understanding these definitions clarifies tax implications, legal requirements, and the timing of asset transfer between inheritance and gift.

Legal Differences Between Inheritance and Gift

Legal differences between inheritance and gift primarily hinge on timing and taxation; inheritance transfers assets after death through wills or intestate succession, while gifts are voluntary transfers during the donor's lifetime. Inheritance often involves probate court to validate wills and distribute assets, whereas gifts bypass probate but may require gift tax filings depending on value thresholds established by tax authorities. You should understand these distinctions to navigate estate planning effectively and minimize legal complications.

Tax Implications: Inheritance vs Gift

Inheritance typically incurs estate taxes based on the deceased's estate value, with heirs possibly facing capital gains tax on inherited property when sold. Gifts exceeding the annual exclusion amount trigger gift tax obligations for the donor, but recipients generally bear no immediate tax liability. Understanding the annual gift tax exclusion, lifetime exemption limits, and step-up in basis rules is critical for effective tax planning between inheritance and gift transfers.

Process and Documentation Required

Inheritance requires formal probate court proceedings to validate the deceased's will and transfer assets according to legal guidelines, typically needing a death certificate, will, and court documents. Gifts involve a direct transfer of ownership during the donor's lifetime, requiring a gift deed and often valuation documents for tax purposes, without court involvement. Estate inheritance may involve more complex documentation such as estate tax returns, letters of administration, and asset inventories to ensure compliance with inheritance laws and tax regulations.

Timing: When Assets Are Transferred

Inheritance transfers assets after the owner's death, typically through probate, which can delay access by months or even years. Gifts occur during the giver's lifetime, allowing You to receive assets immediately without probate, but with potential tax implications depending on the value and jurisdiction. Estate planning often balances both methods to optimize timing and minimize taxation.

Rights and Obligations of Recipients

Recipients of inheritance gain ownership rights and may be responsible for settling any outstanding debts or liabilities of the deceased's estate, subject to probate laws. Gift recipients obtain full ownership free from debts of the giver, but gifts may incur tax obligations depending on jurisdiction and value. Inheritance gifts during a lifetime, often referred to as inter vivos gifts, transfer property rights immediately, yet recipients must understand potential tax impositions and the possible revocation risks imposed by the donor.

Common Scenarios: Inheritance vs Gifting

Inheritance and gifting both transfer assets but differ in timing and tax implications, with inheritance occurring after death and gifting during the giver's lifetime. Your decision between these depends on factors such as estate size, tax exemptions, and the potential for gift tax or inheritance tax liabilities. Common scenarios include parents gifting property to children to reduce estate taxes or heirs inheriting assets under a will, each requiring careful planning to optimize financial outcomes.

Pros and Cons of Gifting Compared to Inheritance

Gifting allows for immediate transfer of assets, potentially reducing estate taxes and enabling recipients to benefit from the assets sooner, but it may incur gift tax liabilities and reduce the giver's estate value. Inheritance typically occurs after death, often avoiding gift taxes and allowing for a step-up in basis on inherited assets, which can minimize capital gains tax for heirs, though it may delay access to assets and complicate estate administration. Gifting requires careful planning to balance tax implications and control retention, whereas inheritance offers a more structured yet less flexible transfer process.

Strategies for Estate Planning

Effective estate planning strategies involve understanding the differences between inheritance, gifts, and trusts to minimize tax liabilities and ensure asset protection. Utilizing lifetime gifts can reduce estate size and potential estate taxes, while establishing trusts provides control over asset distribution and safeguards beneficiaries. Coordinating these tools with legal and financial professionals optimizes the transfer of wealth according to individual goals and regulatory requirements.

Frequently Asked Questions (FAQs)

Inheritance refers to assets transferred after the death of the owner, often subject to probate and inheritance tax, while a gift is a voluntary transfer of property during the donor's lifetime, potentially triggering gift tax depending on the jurisdiction. Frequently asked questions include differences in tax implications, the impact on estate planning, and legal documentation required for each method. Understanding the timing, tax liabilities, and legal processes helps individuals choose the most efficient way to transfer wealth.

Infographic: Inheritance vs Gift

relatioo.com

relatioo.com