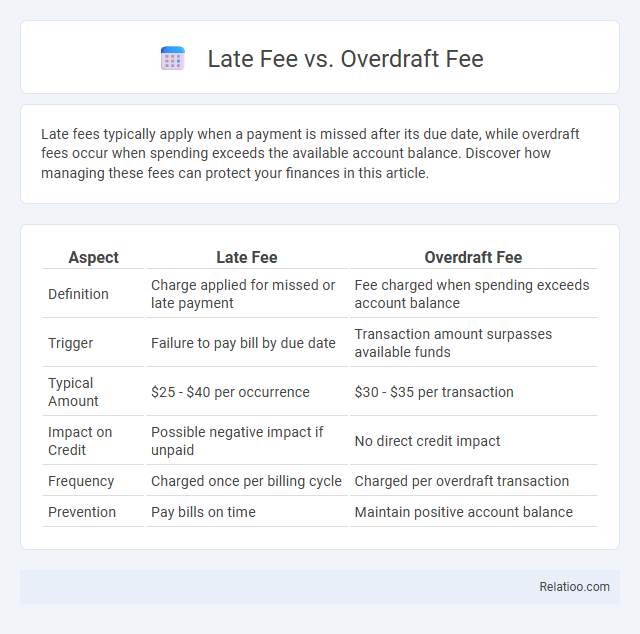

Late fees typically apply when a payment is missed after its due date, while overdraft fees occur when spending exceeds the available account balance. Discover how managing these fees can protect your finances in this article.

Table of Comparison

| Aspect | Late Fee | Overdraft Fee |

|---|---|---|

| Definition | Charge applied for missed or late payment | Fee charged when spending exceeds account balance |

| Trigger | Failure to pay bill by due date | Transaction amount surpasses available funds |

| Typical Amount | $25 - $40 per occurrence | $30 - $35 per transaction |

| Impact on Credit | Possible negative impact if unpaid | No direct credit impact |

| Frequency | Charged once per billing cycle | Charged per overdraft transaction |

| Prevention | Pay bills on time | Maintain positive account balance |

Understanding Late Fees: Definition and Purpose

Late fees are charges imposed when a payment is not received by the due date, designed to encourage timely payments and compensate the lender for the delay. Overdraft fees occur when you spend more money than your bank account holds, resulting in a penalty for exceeding the available balance. Understanding the distinction between late fees and overdraft fees helps you manage your finances effectively and avoid unnecessary charges.

What Is an Overdraft Fee?

An overdraft fee occurs when you spend more money than available in your checking account, causing the bank to cover the excess temporarily. Late fees are charged when you miss a payment deadline on loans or credit cards, distinct from overdraft fees that arise from insufficient funds during transactions. Understanding your account's overdraft policies helps you avoid unexpected charges and manage your finances effectively.

Key Differences Between Late Fees and Overdraft Fees

Late fees are charged when a payment is not made by its due date, typically associated with credit cards, loans, or rent, and are calculated as a fixed amount or percentage of the missed payment. Overdraft fees occur when a bank account balance falls below zero due to transactions exceeding the available funds, resulting in charges for each transaction that causes the account to go negative. Key differences include the context of application--late fees relate to missed payments on debt obligations, while overdraft fees involve insufficient funds during account transactions--and the fee calculation, where late fees are tied to payment schedules whereas overdraft fees depend on transaction volume and bank policies.

Common Causes of Late Fees

Late fees commonly result from missed or delayed payments on credit cards, loans, and utility bills, often triggered by insufficient funds or forgetfulness. Overdraft fees occur when transactions exceed the available balance in a checking account, leading to bank charges for covering the shortfall. Understanding these fee structures helps consumers manage financial obligations and avoid costly penalties.

When Do Overdraft Fees Occur?

Overdraft fees occur when a bank account holder attempts a transaction that exceeds their available balance, causing the account to go into a negative balance. Late fees are charged when a payment, such as a credit card bill or loan installment, is not made by its due date. Understanding the timing and conditions triggering overdraft fees helps consumers manage their funds and avoid unnecessary charges.

Impact of Late Fees on Your Credit Score

Late fees primarily affect your payment history, which is a significant factor in calculating your credit score, as missed or delayed payments can lower your score over time. Overdraft fees occur when you spend more than your account balance, but they do not directly impact your credit score unless the overdraft leads to unpaid debts sent to collections. Understanding the distinction between these fees helps you manage your finances effectively while safeguarding your creditworthiness.

How Overdraft Fees Affect Your Bank Account

Overdraft fees occur when you spend more than your account balance, leading to immediate charges that can significantly reduce your available funds and increase your financial burden. Late fees apply when you miss a payment deadline, often adding to debt but not directly impacting your current account balance like overdraft fees do. Understanding how overdraft fees affect your bank account helps you manage your spending to avoid unnecessary penalties and maintain financial stability.

Strategies to Avoid Late Fees

Implementing automatic bill payments and setting calendar reminders effectively prevent missing payment deadlines, significantly reducing late fees. Monitoring account balances closely and opting for overdraft protection plans can help avoid overdraft fees by ensuring transactions do not exceed available funds. Regularly reviewing billing statements and maintaining a financial buffer balance are crucial strategies to manage expenses and avoid both late and overdraft fees.

Tips to Prevent Overdraft Fees

Overdraft fees typically occur when withdrawals exceed available bank account funds, while late fees arise from missed bill payments. To prevent overdraft fees, keep a close eye on account balances using mobile banking alerts and maintain a buffer amount that covers unexpected expenses. Setting up automatic transfers or linking a savings account for overdraft protection can further safeguard against costly fees.

Choosing the Right Financial Products to Minimize Fees

Understanding the differences between late fees, overdraft fees, and service charges is essential for selecting financial products that minimize unnecessary costs. Choosing credit cards with grace periods, bank accounts with no overdraft protection, or payment plans that avoid late payments can significantly reduce these fees. Reviewing fee schedules and opting for accounts with low or waived penalties helps maintain better financial health and avoid unexpected charges.

Infographic: Late Fee vs Overdraft Fee

relatioo.com

relatioo.com