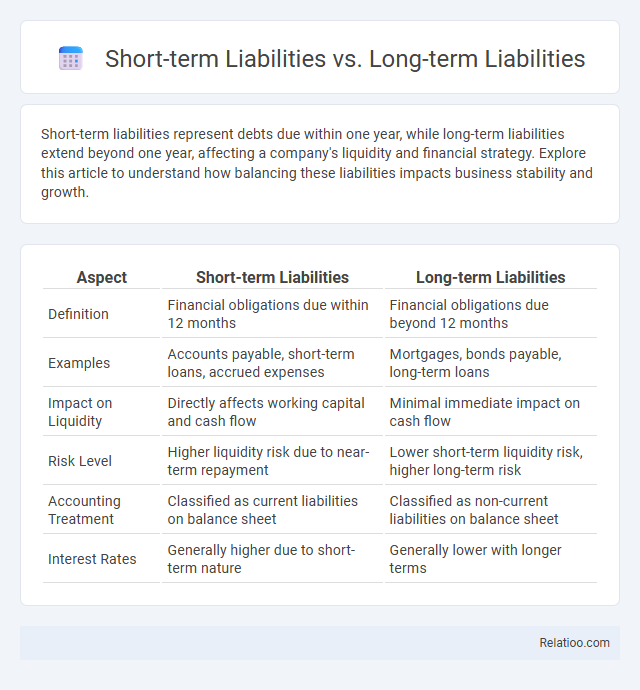

Short-term liabilities represent debts due within one year, while long-term liabilities extend beyond one year, affecting a company's liquidity and financial strategy. Explore this article to understand how balancing these liabilities impacts business stability and growth.

Table of Comparison

| Aspect | Short-term Liabilities | Long-term Liabilities |

|---|---|---|

| Definition | Financial obligations due within 12 months | Financial obligations due beyond 12 months |

| Examples | Accounts payable, short-term loans, accrued expenses | Mortgages, bonds payable, long-term loans |

| Impact on Liquidity | Directly affects working capital and cash flow | Minimal immediate impact on cash flow |

| Risk Level | Higher liquidity risk due to near-term repayment | Lower short-term liquidity risk, higher long-term risk |

| Accounting Treatment | Classified as current liabilities on balance sheet | Classified as non-current liabilities on balance sheet |

| Interest Rates | Generally higher due to short-term nature | Generally lower with longer terms |

Introduction to Short-term and Long-term Liabilities

Short-term liabilities are financial obligations due within one year, such as accounts payable and short-term loans, playing a crucial role in managing your company's immediate cash flow. Long-term liabilities extend beyond one year and include items like mortgages and bonds payable, impacting your organization's long-term financial stability and investment capacity. Understanding the distinction between short-term and long-term liabilities is essential for accurate financial analysis and strategic planning.

Defining Short-term Liabilities

Short-term liabilities are financial obligations due within one year, including accounts payable, short-term loans, and accrued expenses. Your understanding of liabilities should distinguish these from long-term liabilities, which extend beyond a year and often involve larger debts like mortgages or bonds payable. Accurately defining short-term liabilities helps in evaluating your company's current financial health and liquidity position.

Understanding Long-term Liabilities

Long-term liabilities are financial obligations a company must settle beyond one year, such as bonds payable, mortgages, and long-term loans, distinguishing them from short-term liabilities that are due within a year like accounts payable and accrued expenses. Understanding long-term liabilities is crucial for assessing a company's financial stability and future cash flow requirements, as these debts impact capital structure and investment capacity. Proper management and disclosure of long-term liabilities enhance transparency for investors and creditors evaluating the firm's long-term solvency and financial planning.

Key Differences Between Short-term and Long-term Liabilities

Short-term liabilities, also known as current liabilities, are obligations due within one year, including accounts payable, short-term loans, and accrued expenses, whereas long-term liabilities extend beyond one year, such as bonds payable, long-term loans, and lease obligations. The primary difference lies in the time frame for settlement, impacting a company's liquidity and financial planning strategies. Understanding this distinction helps assess a firm's short-term solvency and long-term financial stability.

Examples of Short-term Liabilities

Short-term liabilities are financial obligations due within one year, commonly including accounts payable, short-term loans, accrued expenses, and taxes payable. Long-term liabilities, by contrast, involve debts or obligations such as bonds payable, mortgages, and long-term leases that extend beyond one year. Understanding the distinction between short-term liabilities and long-term liabilities is crucial for assessing a company's liquidity and financial stability.

Common Types of Long-term Liabilities

Common types of long-term liabilities include bonds payable, mortgages, and long-term loans, which extend beyond one year and provide businesses with essential financing for major investments. Short-term liabilities, such as accounts payable and accrued expenses, are obligations due within a year and are critical for managing day-to-day operations. Understanding the distinction between short-term and long-term liabilities helps businesses maintain balanced financial health by aligning debt obligations with cash flow capabilities.

Impact on Business Liquidity

Short-term liabilities, due within one year, directly affect your business liquidity by requiring prompt cash outflows that can strain working capital. Long-term liabilities, payable over multiple years, offer more flexibility in managing cash flow but still impact your overall financial stability and borrowing capacity. Understanding the balance between these liabilities is crucial for maintaining adequate liquidity and ensuring your company can meet both immediate and future obligations without financial distress.

Role in Financial Statements

Short-term liabilities represent obligations due within one year, impacting the current ratio and liquidity analysis on the balance sheet. Long-term liabilities extend beyond one year, influencing solvency ratios and long-term financial stability assessments. Together, these liabilities provide a comprehensive view of a company's financial obligations, essential for evaluating overall financial health and risk in financial statements.

Importance in Financial Planning and Management

Short-term liabilities, including accounts payable and short-term loans, impact your company's liquidity and ability to meet immediate obligations, making accurate cash flow forecasting essential. Long-term liabilities, such as bonds payable and mortgages, influence strategic financial planning by affecting capital structure and long-term solvency. Efficient management of both liability types ensures balanced financial health and supports sustainable business growth.

Short-term vs Long-term Liabilities: Which Matters More?

Short-term liabilities, such as accounts payable and accrued expenses, represent obligations due within one year and directly impact a company's liquidity and working capital management. Long-term liabilities, including bonds payable and long-term loans, influence a company's financial structure and solvency over an extended period. Understanding the balance between short-term and long-term liabilities is crucial for assessing a company's ability to meet immediate financial obligations while maintaining long-term financial stability.

Infographic: Short-term Liabilities vs Long-term Liabilities

relatioo.com

relatioo.com