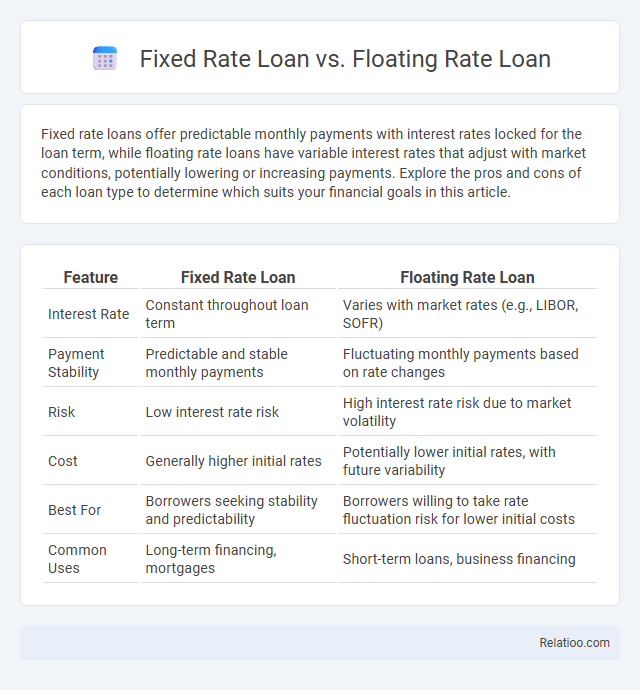

Fixed rate loans offer predictable monthly payments with interest rates locked for the loan term, while floating rate loans have variable interest rates that adjust with market conditions, potentially lowering or increasing payments. Explore the pros and cons of each loan type to determine which suits your financial goals in this article.

Table of Comparison

| Feature | Fixed Rate Loan | Floating Rate Loan |

|---|---|---|

| Interest Rate | Constant throughout loan term | Varies with market rates (e.g., LIBOR, SOFR) |

| Payment Stability | Predictable and stable monthly payments | Fluctuating monthly payments based on rate changes |

| Risk | Low interest rate risk | High interest rate risk due to market volatility |

| Cost | Generally higher initial rates | Potentially lower initial rates, with future variability |

| Best For | Borrowers seeking stability and predictability | Borrowers willing to take rate fluctuation risk for lower initial costs |

| Common Uses | Long-term financing, mortgages | Short-term loans, business financing |

Introduction to Fixed and Floating Rate Loans

Fixed rate loans offer a consistent interest rate throughout the loan term, providing predictable monthly payments that help You manage your budget effectively. Floating rate loans, also known as variable rate loans, have interest rates that fluctuate based on market conditions or benchmark rates such as LIBOR or SOFR, potentially lowering costs when rates drop but increasing them when rates rise. Understanding the key differences in interest rate stability and payment predictability between fixed and floating rate loans is essential for selecting the right financing option for Your financial needs.

Key Features of Fixed Rate Loans

Fixed rate loans offer borrowers consistent monthly payments and protection against interest rate fluctuations, making budgeting predictable over the loan term. Unlike floating rate loans, which have variable interest rates tied to market indexes, fixed rate loans maintain stable interest rates regardless of economic changes. Key features include fixed interest, set repayment schedules, and long-term financial certainty, ideal for borrowers prioritizing stability.

Key Features of Floating Rate Loans

Floating rate loans feature interest rates that adjust periodically based on benchmark indexes such as LIBOR or SOFR, providing borrowers with the potential benefit of lower initial rates compared to fixed rate loans. These loans offer flexibility in repayment amounts due to variable interest costs, which can fluctuate with market conditions and impact monthly payments. Unlike fixed rate loans that maintain constant interest rates throughout the loan term, floating rate loans expose borrowers to interest rate risk but may result in cost savings if rates decrease.

How Fixed Rate Loans Work

Fixed rate loans maintain a constant interest rate throughout the loan term, providing predictable monthly payments and protection from market fluctuations. Your payments remain stable regardless of changes in benchmark rates, making budgeting easier and reducing financial uncertainty. Understanding how fixed rate loans work helps you choose between this and floating rate loans, which adjust periodically based on interest rate indexes.

How Floating Rate Loans Work

Floating rate loans adjust interest rates periodically based on a benchmark index like LIBOR or SOFR, causing monthly payments to fluctuate with market rates. These loans offer potential savings when interest rates decline but also pose the risk of higher payments if rates rise, making them suitable for borrowers expecting stable or falling rates. Unlike fixed rate loans that maintain constant interest and payment over the loan term, floating rate loans provide adaptability tied directly to financial market conditions.

Pros and Cons of Fixed Rate Loans

Fixed rate loans offer predictable monthly payments and protection against interest rate increases, making budgeting easier for borrowers who prefer stability. However, these loans typically have higher initial interest rates compared to floating rate loans and lack the benefit of decreased payments when market rates fall. The rigidity of fixed rates can result in missed opportunities for savings during periods of declining interest rates.

Pros and Cons of Floating Rate Loans

Floating rate loans offer lower initial interest rates compared to fixed rate loans, allowing you to benefit from falling market rates, which can reduce your overall borrowing costs. However, the interest rate variability introduces uncertainty, potentially increasing your repayment amounts when rates rise, posing a risk to budgeting and long-term financial planning. While fixed rate loans provide stability and predictability with consistent payments, floating rate loans are advantageous if you anticipate interest rates will remain stable or decline during your loan term.

Factors to Consider When Choosing

When choosing between a fixed rate loan, floating rate loan, or general loan options, consider interest rate stability, repayment flexibility, and market volatility impact. Fixed rate loans offer predictable payments, shielding borrowers from rate hikes, while floating rate loans can provide lower initial rates but expose borrowers to changing market conditions. Assess credit score, loan tenure, and risk tolerance to determine the optimal loan structure that aligns with financial goals and economic forecasts.

Ideal Borrowers for Each Loan Type

Fixed rate loans suit borrowers seeking predictable monthly payments and protection from interest rate fluctuations, ideal for long-term planning. Floating rate loans appeal to borrowers willing to accept short-term rate variability in exchange for potentially lower initial interest costs, often favored by those expecting falling rates or planning to pay off quickly. General loans encompass various structures, best chosen based on the borrower's financial stability, risk tolerance, and repayment timeline to optimize cost and flexibility.

Conclusion: Which Loan Is Right For You?

Choosing between a fixed rate loan, floating rate loan, or a general loan depends on your financial stability, risk tolerance, and market conditions. Fixed rate loans offer predictable payments ideal for budgeting, while floating rate loans can provide lower initial rates but come with interest rate fluctuations that may increase costs. Your decision should align with your long-term financial goals and ability to manage potential interest rate changes.

Infographic: Fixed Rate Loan vs Floating Rate Loan

relatioo.com

relatioo.com