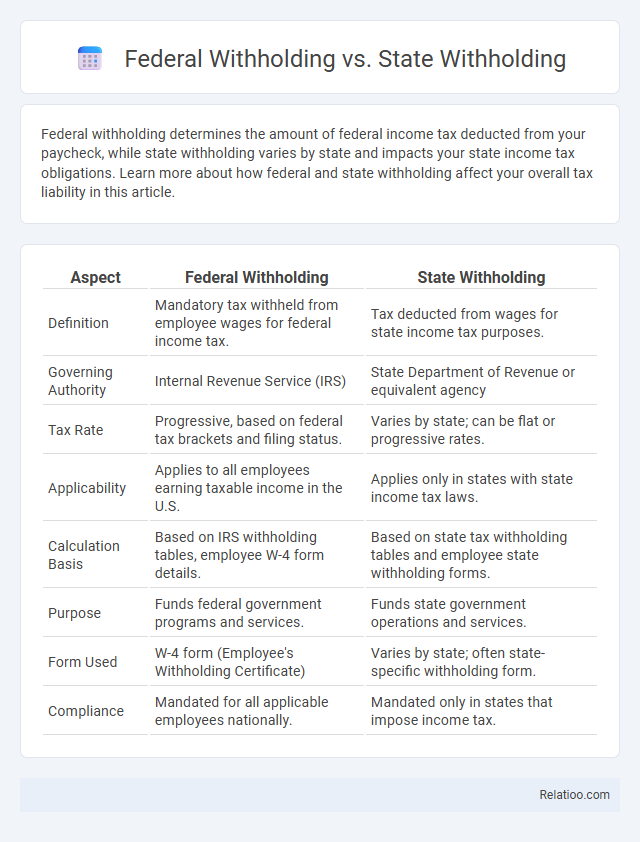

Federal withholding determines the amount of federal income tax deducted from your paycheck, while state withholding varies by state and impacts your state income tax obligations. Learn more about how federal and state withholding affect your overall tax liability in this article.

Table of Comparison

| Aspect | Federal Withholding | State Withholding |

|---|---|---|

| Definition | Mandatory tax withheld from employee wages for federal income tax. | Tax deducted from wages for state income tax purposes. |

| Governing Authority | Internal Revenue Service (IRS) | State Department of Revenue or equivalent agency |

| Tax Rate | Progressive, based on federal tax brackets and filing status. | Varies by state; can be flat or progressive rates. |

| Applicability | Applies to all employees earning taxable income in the U.S. | Applies only in states with state income tax laws. |

| Calculation Basis | Based on IRS withholding tables, employee W-4 form details. | Based on state tax withholding tables and employee state withholding forms. |

| Purpose | Funds federal government programs and services. | Funds state government operations and services. |

| Form Used | W-4 form (Employee's Withholding Certificate) | Varies by state; often state-specific withholding form. |

| Compliance | Mandated for all applicable employees nationally. | Mandated only in states that impose income tax. |

Introduction to Federal and State Withholding

Federal withholding refers to the mandatory payroll tax deducted by the Internal Revenue Service (IRS) to cover your federal income tax obligations, based on your earnings and withheld according to Form W-4. State withholding operates similarly but varies by state, where each state's tax authority determines rates and rules to fund state-level programs and services. Understanding the differences between federal and state withholding is essential for accurate tax compliance and ensuring your paycheck deductions properly reflect your tax liabilities.

What Is Federal Withholding?

Federal withholding is the portion of your paycheck that the federal government deducts to cover income taxes, Social Security, and Medicare. This mandatory withholding is calculated based on IRS tax tables and your Form W-4 allowances, ensuring you meet your federal tax obligations throughout the year. Understanding federal withholding helps you manage your tax liability and avoid unexpected tax bills or penalties during tax season.

What Is State Withholding?

State withholding refers to the money your employer deducts from your paycheck to cover state income tax obligations, varying widely by state regulations and tax rates. Unlike federal withholding, which is standardized across the country for federal income tax, state withholding directly funds your state's public services and infrastructure. Understanding your state withholding is crucial for accurate tax planning and avoiding unexpected balances due during tax season.

Key Differences Between Federal and State Withholding

Federal withholding refers to the mandatory tax deductions taken by the Internal Revenue Service (IRS) from an employee's paycheck to cover federal income taxes, Social Security, and Medicare contributions. State withholding involves deductions specific to individual state tax laws and rates, varying widely depending on the state's tax regulations and often including state income taxes and other local taxes. Key differences between federal and state withholding include the scope of taxes covered, regulatory authorities (IRS for federal and respective state tax agencies for state withholding), and variation in tax rates and brackets, influencing how much is withheld and the complexity of compliance for employers and employees.

How Federal Withholding Is Calculated

Federal withholding is calculated based on your taxable income, filing status, and the IRS tax withholding tables or formulas, which consider allowances and additional withholding amounts on your W-4 form. State withholding varies by state rules and rates but is generally calculated similarly using state-specific guidelines; it is separate from federal withholding, which funds national programs like Social Security and Medicare. Your paycheck deductions for federal withholding ensure that your federal income tax liability is partially paid throughout the year, reducing your balance due at tax time.

How State Withholding Is Determined

State withholding is determined based on specific state tax rates, withholding tables, and the employee's filing status and allowances claimed on state W-4 forms, which differ from federal guidelines. Each state sets its own withholding rules, which may include flat rates, graduated tax brackets, or no withholding at all for states without income tax. Employers calculate state withholding by applying these unique state criteria to the employee's wages, ensuring compliance with local tax laws separate from federal withholding requirements.

Common Mistakes in Withholding Taxes

Common mistakes in withholding taxes often arise from confusing federal withholding, state withholding, and general withholding obligations. Taxpayers frequently underestimate state withholding requirements, leading to unexpected tax liabilities or penalties due to varying state tax laws and rates. Failure to update withholding allowances after life changes or income adjustments can cause significant discrepancies in both federal and state tax payments.

Impact of Withholding on Your Tax Refund

Federal withholding directly reduces your taxable income for federal taxes, influencing the size of your federal tax refund based on the amount withheld throughout the year. State withholding operates similarly but applies to state income tax, affecting your state tax refund independently of federal returns. Accurate withholding in both categories ensures you avoid underpayment penalties and increases the likelihood of receiving a refund rather than owing additional taxes at filing.

Adjusting Your Federal and State Withholding

Adjusting your federal and state withholding ensures accurate tax deductions from your paycheck, preventing underpayment or overpayment of taxes throughout the year. Federal withholding covers income taxes owed to the IRS, while state withholding pertains to taxes required by your specific state government; both amounts are influenced by factors such as marital status, exemptions, and additional income. Review and update your W-4 and any state withholding forms regularly to align with changes in your financial situation, maximizing your tax refund or minimizing liability.

Frequently Asked Questions About Tax Withholding

Federal withholding refers to the amount your employer deducts from your paycheck to cover your federal income tax obligations, while state withholding is similarly deducted for state income taxes, which vary based on where you live and work. Withholding ensures you pay taxes gradually throughout the year, preventing a large tax bill at filing time and potentially resulting in a refund if too much is withheld. Understanding your withholding options allows you to adjust the amounts so Your tax liability is accurately covered and helps avoid underpayment penalties or unexpected tax dues.

Infographic: Federal Withholding vs State Withholding

relatioo.com

relatioo.com