Automatic Payment allows consumers to pre-authorize merchants to pull funds for recurring bills, while Direct Debit enables businesses to initiate transfers directly from customers' bank accounts with guaranteed payment. Discover the key differences and benefits of Automatic Payment vs Direct Debit in this article.

Table of Comparison

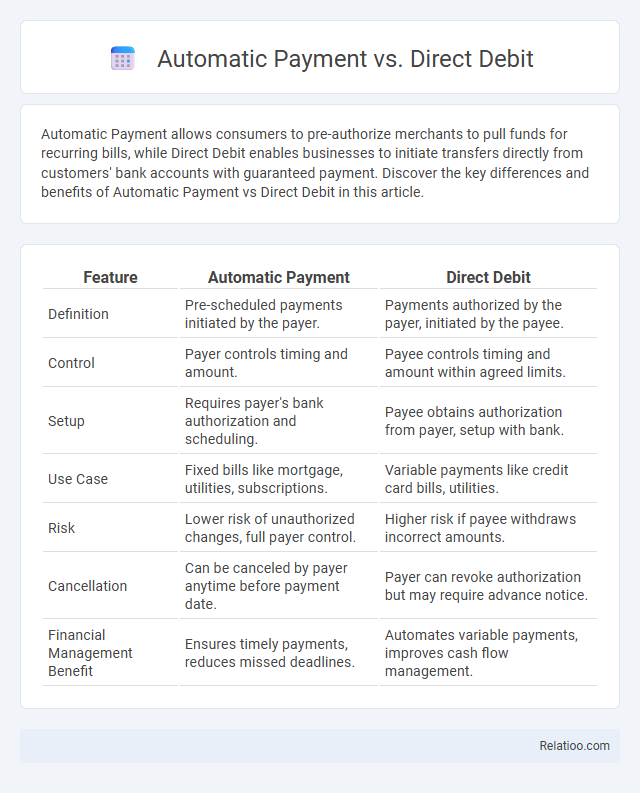

| Feature | Automatic Payment | Direct Debit |

|---|---|---|

| Definition | Pre-scheduled payments initiated by the payer. | Payments authorized by the payer, initiated by the payee. |

| Control | Payer controls timing and amount. | Payee controls timing and amount within agreed limits. |

| Setup | Requires payer's bank authorization and scheduling. | Payee obtains authorization from payer, setup with bank. |

| Use Case | Fixed bills like mortgage, utilities, subscriptions. | Variable payments like credit card bills, utilities. |

| Risk | Lower risk of unauthorized changes, full payer control. | Higher risk if payee withdraws incorrect amounts. |

| Cancellation | Can be canceled by payer anytime before payment date. | Payer can revoke authorization but may require advance notice. |

| Financial Management Benefit | Ensures timely payments, reduces missed deadlines. | Automates variable payments, improves cash flow management. |

Understanding Automatic Payment and Direct Debit

Automatic Payment enables you to schedule recurring payments directly from your bank account or credit card to settle bills on time without manual intervention. Direct Debit authorizes companies to withdraw funds from your account, giving them control to collect varying amounts based on invoice details and due dates. Understanding these differences helps manage your cash flow effectively and ensures timely payments tailored to your preferences.

Key Differences Between Automatic Payment and Direct Debit

Automatic Payment and Direct Debit both automate bill settlements but differ primarily in authorization and control mechanisms. Automatic Payment requires the payer to initiate payments via stored payment details, offering greater control over timing, whereas Direct Debit authorizes the payee to withdraw funds directly from the payer's account on agreed dates. Key differences include Automatic Payment's reliance on payer-initiated transactions versus Direct Debit's payee-driven deductions, impacting flexibility, risk allocation, and dispute resolution processes.

How Automatic Payment Works

Automatic payment works by authorizing a company or service provider to withdraw funds directly from your bank account or charge your credit card on scheduled dates, ensuring timely bill settlements without manual intervention. Unlike direct debit, where the payee initiates the transaction, automatic payment is often set up by the payer to make recurring payments for utilities, subscriptions, or loans. This system enhances convenience, reduces the risk of late fees, and provides a seamless way to manage regular financial obligations.

How Direct Debit Operates

Direct Debit operates by authorizing a third party, typically a company or service provider, to collect variable amounts directly from Your bank account on agreed dates. This method provides a secure and efficient way to manage payments without Your manual intervention, ensuring bills are paid on time. Unlike Automatic Payment, which deducts fixed amounts, Direct Debit allows flexible payment amounts based on actual bills or invoices.

Pros and Cons of Automatic Payment

Automatic Payment offers the convenience of scheduled transactions, ensuring your bills are paid on time without manual intervention, which reduces late fees and improves your credit score. However, it may lead to overdraft fees if your account balance is insufficient and requires careful monitoring to avoid unexpected payments. You benefit from seamless payment flow, but the lack of flexibility and potential security risks should be considered carefully.

Advantages and Disadvantages of Direct Debit

Direct Debit offers the advantage of convenience by allowing your bills to be paid automatically from your bank account, reducing the risk of missed payments and late fees. However, it carries the disadvantage of requiring authorization and trust in the payee, as payments can be withdrawn without immediate notification. Unlike Automatic Payment, Direct Debit is initiated by the payee, which can sometimes lead to less control over the exact payment date and amount for you.

Security and Fraud Considerations

Automatic payment and direct debit both facilitate scheduled transactions but differ in security protocols and fraud risks. Direct debit typically involves bank authorization and offers stronger consumer protection through mandates and dispute rights, reducing fraud exposure. Automatic payments rely heavily on the payment processor's security measures, which can vary, making them potentially more vulnerable to unauthorized charges if proper safeguards are not in place.

Impact on Personal Finance Management

Automatic Payment, Direct Debit, and Standing Order each impact your personal finance management differently based on control and flexibility. Automatic Payment allows you to schedule regular payments for bills or debts, ensuring timeliness but requiring you to monitor account balances closely to avoid overdrafts. Direct Debit offers convenience by enabling companies to withdraw varying amounts, which can streamline bill management but demands vigilant tracking to prevent unexpected deductions affecting your budget.

Choosing Between Automatic Payment and Direct Debit

Choosing between Automatic Payment and Direct Debit depends on the control and timing of your bill payments. Automatic Payment involves scheduling payments directly through your bank or credit card, giving you flexibility to set specific amounts and dates. Direct Debit authorizes creditors to withdraw varying amounts automatically, ideal for recurring bills where amounts fluctuate.

Frequently Asked Questions (FAQs)

Automatic Payment, Direct Debit, and Standing Order often confuse users seeking clarity on their differences. Automatic Payment involves you authorizing your bank to pay fixed amounts to a payee regularly, providing control over payment timing and amount. Direct Debit authorizes a third party to collect varying amounts directly from your account on agreed dates, while Standing Orders are fixed payments set up by you to transfer money regularly, commonly used for rent or subscriptions.

Infographic: Automatic Payment vs Direct Debit

relatioo.com

relatioo.com