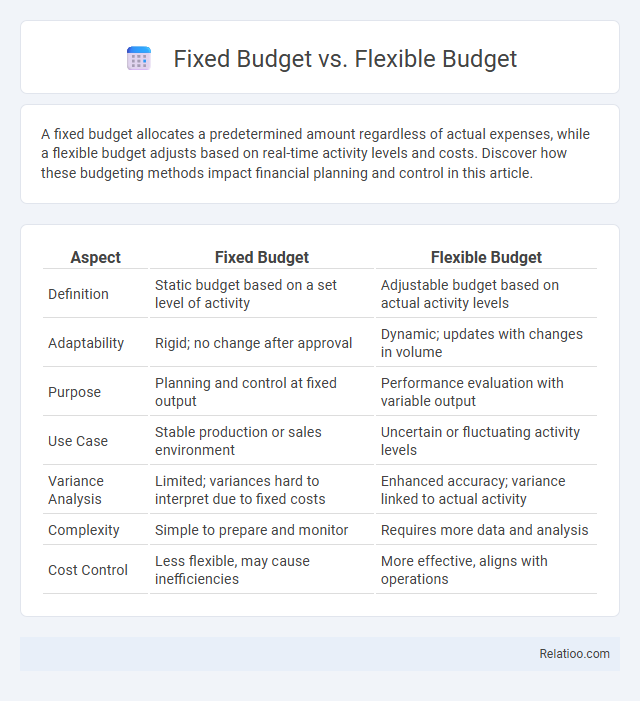

A fixed budget allocates a predetermined amount regardless of actual expenses, while a flexible budget adjusts based on real-time activity levels and costs. Discover how these budgeting methods impact financial planning and control in this article.

Table of Comparison

| Aspect | Fixed Budget | Flexible Budget |

|---|---|---|

| Definition | Static budget based on a set level of activity | Adjustable budget based on actual activity levels |

| Adaptability | Rigid; no change after approval | Dynamic; updates with changes in volume |

| Purpose | Planning and control at fixed output | Performance evaluation with variable output |

| Use Case | Stable production or sales environment | Uncertain or fluctuating activity levels |

| Variance Analysis | Limited; variances hard to interpret due to fixed costs | Enhanced accuracy; variance linked to actual activity |

| Complexity | Simple to prepare and monitor | Requires more data and analysis |

| Cost Control | Less flexible, may cause inefficiencies | More effective, aligns with operations |

Introduction to Fixed and Flexible Budgets

Fixed budgets are predetermined financial plans set for a specific period, remaining constant regardless of changes in activity levels, ideal for organizations with stable operations. Flexible budgets adjust according to actual activity or production volumes, providing a more accurate reflection of expenses and revenues under varying conditions. Understanding your business needs helps determine whether a fixed or flexible budget best supports effective financial control and decision-making.

Definition of Fixed Budget

A fixed budget is a financial plan that remains unchanged regardless of variations in actual activity levels, providing a set amount of resources allocated for a specific period. Unlike a flexible budget, which adjusts expenses according to changes in output or sales volume, a fixed budget is rigid and best suited for organizations with stable operations. Understanding your fixed budget helps ensure controlled spending and predictable financial performance without accommodating fluctuations in business activity.

Definition of Flexible Budget

A flexible budget adjusts based on actual activity levels, allowing organizations to compare real costs against expected costs under varying conditions. Unlike a fixed budget, which remains constant regardless of changes in business volume, a flexible budget provides more accurate cost control and performance evaluation. This adaptability makes the flexible budget essential for dynamic environments where spending and revenues fluctuate.

Key Differences Between Fixed and Flexible Budgets

Fixed budgets allocate a predetermined amount of resources regardless of actual activity levels, making them ideal for organizations with stable operations but less adaptable to change. Flexible budgets adjust expenses based on real-time activity fluctuations, providing more accuracy and control for your business during varying operational conditions. Understanding these key differences helps your company optimize financial planning by selecting a budget type that aligns with operational flexibility and performance measurement.

Advantages of Fixed Budget

Fixed budgets provide clear financial targets and facilitate straightforward expense control, enabling organizations to maintain strict spending discipline. This budgeting method simplifies forecasting by setting predetermined costs, which helps in stabilizing financial planning under stable operational conditions. Fixed budgets are particularly advantageous for businesses with predictable revenues and minimal variability in expenses, ensuring consistent resource allocation and efficient performance measurement.

Advantages of Flexible Budget

Flexible Budget offers significant advantages by allowing your expenses to adapt in real-time to changes in activity levels, ensuring more accurate financial control. It provides enhanced variance analysis by comparing actual costs against budgeted expenses tailored to actual output, facilitating better performance evaluation. This adaptability supports proactive decision-making, helping you manage resources efficiently under varying business conditions.

Disadvantages of Fixed Budget

Fixed budgets limit your ability to adapt to unexpected changes in costs or revenues, which can lead to inaccurate financial planning and resource allocation. They do not accommodate fluctuations in production volume or market conditions, potentially causing inefficiencies or missed opportunities. The rigidity of fixed budgets often results in poor responsiveness to dynamic business environments, impacting overall operational effectiveness.

Disadvantages of Flexible Budget

Flexible budgets can lead to complexities in variance analysis due to constant adjustments based on activity levels, making performance evaluation less straightforward. They may also encourage inefficient spending if managers anticipate budget increases as activity rises, reducing cost control incentives. Furthermore, flexible budgets require accurate activity projections, and errors in estimating these can result in misleading financial assessments.

Situations Best Suited for Each Budget Type

Fixed budgets are ideal for organizations with stable operations and predictable expenses, ensuring strict control over costs in environments such as manufacturing with consistent production levels. Flexible budgets suit businesses with fluctuating activity levels, like retail or hospitality, allowing adjustments based on actual output or sales volume to maintain accuracy in performance evaluation. Traditional budgets serve planning and resource allocation purposes in environments where long-term financial goals and periodic reviews are paramount, often used by government entities or large corporations with set funding cycles.

Choosing the Right Budget for Your Business

Choosing the right budget for your business depends on its size, industry, and financial goals, with fixed budgets providing strict spending limits ideal for stable environments and flexible budgets allowing adjustments based on actual performance, suited for dynamic operations. Fixed budgets simplify cost control by setting a predetermined spending plan, while flexible budgets enable companies to respond to varying sales volumes and operational conditions, improving accuracy in variance analysis. Assessing your business's volatility, cash flow consistency, and strategic priorities ensures selecting the budget type that optimizes resource allocation and financial planning.

Infographic: Fixed Budget vs Flexible Budget

relatioo.com

relatioo.com