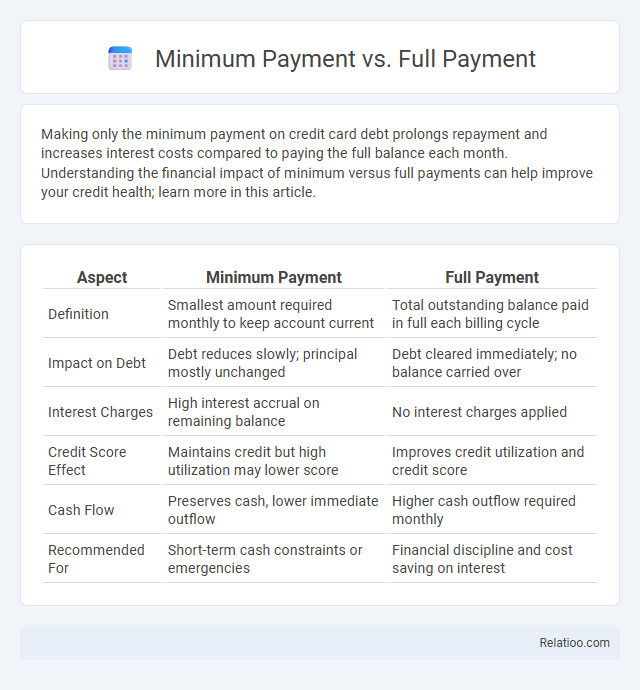

Making only the minimum payment on credit card debt prolongs repayment and increases interest costs compared to paying the full balance each month. Understanding the financial impact of minimum versus full payments can help improve your credit health; learn more in this article.

Table of Comparison

| Aspect | Minimum Payment | Full Payment |

|---|---|---|

| Definition | Smallest amount required monthly to keep account current | Total outstanding balance paid in full each billing cycle |

| Impact on Debt | Debt reduces slowly; principal mostly unchanged | Debt cleared immediately; no balance carried over |

| Interest Charges | High interest accrual on remaining balance | No interest charges applied |

| Credit Score Effect | Maintains credit but high utilization may lower score | Improves credit utilization and credit score |

| Cash Flow | Preserves cash, lower immediate outflow | Higher cash outflow required monthly |

| Recommended For | Short-term cash constraints or emergencies | Financial discipline and cost saving on interest |

Understanding Minimum Payment vs Full Payment

Understanding the difference between minimum payment and full payment is crucial for managing your credit card effectively. The minimum payment is the smallest amount you must pay by the due date to keep your account in good standing, typically calculated as a small percentage of your outstanding balance or a fixed amount. Paying the full payment, which is the total outstanding balance shown on your statement, helps you avoid interest charges and maintain a healthy credit score.

How Minimum Payments Affect Your Debt

Making only the minimum payment on credit card bills primarily covers interest charges and a small portion of the principal balance, significantly extending the time it takes to pay off debt. Full payments reduce both the principal and interest, preventing the accrual of additional costs and leading to faster debt elimination. Ignoring the payment due date can result in late fees, increased interest rates, and negative impacts on credit scores, further complicating debt management.

The Benefits of Making Full Payments

Making full payments on credit card balances helps avoid interest charges and improves credit score by maintaining a low credit utilization ratio. Paying only the minimum extends debt repayment time and increases overall interest costs, hindering financial progress. Timely full payments demonstrate responsible credit behavior, enhancing lender trust and access to better credit terms.

Interest Charges: What You Need to Know

Making only the minimum payment on a credit card balance results in higher interest charges over time, as the remaining balance accrues interest. Paying the full payment by the due date avoids interest fees entirely, effectively maximizing credit card benefits. Missing the payment due date can lead to late fees and increased interest rates, significantly increasing the overall cost of borrowing.

Impact on Credit Score: Minimum vs Full

Making only the minimum payment each month can negatively impact your credit score by increasing your credit utilization and prolonging debt repayment, which signals higher credit risk to lenders. Full payment avoids interest charges and demonstrates responsible credit management, positively affecting your credit score by lowering credit utilization and showing consistent, on-time repayment behavior. Payment due represents the total amount owed for a billing cycle, and paying it in full is the optimal strategy to maintain or improve credit score health.

Long-Term Financial Consequences

Making only the minimum payment on credit card debt significantly extends the repayment period and increases interest costs, leading to a higher overall financial burden. Full payment of the balance each month avoids interest charges, promoting better credit health and long-term financial stability. Ignoring the payment due date results in late fees and potential credit score damage, complicating future borrowing and increasing financial strain.

Tips for Managing Credit Card Payments

Managing credit card payments effectively involves understanding the differences between minimum payment, full payment, and payment due date to avoid interest charges and late fees. Paying only the minimum payment can lead to accumulating high-interest debt, while making full payments each billing cycle helps maintain a healthy credit score and reduces financial costs. Setting reminders for the payment due date and budgeting for full payments ensures timely payments and long-term credit health.

Common Myths About Minimum Payments

Many people mistakenly believe that making only the minimum payment on credit cards is harmless, but it often leads to higher interest costs and prolonged debt repayment. Minimum payments typically cover just a small portion of the principal balance, causing balances to accrue interest over time. Paying the full statement balance each month avoids interest charges and improves credit health, while the payment due date indicates when the minimum or full payment must be received to avoid penalties.

When Is Paying the Minimum Ever Acceptable?

Paying the minimum on your credit card is acceptable only when you're facing temporary cash flow issues and need to avoid late fees and penalties. This option helps maintain your credit score by keeping your account in good standing but should be avoided as a long-term strategy due to high interest accrual on the remaining balance. For optimal financial health, prioritize paying the full payment by the due date to minimize interest charges and reduce debt more efficiently.

Building Healthy Payment Habits

Understanding the differences between minimum payment, full payment, and payment due is crucial for building healthy payment habits and maintaining strong credit scores. Making only the minimum payment increases interest costs and extends debt repayment, while paying in full every month helps avoid interest charges and reduces financial stress. Staying aware of the payment due date ensures timely payments, preventing late fees and negative impacts on credit history.

Infographic: Minimum Payment vs Full Payment

relatioo.com

relatioo.com