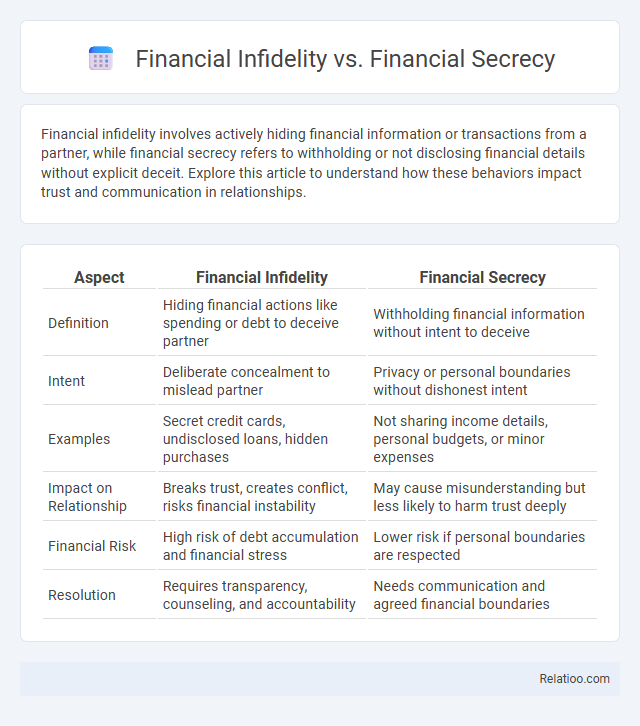

Financial infidelity involves actively hiding financial information or transactions from a partner, while financial secrecy refers to withholding or not disclosing financial details without explicit deceit. Explore this article to understand how these behaviors impact trust and communication in relationships.

Table of Comparison

| Aspect | Financial Infidelity | Financial Secrecy |

|---|---|---|

| Definition | Hiding financial actions like spending or debt to deceive partner | Withholding financial information without intent to deceive |

| Intent | Deliberate concealment to mislead partner | Privacy or personal boundaries without dishonest intent |

| Examples | Secret credit cards, undisclosed loans, hidden purchases | Not sharing income details, personal budgets, or minor expenses |

| Impact on Relationship | Breaks trust, creates conflict, risks financial instability | May cause misunderstanding but less likely to harm trust deeply |

| Financial Risk | High risk of debt accumulation and financial stress | Lower risk if personal boundaries are respected |

| Resolution | Requires transparency, counseling, and accountability | Needs communication and agreed financial boundaries |

Understanding Financial Infidelity

Understanding financial infidelity involves recognizing intentional deception about money matters within relationships, often manifesting as hidden spending, secret accounts, or undisclosed debts. Unlike financial secrecy, which may stem from privacy preferences without malicious intent, financial infidelity breaches trust and can severely damage relationship dynamics. Clarity in communication and transparency about finances are crucial to differentiating and addressing these issues effectively.

Defining Financial Secrecy

Financial secrecy involves intentionally hiding financial information, such as income, debts, or assets, from a partner to control money or avoid conflict, differentiating it from financial infidelity, which often includes deceptive actions like secret spending or lying about financial behavior. While financial infidelity encompasses betrayal typically involving trust violations, financial secrecy specifically refers to the nondisclosure of key financial details, creating barriers to transparency in a relationship. Understanding these distinctions helps identify underlying issues that impact financial intimacy and trust between partners.

Key Differences Between Financial Infidelity and Secrecy

Financial infidelity involves deliberately hiding financial actions such as secret spending, undisclosed debts, or hidden accounts from a partner, often eroding trust and causing relationship strain. Financial secrecy, on the other hand, may include withholding financial information without necessarily engaging in deceitful behavior, sometimes done to prevent conflict or protect privacy. The key difference lies in intent and impact: financial infidelity implies intentional deception harming relational transparency, whereas secrecy does not always involve intentional harm but can still undermine communication and mutual financial decision-making.

Common Causes of Financial Infidelity

Common causes of financial infidelity include fear of judgment, lack of communication, and power imbalances within relationships. Financial secrecy often stems from a desire to maintain control or avoid conflict, leading individuals to hide debts, purchases, or income information. Both financial infidelity and secrecy undermine trust and can create significant emotional and logistical challenges for couples managing shared finances.

Reasons Behind Financial Secrecy

Financial secrecy often stems from fear of judgment, desire for control, or avoidance of conflict, distinguishing it from financial infidelity which involves deliberate deception for personal gain. Unlike financial infidelity that is characterized by hiding financial transactions or debts, financial secrecy may include withholding information to protect one's partner from stress or preserve autonomy in financial decisions. Understanding these underlying psychological and relational motives clarifies why individuals maintain financial secrecy despite the risks to trust and transparency in relationships.

Signs Your Partner Is Hiding Money

Signs your partner is hiding money include unexplained withdrawals, secret accounts, or discrepancies in shared financial statements. Behavioral indicators such as reluctance to discuss finances, inconsistent spending patterns, or sudden cash flow changes often signal financial infidelity or secrecy. Recognizing these signs early helps address trust issues and promotes transparent money management in relationships.

Psychological Impact on Relationships

Financial infidelity involves deliberate deception about money matters, causing trust erosion and increased anxiety within relationships. Financial secrecy, while potentially less harmful, can foster feelings of exclusion and lead to misunderstandings between partners, negatively impacting emotional intimacy. Both behaviors contribute to heightened stress and conflict, undermining relationship stability and overall psychological well-being.

Consequences of Financial Dishonesty

Financial infidelity, financial secrecy, and financial dishonesty can severely impact trust and communication in relationships, often leading to emotional distress and long-term damage. Consequences include loss of financial stability, increased stress, and potential legal complications if debts or assets are hidden from a partner. You must address these issues openly to rebuild trust and secure your financial future together.

Rebuilding Trust After Financial Betrayal

Rebuilding trust after financial betrayal involves addressing the core issues of financial infidelity, financial secrecy, and financial neglect, which each damage your relationship differently. Financial infidelity, such as hiding large purchases or secret accounts, directly breaches trust, while financial secrecy creates a barrier to open communication, and financial neglect erodes partnership by ignoring shared responsibilities. Transparent conversations, setting clear financial goals, and engaging in joint financial planning are essential steps to restore trust and foster financial harmony.

Strategies for Financial Transparency in Relationships

Financial infidelity, financial secrecy, and financial dishonesty undermine trust in relationships, often leading to conflict and financial instability. Effective strategies for financial transparency include open communication about income, expenses, and debts, setting shared financial goals, and regularly reviewing budgets together. You can strengthen your relationship by creating a safe environment for honest discussions and using joint financial planning tools to foster accountability and mutual understanding.

Infographic: Financial Infidelity vs Financial Secrecy

relatioo.com

relatioo.com