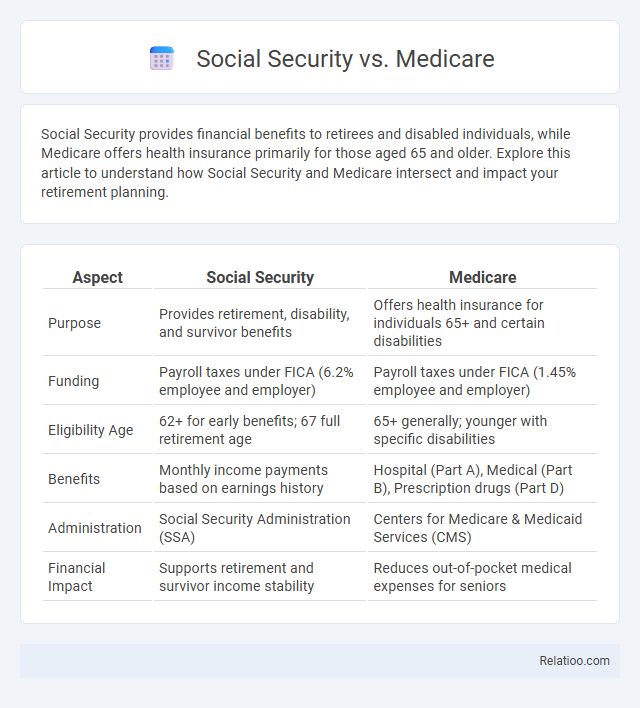

Social Security provides financial benefits to retirees and disabled individuals, while Medicare offers health insurance primarily for those aged 65 and older. Explore this article to understand how Social Security and Medicare intersect and impact your retirement planning.

Table of Comparison

| Aspect | Social Security | Medicare |

|---|---|---|

| Purpose | Provides retirement, disability, and survivor benefits | Offers health insurance for individuals 65+ and certain disabilities |

| Funding | Payroll taxes under FICA (6.2% employee and employer) | Payroll taxes under FICA (1.45% employee and employer) |

| Eligibility Age | 62+ for early benefits; 67 full retirement age | 65+ generally; younger with specific disabilities |

| Benefits | Monthly income payments based on earnings history | Hospital (Part A), Medical (Part B), Prescription drugs (Part D) |

| Administration | Social Security Administration (SSA) | Centers for Medicare & Medicaid Services (CMS) |

| Financial Impact | Supports retirement and survivor income stability | Reduces out-of-pocket medical expenses for seniors |

Overview of Social Security and Medicare

Social Security provides financial support to retirees, disabled individuals, and survivors, while Medicare offers health insurance primarily for people aged 65 and older and certain younger individuals with disabilities. Both programs are funded through payroll taxes under the Federal Insurance Contributions Act (FICA) and serve as critical components of the U.S. social safety net. Understanding how your Social Security retirement benefits and Medicare coverage work together can help you plan for financial stability and healthcare needs in retirement.

Purpose and Goals of Each Program

Social Security primarily aims to provide financial support through retirement, disability, and survivor benefits to eligible individuals, ensuring income stability. Medicare focuses on delivering health insurance coverage to people aged 65 and older, as well as certain younger individuals with disabilities, promoting access to medical care. While both programs serve social welfare objectives, Social Security targets income security, and Medicare addresses healthcare needs for seniors and disabled beneficiaries.

Eligibility Requirements Compared

Social Security eligibility requires earning 40 credits through paid work, typically about 10 years, with full benefits available at full retirement age ranging from 66 to 67 depending on birth year. Medicare eligibility begins at age 65, regardless of work credits, with automatic enrollment for those receiving Social Security benefits, while others must apply manually. Unlike Social Security, which is based on work history and age, Medicaid eligibility depends on income and state-specific criteria, serving low-income individuals and families.

Funding Sources and Sustainability

Social Security is primarily funded through payroll taxes under the Federal Insurance Contributions Act (FICA), with contributions split between employees and employers, ensuring a dedicated revenue stream for retirement, disability, and survivors benefits. Medicare financing combines payroll taxes, general tax revenues, and beneficiary premiums, creating a multi-source funding approach that supports hospital insurance (Part A) and supplementary services (Parts B and D). Sustainability challenges differ: Social Security faces long-term solvency concerns due to demographic shifts, while Medicare contends with rising healthcare costs and an aging population, prompting ongoing policy discussions about funding reforms and cost control measures.

Key Benefits and Coverage Differences

Social Security provides monthly financial support based on your work history to retirees, disabled individuals, or survivors, focusing on income replacement. Medicare delivers healthcare coverage primarily for those aged 65 and older, offering hospital insurance (Part A), medical insurance (Part B), and prescription drug plans (Part D). Understanding these key benefits and coverage differences helps you optimize your retirement planning and healthcare needs effectively.

Application and Enrollment Process

The Social Security application process involves submitting an online or in-person application through the Social Security Administration, with eligibility based on age and work credits, while the Medicare enrollment requires signing up during specific periods like Initial Enrollment or General Enrollment, often via the official Medicare website or by contacting the Social Security office. Social Security benefits enrollment typically starts at age 62 for retirement, whereas Medicare coverage generally begins at age 65, requiring separate applications despite being administered by overlapping agencies. Understanding the distinct deadlines and documentation requirements, such as proof of age and work history for Social Security and proof of citizenship or residency for Medicare, is crucial for timely and successful enrollment.

Financial Impact on Retirees

Social Security provides a steady monthly income that helps retirees cover basic living expenses, significantly affecting your financial stability during retirement. Medicare primarily addresses healthcare costs, which can be substantial and unpredictable, reducing your out-of-pocket medical expenses and preserving retirement savings. Understanding the interplay between Social Security benefits and Medicare premiums is crucial for managing your overall financial impact and ensuring a secure retirement budget.

Common Myths and Misconceptions

Many individuals confuse Social Security and Medicare, mistakenly believing Social Security funds healthcare benefits or that Medicare covers all medical expenses without out-of-pocket costs. Another common misconception is that Social Security benefits are only for retired workers, while in reality, they also provide disability and survivor benefits. Understanding that Social Security primarily offers financial support, whereas Medicare specifically covers health insurance for seniors and some disabled individuals, clarifies the distinct roles of these programs.

Policy Challenges and Future Trends

Social Security faces policy challenges related to funding sustainability and demographic shifts, while Medicare struggles with rising healthcare costs and expanding coverage needs. Your financial security depends on adapting these programs to future trends like increased longevity and technological advancements in healthcare. Ensuring efficient resource allocation and policy reform is critical to maintaining benefits for aging populations.

Making Informed Choices for Retirement

Understanding the differences between Social Security, Medicare, and Medicaid is crucial for making informed choices for your retirement. Social Security provides monthly income benefits based on your work history, Medicare offers health insurance primarily for those 65 and older, while Medicaid supports low-income individuals with healthcare needs. Evaluating your eligibility, benefits, and coverage options ensures you optimize your retirement planning and healthcare decisions effectively.

Infographic: Social Security vs Medicare

relatioo.com

relatioo.com