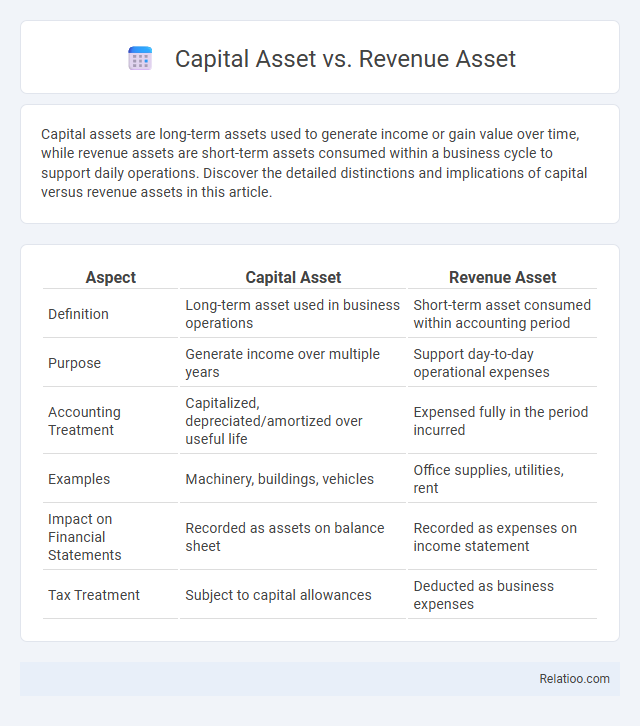

Capital assets are long-term assets used to generate income or gain value over time, while revenue assets are short-term assets consumed within a business cycle to support daily operations. Discover the detailed distinctions and implications of capital versus revenue assets in this article.

Table of Comparison

| Aspect | Capital Asset | Revenue Asset |

|---|---|---|

| Definition | Long-term asset used in business operations | Short-term asset consumed within accounting period |

| Purpose | Generate income over multiple years | Support day-to-day operational expenses |

| Accounting Treatment | Capitalized, depreciated/amortized over useful life | Expensed fully in the period incurred |

| Examples | Machinery, buildings, vehicles | Office supplies, utilities, rent |

| Impact on Financial Statements | Recorded as assets on balance sheet | Recorded as expenses on income statement |

| Tax Treatment | Subject to capital allowances | Deducted as business expenses |

Introduction to Capital Assets and Revenue Assets

Capital assets are long-term tangible or intangible assets used in business operations, such as machinery, buildings, and land, which provide value over multiple accounting periods. Revenue assets, in contrast, are short-term assets primarily involved in generating operational income, including inventory and accounts receivable. Understanding the distinction between capital assets and revenue assets is crucial for accurate financial reporting and tax treatment.

Defining Capital Assets

Capital assets refer to long-term assets used in business operations to generate income, typically including property, plant, and equipment, which are not intended for sale in the regular course of business. In contrast, revenue assets are short-term assets like inventory or accounts receivable that are actively involved in the production or sale of goods and services. Understanding capital assets helps in accurate financial reporting and tax treatment, as they are subject to depreciation or amortization over their useful life.

Defining Revenue Assets

Revenue assets are short-term assets used in the daily operations of a business, directly generating income through sales or services. Unlike capital assets, which are long-term and used for production or investment (such as property, plant, and equipment), revenue assets include inventory, accounts receivable, and cash equivalents. Your understanding of revenue assets helps accurately classify and manage assets for effective financial reporting and operational efficiency.

Key Differences Between Capital and Revenue Assets

Capital assets represent long-term investments such as property, machinery, or equipment, held to generate future economic benefits, while revenue assets are short-term assets like inventory or receivables intended for regular business operations and immediate sale. The primary difference lies in their usage and accounting treatment: capital assets are capitalized and depreciated over time, whereas revenue assets are expensed as part of operational costs in the accounting period they are used. Understanding this distinction is crucial for accurate financial reporting, tax calculation, and asset management strategies.

Examples of Capital Assets

Capital assets include property, machinery, and investments held for long-term appreciation or productive use, such as real estate, equipment, and stocks. Revenue assets consist of inventory or goods held for sale, like raw materials and finished products that generate short-term income. Your understanding of capital assets is crucial for tax planning, as they are subject to different depreciation rules and capital gains taxes compared to revenue assets.

Examples of Revenue Assets

Examples of revenue assets include inventory, accounts receivable, and prepaid expenses, as these are used in daily operations to generate income. In contrast, capital assets like machinery, buildings, and land are long-term assets used to produce goods or services over several years. Understanding the distinction helps businesses manage cash flow and optimize tax treatments effectively.

Accounting Treatment: Capital vs Revenue Assets

Capital assets are long-term assets used in business operations and subject to depreciation or amortization, reflecting their value over time in your financial statements. Revenue assets are short-term or current assets, consumed or sold within the accounting period, impacting your profit and loss directly through expenses. Differentiating capital versus revenue assets determines whether expenditures are capitalized and spread over future periods or expensed immediately, affecting asset valuation and tax treatment.

Tax Implications of Capital and Revenue Assets

Capital assets, such as real estate, stocks, and machinery, are subject to capital gains tax when sold, with tax rates often lower than ordinary income tax rates. Revenue assets, including inventory and accounts receivable, generate ordinary income and their sale proceeds are taxed as regular business income. Understanding the distinction between capital and revenue assets is crucial for accurate tax reporting and optimizing tax liabilities under prevailing tax regulations.

Importance in Financial Reporting

Capital assets represent long-term investments like property and equipment that are crucial for reflecting your company's fixed asset base in financial reports. Revenue assets, such as inventory and receivables, directly impact operational income and cash flow, making their accurate valuation essential for revenue recognition. Understanding the distinction between capital assets and revenue assets ensures precise asset classification, which enhances the accuracy and reliability of your financial statements.

Conclusion: Choosing the Right Asset Classification

Choosing the right asset classification impacts financial reporting, tax treatment, and business strategy. Capital assets, typically long-term investments like property or equipment, provide value over time and are depreciated or capitalized, whereas revenue assets are tied to a company's core operations and expenses are deducted immediately. Proper differentiation ensures accurate balance sheets and income statements, optimizing investment decisions and regulatory compliance.

Infographic: Capital Asset vs Revenue Asset

relatioo.com

relatioo.com