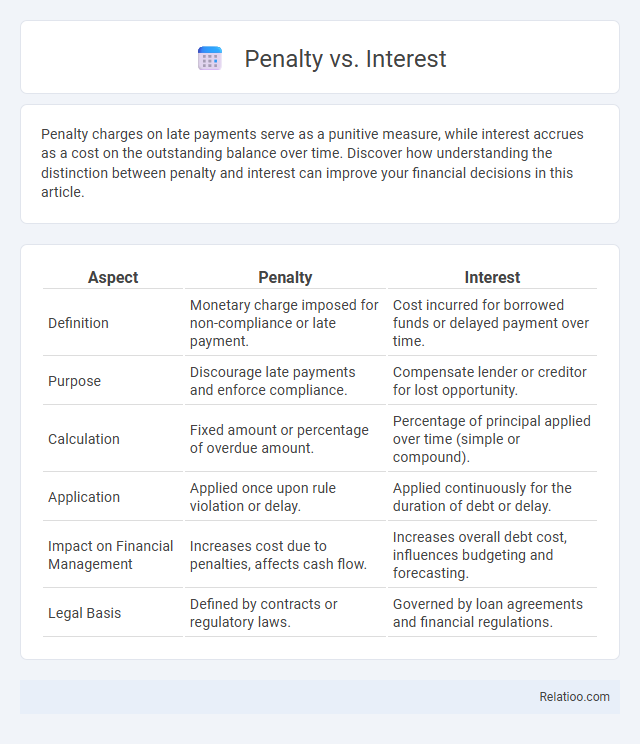

Penalty charges on late payments serve as a punitive measure, while interest accrues as a cost on the outstanding balance over time. Discover how understanding the distinction between penalty and interest can improve your financial decisions in this article.

Table of Comparison

| Aspect | Penalty | Interest |

|---|---|---|

| Definition | Monetary charge imposed for non-compliance or late payment. | Cost incurred for borrowed funds or delayed payment over time. |

| Purpose | Discourage late payments and enforce compliance. | Compensate lender or creditor for lost opportunity. |

| Calculation | Fixed amount or percentage of overdue amount. | Percentage of principal applied over time (simple or compound). |

| Application | Applied once upon rule violation or delay. | Applied continuously for the duration of debt or delay. |

| Impact on Financial Management | Increases cost due to penalties, affects cash flow. | Increases overall debt cost, influences budgeting and forecasting. |

| Legal Basis | Defined by contracts or regulatory laws. | Governed by loan agreements and financial regulations. |

Understanding Penalty and Interest: Key Definitions

Penalty refers to a financial charge imposed for violating rules or missing deadlines, while interest is the cost of borrowing money, calculated as a percentage of the principal amount over time. Understanding the distinction between penalty and interest is crucial for managing debts effectively, as penalties usually represent fixed fines, whereas interest accrues continuously based on outstanding balances. Both concepts play significant roles in finance and law enforcement, influencing payment behaviors and legal compliance.

Legal Basis for Penalties and Interest Charges

Penalties and interest charges are governed by specific legal provisions that define their application in tax and contractual obligations, with penalties imposed as punitive measures for non-compliance or late payment, while interest compensates for the time value of money during the delay. The legal basis for penalties often stems from tax codes, regulatory statutes, or contractual clauses specifying rates and enforcement mechanisms, whereas interest charges typically follow statutory rates outlined in financial laws or agreements to ensure fairness in compensation. Courts and regulatory agencies interpret these laws to ensure that penalties remain proportional and interest charges reflect reasonable compensation for delayed payments.

Main Differences Between Penalty and Interest

Penalty represents a punitive charge imposed for violating laws or agreements, often fixed or calculated as a percentage of the unpaid amount, whereas interest is a compensation for the time value of money, calculated as a percentage over time on outstanding balances. Penalties are intended to discourage non-compliance and late payments, while interest serves as a cost for borrowing or delaying payment. Both impact financial obligations differently, with penalties typically being one-time charges and interest accruing continuously until full payment.

Common Scenarios Triggering Penalties

Common scenarios triggering penalties include late payments, failure to file required tax returns on time, and underreporting income. Interest accrues on unpaid taxes from the due date until the balance is paid in full, compounding the financial burden beyond the initial penalty. Your awareness of these triggers helps avoid unnecessary fines and manage tax obligations effectively.

How Interest Is Calculated on Overdue Payments

Interest on overdue payments is calculated based on the outstanding principal amount multiplied by the interest rate and the time period the payment remains unpaid, often expressed as an annual percentage rate (APR). Penalties, unlike interest, are fixed fees or percentages imposed as punishment for late payment, while penalties and interest can both accumulate independently, increasing the total amount owed. Understanding how interest compounds or accrues daily is crucial for accurately determining the cost of overdue balances and managing financial obligations effectively.

Impact of Penalties and Interest on Taxpayers

Penalties impose fixed financial charges for violations such as late filing or underpayment of taxes, significantly increasing a taxpayer's total liability and potentially leading to long-term financial strain. Interest accrues on unpaid tax amounts at specified rates over time, compounding the taxpayer's debt and incentivizing prompt payment to avoid escalating costs. Both penalties and interest can deter non-compliance but also create substantial economic burdens, often affecting taxpayers' cash flow and increasing the urgency for effective tax planning.

Reducing or Avoiding Penalty and Interest

To reduce or avoid penalty and interest charges, you must ensure timely payment of your obligations by the due date set by the authority or creditor. Filing accurate and complete documentation promptly helps prevent errors that trigger penalties, while maintaining clear communication with tax agencies or lenders can lead to negotiated payment plans or penalty abatement. Monitoring deadlines and using automated reminders safeguard your financial standing by minimizing the risk of incurring costly penalties and accumulating interest.

Appeal Process for Penalty and Interest Assessments

The appeal process for penalty and interest assessments requires you to file a formal written protest with the tax authority within the specified deadline. Penalties often result from willful negligence or failure to comply with tax laws, while interest accrues on unpaid tax balances over time, both subject to separate appeal considerations. Understanding your rights and providing substantial documentation during the appeal can improve the chances of reducing or abating penalties and interest charges.

Real-life Examples of Penalty vs Interest Cases

Penalty fees often arise in loan agreements when payments are missed, such as a $50 late fee on a mortgage payment, while interest refers to the ongoing cost of borrowing, exemplified by a 5% annual interest rate on credit card balances. In real-life cases, the IRS imposes penalties for late tax filings, which can quickly exceed the interest accrued on unpaid taxes, demonstrating how penalties are designed to encourage timely compliance. Businesses frequently face both penalties and interest charges in vendor contracts, where failure to pay invoices may result in a 2% monthly penalty plus interest, increasing the total amount owed substantially over time.

Best Practices for Managing Financial Obligations

Effective management of financial obligations requires distinguishing penalties, which are enforced charges for non-compliance, from interest, which accrues as the cost of borrowing over time. Best practices include timely payment to avoid penalties, accurate calculation of interest to forecast expenses, and maintaining transparent records for audit compliance. Implementing automated tracking systems enhances accuracy and ensures adherence to deadlines, reducing financial risks and improving cash flow management.

Infographic: Penalty vs Interest

relatioo.com

relatioo.com