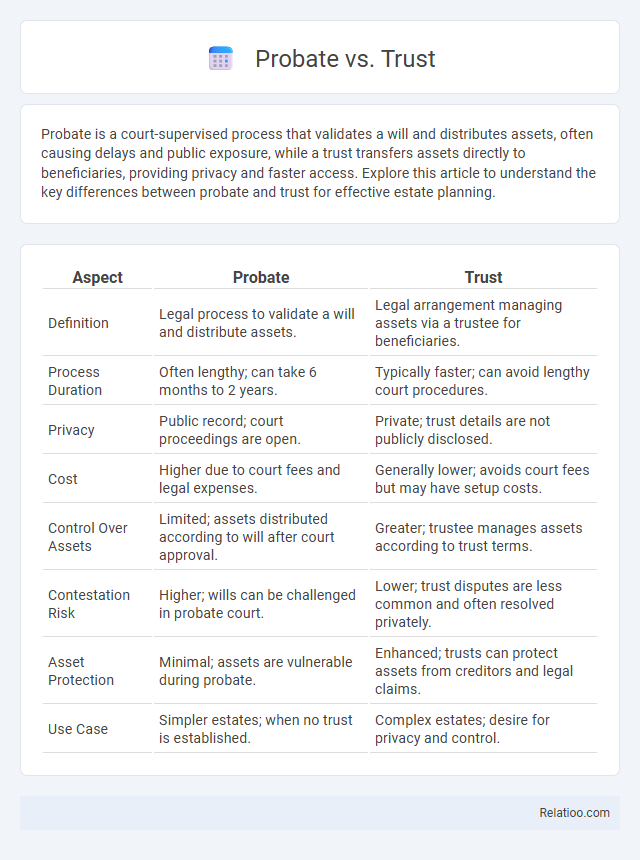

Probate is a court-supervised process that validates a will and distributes assets, often causing delays and public exposure, while a trust transfers assets directly to beneficiaries, providing privacy and faster access. Explore this article to understand the key differences between probate and trust for effective estate planning.

Table of Comparison

| Aspect | Probate | Trust |

|---|---|---|

| Definition | Legal process to validate a will and distribute assets. | Legal arrangement managing assets via a trustee for beneficiaries. |

| Process Duration | Often lengthy; can take 6 months to 2 years. | Typically faster; can avoid lengthy court procedures. |

| Privacy | Public record; court proceedings are open. | Private; trust details are not publicly disclosed. |

| Cost | Higher due to court fees and legal expenses. | Generally lower; avoids court fees but may have setup costs. |

| Control Over Assets | Limited; assets distributed according to will after court approval. | Greater; trustee manages assets according to trust terms. |

| Contestation Risk | Higher; wills can be challenged in probate court. | Lower; trust disputes are less common and often resolved privately. |

| Asset Protection | Minimal; assets are vulnerable during probate. | Enhanced; trusts can protect assets from creditors and legal claims. |

| Use Case | Simpler estates; when no trust is established. | Complex estates; desire for privacy and control. |

Understanding Probate and Trust: Key Differences

Probate is a legal process that validates a will and ensures the distribution of assets under court supervision, often causing delays and public disclosure of your estate. Trusts allow you to transfer assets directly to beneficiaries outside of probate, providing privacy and faster access to your property. Understanding these key differences helps you choose the best method for managing and protecting your inheritance efficiently.

What Is Probate? An Overview

Probate is the legal process through which a deceased person's estate is administered and distributed under court supervision, ensuring debts are paid and assets are properly transferred to heirs. Unlike trusts, which can bypass probate and provide faster access to assets, probate can be time-consuming and costly depending on the estate's complexity and jurisdiction. Understanding probate allows you to better plan your estate and minimize delays in transferring your assets after death.

What Is a Trust? Essentials Explained

A trust is a legal arrangement where one party, the trustee, holds and manages assets for the benefit of another, known as the beneficiary. Unlike probate, which is a public court process to validate a will and distribute assets, a trust allows your estate to avoid probate, ensuring privacy and faster transfer of assets. Trusts can be revocable or irrevocable, offering flexibility and control over how and when your property is distributed after your passing.

Probate Process: Steps and Timeline

The probate process involves validating a deceased person's will, inventorying assets, paying debts, and distributing the remaining estate under court supervision, typically lasting six months to over a year depending on complexity and jurisdiction. Trusts often bypass probate, allowing for faster asset transfer directly to beneficiaries, while inheritance through probate can face delays and legal fees. Understanding probate timelines and procedural steps is crucial for efficient estate planning and minimizing administrative burdens on heirs.

Types of Trusts: Revocable vs Irrevocable

Revocable trusts allow you to retain control over your assets, making changes or dissolving the trust during your lifetime, while irrevocable trusts transfer ownership permanently, offering potential tax benefits and creditor protection. Probate is a court-supervised process that validates wills and distributes assets, often resulting in delays and public record exposure, whereas trusts help avoid probate by privately managing and distributing your estate. Understanding the differences between revocable and irrevocable trusts is essential to choose the right estate planning tool to protect your assets and streamline your inheritance process.

Costs: Probate Fees vs Trust Expenses

Probate fees typically range from 2% to 5% of the estate's value, often including court costs, attorney fees, and executor fees, which can significantly reduce the net inheritance. Trust expenses usually involve initial setup costs between $1,500 and $5,000 and ongoing administration fees, but they generally avoid probate fees, resulting in overall lower costs. Choosing a trust can minimize legal fees and court involvement, preserving more wealth for beneficiaries compared to the often higher and more variable probate fees.

Timeframe: Probate Delays vs Trust Efficiency

Probate proceedings typically extend over six to twelve months due to court involvement and creditor notifications, often causing significant delays in asset distribution. Trusts, on the other hand, bypass probate, allowing beneficiaries expedited access to assets, frequently within weeks or a few months. Inheritance through probate can be time-consuming and costly, while trusts provide a more efficient and private mechanism for transferring wealth.

Privacy Concerns: Public Probate vs Private Trust

Probate is a public legal process that makes your estate details accessible to anyone, potentially compromising privacy after death. Trusts, however, are private arrangements that keep your assets and beneficiaries confidential, avoiding public disclosure. Choosing a trust over probate ensures your financial affairs remain protected from public scrutiny, preserving your family's privacy.

Asset Distribution: Probate Outcomes vs Trust Benefits

Probate involves a court-supervised process that validates a will and oversees the distribution of assets, often resulting in lengthy delays and public record disclosures. Trusts allow for private, streamlined asset distribution, bypassing probate and enabling immediate transfer of assets to beneficiaries upon the grantor's death. Inheritance through probate can become subject to creditor claims and higher administrative costs, whereas trusts offer protection against creditors and reduce estate taxes, ensuring more efficient and secure asset management.

Choosing the Right Option: Probate or Trust?

Choosing the right option between probate and trust involves evaluating factors such as asset type, estate size, and privacy preferences. Probate is a court-supervised process that can be time-consuming and public, while trusts offer a streamlined, private way to transfer assets directly to beneficiaries. Your decision should prioritize minimizing legal complexities, reducing costs, and ensuring a smooth transfer of your estate to meet your family's needs.

Infographic: Probate vs Trust

relatioo.com

relatioo.com