Late fees are fixed penalties charged for missed payments, while finance charges refer to the total cost of borrowing, including interest and fees. Understand the key differences between late fees and finance charges to manage your finances effectively; learn more in this article.

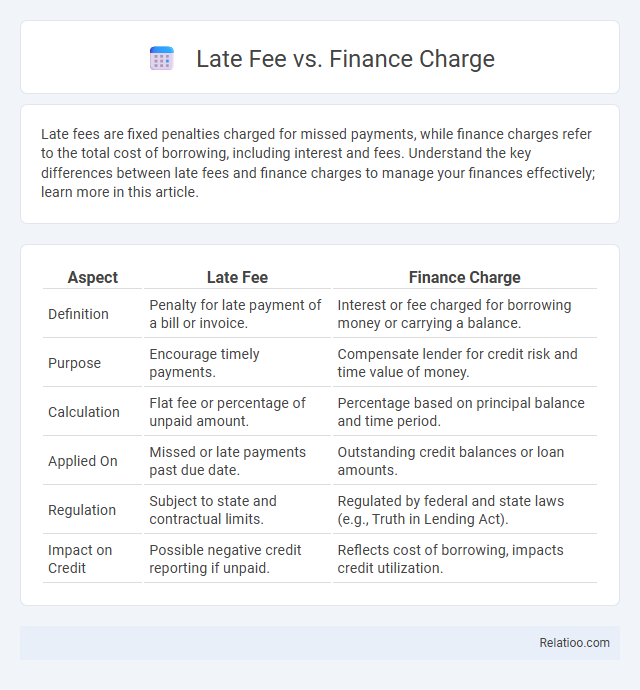

Table of Comparison

| Aspect | Late Fee | Finance Charge |

|---|---|---|

| Definition | Penalty for late payment of a bill or invoice. | Interest or fee charged for borrowing money or carrying a balance. |

| Purpose | Encourage timely payments. | Compensate lender for credit risk and time value of money. |

| Calculation | Flat fee or percentage of unpaid amount. | Percentage based on principal balance and time period. |

| Applied On | Missed or late payments past due date. | Outstanding credit balances or loan amounts. |

| Regulation | Subject to state and contractual limits. | Regulated by federal and state laws (e.g., Truth in Lending Act). |

| Impact on Credit | Possible negative credit reporting if unpaid. | Reflects cost of borrowing, impacts credit utilization. |

Understanding Late Fees: Definition and Purpose

Late fees are penalties charged when payment is not received by the due date, designed to encourage timely payments and cover administrative costs. Finance charges differ as they represent the cost of borrowing money, including interest and fees over time. Understanding these distinctions helps you manage your bills effectively and avoid unnecessary extra costs.

What is a Finance Charge? Explained

A finance charge represents the total cost of credit, including interest, fees, and other charges associated with borrowing money, whereas a late fee is a specific penalty for missing a payment deadline. Finance charges encompass a broader range of expenses such as interest rates, service fees, and finance-related costs, directly impacting the overall amount you owe on loans or credit cards. Understanding your finance charge helps you manage credit expenses effectively and avoid unnecessary penalties like late fees.

Key Differences Between Late Fees and Finance Charges

Late fees are fixed penalties imposed for overdue payments, typically a set amount or percentage of the past due balance, and are meant to incentivize timely payments. Finance charges encompass a broader category, including interest accrued on outstanding balances and any additional costs such as service fees, reflecting the overall cost of borrowing. The key difference lies in scope: late fees apply strictly to late payments, while finance charges represent the total cost of credit, incorporating interest and other related charges.

How Late Fees Impact Your Finances

Late fees increase your immediate financial burden by adding extra charges to overdue payments, which can quickly accumulate and strain your budget. Finance charges, often representing the total interest and fees over time, affect the overall cost of credit but may not be as immediately punitive as late fees. Understanding the distinction helps you manage your finances better and avoid unnecessary expenses that can jeopardize your credit score and financial health.

The Role of Finance Charges in Borrowing

Finance charges represent the total cost of borrowing, including interest and fees, directly impacting the overall expense of loans and credit. Late fees are specific penalties applied when payments are not made by the due date, distinct from finance charges but often adding to the borrower's debt burden. Understanding the role of finance charges helps borrowers assess loan affordability and make informed decisions about credit management.

Common Triggers for Late Fees and Finance Charges

Late fees commonly trigger when a payment is not received by the specified due date, often outlined in credit card or loan agreements. Finance charges accumulate based on the outstanding balance and the periodic interest rate, typically starting from the billing cycle's closing date. Late fees differ from finance charges as they are fixed penalties for missed deadlines, while finance charges represent the cost of borrowing over time.

Legal Regulations Governing Late Fees vs Finance Charges

Legal regulations governing late fees and finance charges vary by jurisdiction but generally distinguish between the two based on purpose and calculation. Late fees are penalties imposed for missed payments, regulated to ensure they are reasonable and not punitive, while finance charges refer to the cost of credit, including interest and related fees, governed by laws like the Truth in Lending Act (TILA). Understanding these regulations helps you avoid unlawful charges and ensures compliance with consumer protection standards.

Strategies to Avoid Late Fees and Finance Charges

Late fees and finance charges can significantly increase the cost of credit if payments are not made on time, with late fees typically being a fixed penalty and finance charges representing interest accrued on outstanding balances. Implementing strategies such as setting up automatic payments, maintaining a budget to ensure timely payments, and regularly monitoring account statements can effectively prevent these costly charges. Prioritizing payment schedules and communicating with creditors in case of potential delays can also help avoid late fees and minimize finance charges.

Comparing Late Fees and Finance Charges in Credit Cards

Late fees and finance charges are distinct costs associated with credit cards, where a late fee is a fixed penalty for missed or late payments, while finance charges are interest fees calculated on your outstanding balance. Finance charges vary based on your card's Annual Percentage Rate (APR) and the amount owed, impacting your overall debt more significantly over time. Understanding these differences helps you avoid extra costs and manage your credit effectively.

Final Thoughts: Choosing Smart Borrowing Practices

Late fees and finance charges significantly impact the cost of borrowing, with late fees imposed for missed payments and finance charges representing the overall cost of credit, including interest and fees. Understanding the differences helps borrowers avoid unnecessary expenses by prioritizing timely payments and seeking transparent lending terms. Adopting smart borrowing practices involves comparing APRs, evaluating penalty fees, and maintaining a consistent payment schedule to minimize financial strain.

Infographic: Late Fee vs Finance Charge

relatioo.com

relatioo.com