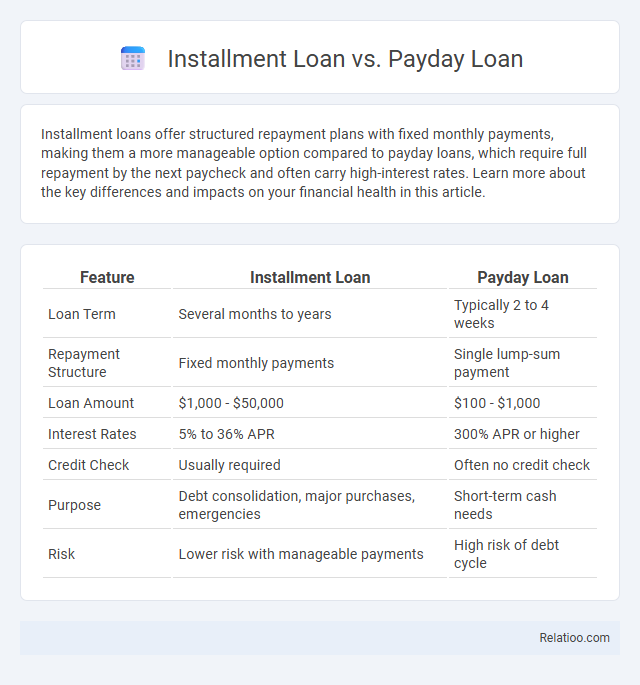

Installment loans offer structured repayment plans with fixed monthly payments, making them a more manageable option compared to payday loans, which require full repayment by the next paycheck and often carry high-interest rates. Learn more about the key differences and impacts on your financial health in this article.

Table of Comparison

| Feature | Installment Loan | Payday Loan |

|---|---|---|

| Loan Term | Several months to years | Typically 2 to 4 weeks |

| Repayment Structure | Fixed monthly payments | Single lump-sum payment |

| Loan Amount | $1,000 - $50,000 | $100 - $1,000 |

| Interest Rates | 5% to 36% APR | 300% APR or higher |

| Credit Check | Usually required | Often no credit check |

| Purpose | Debt consolidation, major purchases, emergencies | Short-term cash needs |

| Risk | Lower risk with manageable payments | High risk of debt cycle |

Introduction to Installment Loans and Payday Loans

Installment loans allow borrowers to repay borrowed funds over a set period with fixed monthly payments, making them suitable for larger expenses and better credit management. Payday loans are short-term, high-interest loans designed for immediate cash needs, typically due on the borrower's next paycheck. Understanding these loan types helps consumers choose financial products that match their repayment ability and urgency.

Key Differences Between Installment and Payday Loans

Installment loans involve borrowing a fixed amount repaid over a set period with regular monthly payments, often featuring lower interest rates and longer repayment terms. Payday loans are short-term, high-interest loans due on the borrower's next payday, usually designed for emergency cash and carrying higher fees and rates. Key differences include the repayment structure, interest rates, loan duration, and overall cost, with installment loans offering more manageable payments compared to the typically expensive and brief terms of payday loans.

Application Process Comparison

Installment loans require a detailed application involving credit checks, income verification, and longer approval times, reflecting their structured repayment plans over months or years. Payday loans have a swift, minimal application process with fewer requirements, often granting funds within hours based on proof of income and a bank account, intended for short-term borrowing. Traditional loans, such as personal or auto loans, involve comprehensive assessments of creditworthiness, employment history, and financial stability, typically taking several days to complete approval and disbursement.

Loan Amounts and Repayment Terms

Installment loans typically offer larger loan amounts ranging from $1,000 to $100,000 with repayment periods spanning several months to years, allowing for scheduled payments. Payday loans provide smaller amounts, usually between $100 and $1,500, with very short repayment terms, often due on the borrower's next paycheck within two to four weeks. General loan categories vary widely, but understanding the distinct differences in loan sizes and repayment schedules helps borrowers select options aligned with their financial needs and capacity.

Interest Rates and Fees Explained

Installment loans generally offer lower interest rates and fixed monthly payments spread over a longer period, making them more affordable compared to payday loans. Payday loans have extremely high interest rates and fees, often resulting in an annual percentage rate (APR) exceeding 300%, which can trap borrowers in a cycle of debt. Understanding these differences helps you choose a loan that aligns with your financial situation and minimizes costly fees.

Eligibility and Approval Requirements

Installment loans typically require proof of steady income, a good credit score, and a thorough credit check, making eligibility stricter compared to payday loans, which often approve borrowers based on minimal requirements like a regular paycheck and an active bank account. Payday loans have faster approval times, usually within minutes to a few hours, but come with higher interest rates and shorter repayment terms, while installment loans require a more detailed application process but offer longer repayment periods and lower interest rates. General loans, such as personal or secured loans, vary widely in eligibility criteria depending on the lender and loan type, but usually demand comprehensive documentation, including credit history, income verification, and collateral in some cases.

Pros and Cons of Installment Loans

Installment loans offer fixed monthly payments over a set period, making budgeting easier and often featuring lower interest rates compared to payday loans. Unlike payday loans that demand full repayment by your next paycheck, installment loans provide longer repayment terms, reducing financial strain but requiring disciplined payment to avoid fees. Your choice should consider the pros of steady payments and potential credit building against cons like possible higher total interest and the risk of overborrowing.

Pros and Cons of Payday Loans

Payday loans offer quick access to cash with minimal credit checks, making them ideal for urgent financial needs. Your main concern with payday loans is their high-interest rates and short repayment terms, which can lead to a cycle of debt if not managed carefully. Unlike traditional installment loans, payday loans lack flexible repayment options and often come with fees that increase your total repayment amount significantly.

Impact on Credit Scores

Installment loans typically have a positive impact on credit scores when payments are made on time, as they demonstrate responsible debt management over a longer term. Payday loans rarely affect credit scores directly since most lenders do not report them to credit bureaus, but failure to repay can lead to collections, damaging credit. General loans vary in impact based on type and repayment history, with timely payments boosting credit and defaults harming creditworthiness.

Which Loan Type is Right for You?

Installment loans offer structured repayment schedules with fixed monthly payments, making them ideal for borrowers seeking manageable long-term credit with lower interest rates. Payday loans provide quick cash but come with high fees and short repayment terms, suitable only for emergency expenses when immediate funds are necessary. Assess your financial situation and repayment ability to choose between the affordability and flexibility of installment loans or the convenience and cost risk of payday loans.

Infographic: Installment Loan vs Payday Loan

relatioo.com

relatioo.com