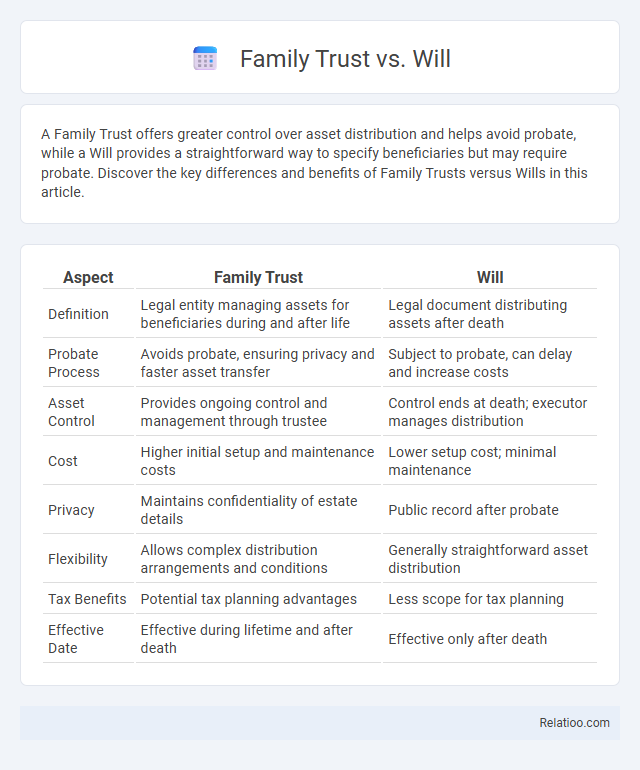

A Family Trust offers greater control over asset distribution and helps avoid probate, while a Will provides a straightforward way to specify beneficiaries but may require probate. Discover the key differences and benefits of Family Trusts versus Wills in this article.

Table of Comparison

| Aspect | Family Trust | Will |

|---|---|---|

| Definition | Legal entity managing assets for beneficiaries during and after life | Legal document distributing assets after death |

| Probate Process | Avoids probate, ensuring privacy and faster asset transfer | Subject to probate, can delay and increase costs |

| Asset Control | Provides ongoing control and management through trustee | Control ends at death; executor manages distribution |

| Cost | Higher initial setup and maintenance costs | Lower setup cost; minimal maintenance |

| Privacy | Maintains confidentiality of estate details | Public record after probate |

| Flexibility | Allows complex distribution arrangements and conditions | Generally straightforward asset distribution |

| Tax Benefits | Potential tax planning advantages | Less scope for tax planning |

| Effective Date | Effective during lifetime and after death | Effective only after death |

Introduction to Family Trusts and Wills

Family trusts and wills serve distinct purposes in estate planning, with family trusts managing asset distribution during and after the grantor's lifetime, while wills provide directives for asset allocation upon death. A family trust holds assets under a trustee's control for beneficiaries, offering privacy, probate avoidance, and potential tax benefits. Wills require probate, disclose assets publicly, and allow appointment of guardians for minor children, making them essential for comprehensive estate planning alongside or in place of a trust.

What Is a Family Trust?

A family trust is a legal arrangement where assets are held by a trustee for the benefit of family members, offering control over asset distribution and potential tax benefits. Unlike a will, which takes effect only after death, a family trust can manage and protect assets during the grantor's lifetime and beyond. This flexibility makes family trusts a powerful tool for estate planning, asset protection, and minimizing probate complexities.

What Is a Will?

A will is a legal document that outlines how a person's assets and property will be distributed after their death, ensuring that their wishes are honored. It appoints an executor to manage the estate, handle debts, and oversee the distribution process. Unlike family trusts that can provide ongoing management of assets during and after life, a will primarily takes effect upon death and requires probate.

Key Differences Between Family Trusts and Wills

Family trusts provide greater control over asset distribution and can help avoid probate, whereas wills take effect only after death and must go through probate court. Your family trust allows ongoing management of assets for beneficiaries, offering privacy and potential tax advantages, while a will offers straightforward inheritance instructions but is subject to public record and possible contestation. Understanding these key differences helps you choose the best estate planning tool to protect your family's financial future.

Benefits of Establishing a Family Trust

Establishing a family trust offers significant benefits including enhanced asset protection, tax efficiency, and control over wealth distribution, unlike a will which only takes effect after death. A family trust allows you to manage and safeguard your assets during your lifetime and provide for your beneficiaries according to your specific wishes. Your estate planning can be more flexible, ensuring financial security and privacy that a will alone cannot guarantee.

Advantages of Creating a Will

Creating a will ensures that Your assets are distributed according to Your wishes, providing clear instructions to avoid family disputes and probate delays. A will allows You to appoint guardians for minor children and specify funeral arrangements, offering peace of mind for Your family's future. Unlike a family trust, a will is often simpler and more cost-effective to establish, making it accessible for most individuals seeking direct control over their estate.

Common Drawbacks of Trusts and Wills

Family trusts offer benefits like asset protection and tax planning but often involve complex setup and ongoing administrative costs that can be burdensome. Wills are simpler and cost-effective but may face probate delays and less privacy, potentially exposing your estate to public scrutiny and disputes. Your choice between a family trust and a will should consider these drawbacks to ensure the most efficient estate planning strategy.

Tax Implications of Trusts vs Wills

Family trusts offer significant tax advantages by allowing income to be distributed among beneficiaries, potentially lowering overall tax liability, unlike wills, which do not provide tax planning benefits during the deceased's lifetime. Your estate can benefit from a family trust by minimizing estate taxes and avoiding probate, resulting in quicker asset transfer and greater privacy. Wills may trigger probate fees and higher estate taxes, making family trusts a more tax-efficient option for preserving wealth.

Choosing the Right Estate Planning Tool

Choosing the right estate planning tool depends on your specific goals, assets, and family dynamics. A family trust offers greater control over how and when your assets are distributed, providing privacy and potential tax benefits, while a will is simpler, outlining your wishes to be executed after death but often requiring probate. Understanding the differences helps safeguard your legacy and ensures your family's financial security aligns with your wishes.

Frequently Asked Questions on Trusts and Wills

Family trusts offer benefits like asset protection and probate avoidance, while wills provide a straightforward method for distributing assets after death; your choice depends on estate size, complexity, and privacy preferences. Frequently asked questions include how trusts differ from wills in managing assets, the costs involved, and the tax implications for beneficiaries. Understanding these differences ensures your estate plan aligns with your goals and provides clarity on control and succession.

Infographic: Family Trust vs Will

relatioo.com

relatioo.com