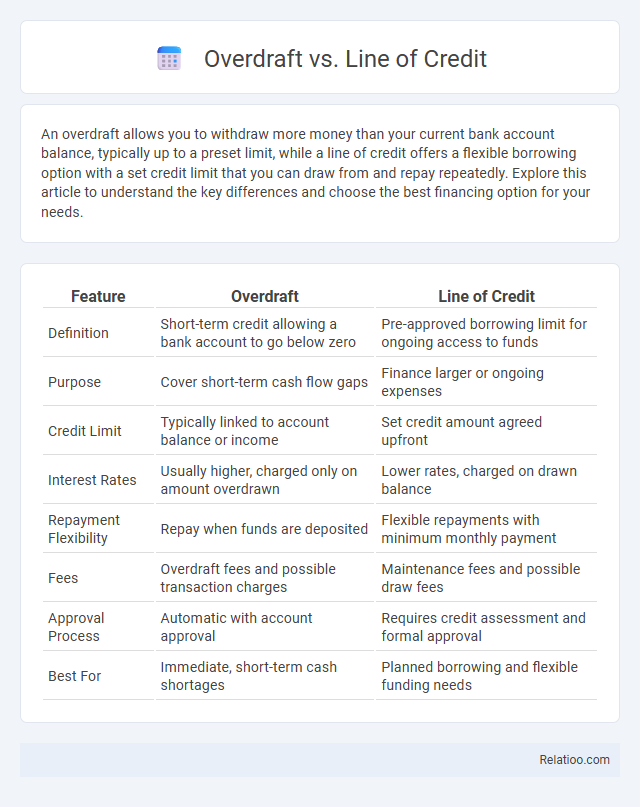

An overdraft allows you to withdraw more money than your current bank account balance, typically up to a preset limit, while a line of credit offers a flexible borrowing option with a set credit limit that you can draw from and repay repeatedly. Explore this article to understand the key differences and choose the best financing option for your needs.

Table of Comparison

| Feature | Overdraft | Line of Credit |

|---|---|---|

| Definition | Short-term credit allowing a bank account to go below zero | Pre-approved borrowing limit for ongoing access to funds |

| Purpose | Cover short-term cash flow gaps | Finance larger or ongoing expenses |

| Credit Limit | Typically linked to account balance or income | Set credit amount agreed upfront |

| Interest Rates | Usually higher, charged only on amount overdrawn | Lower rates, charged on drawn balance |

| Repayment Flexibility | Repay when funds are deposited | Flexible repayments with minimum monthly payment |

| Fees | Overdraft fees and possible transaction charges | Maintenance fees and possible draw fees |

| Approval Process | Automatic with account approval | Requires credit assessment and formal approval |

| Best For | Immediate, short-term cash shortages | Planned borrowing and flexible funding needs |

Understanding Overdraft and Line of Credit

Understanding overdraft and line of credit involves recognizing their roles in managing short-term cash flow needs. An overdraft allows your bank account to go below zero up to an approved limit, providing immediate access to funds for unforeseen expenses and transaction coverages. A line of credit offers a pre-approved borrowing limit that you can draw from repeatedly, with interest charged only on the amount used, making it a flexible option for ongoing financial demands.

Key Differences Between Overdraft and Line of Credit

An overdraft allows You to withdraw more money than your current account balance up to a set limit, mainly for short-term liquidity needs, while a line of credit provides a pre-approved borrowing amount that You can draw from repeatedly with flexible repayment options. Overdrafts typically incur higher interest rates and fees compared to lines of credit, which often have lower interest rates and may offer interest-only payments on borrowed amounts. Key differences include usage purpose, cost structure, repayment terms, and borrowing limits, making lines of credit more suitable for planned, ongoing expenses compared to overdrafts designed for unexpected shortfalls.

How Overdraft Works

An overdraft allows account holders to withdraw more money than their current balance up to an approved limit, effectively providing short-term credit directly linked to a checking account. Interest is typically charged only on the amount overdrawn and the duration of the overdraft, making it a flexible, on-demand borrowing option. Unlike a line of credit, which is a separate loan facility with a structured repayment plan, an overdraft automatically activates when funds are insufficient, offering seamless access to additional cash flow.

How Line of Credit Works

A line of credit is a flexible borrowing option that allows you to access funds up to a predetermined limit whenever needed, with interest charged only on the amount used. Unlike an overdraft, which automatically covers transactions exceeding your current bank balance, a line of credit requires active drawdowns and repayments, offering greater control over your finances. Understanding how a line of credit works helps you manage cash flow efficiently while minimizing unnecessary interest payments.

Advantages of Using an Overdraft

An overdraft provides immediate access to funds beyond your account balance, ensuring you can cover unexpected expenses without applying for a new loan. Unlike a line of credit, overdrafts typically have lower interest rates and flexible repayment terms based on your current account activity. Using an overdraft enhances your financial flexibility, offering a convenient safety net for short-term cash flow management.

Benefits of a Line of Credit

A Line of Credit offers flexible access to funds up to a predetermined limit, allowing you to borrow only what you need and pay interest solely on the utilized amount. Compared to overdraft protection, it provides lower interest rates and structured repayment terms, reducing the risk of unexpected fees. Your financial management improves with the convenience of revolving credit, enabling smoother cash flow without the immediate impact on your account balance.

Common Use Cases for Overdraft and Line of Credit

Overdrafts commonly serve as short-term solutions for covering unexpected expenses or bridging gaps in your checking account, preventing declined transactions and fees. Lines of credit offer more flexible, higher-limit borrowing tailored for ongoing cash flow management, larger purchases, or business expenses requiring multiple draws. Your choice depends on immediate, small-scale needs or sustained financial support with repayment options.

Cost Comparison: Interest Rates and Fees

Overdrafts typically incur higher interest rates and daily fees compared to lines of credit, which offer lower interest rates and more flexible repayment terms. Lines of credit often have fixed or variable interest rates ranging from 5% to 15%, while overdraft fees can include a flat transaction fee plus interest rates as high as 20% to 30%. Comparing cost efficiency, lines of credit are generally more economical for longer-term borrowing, whereas overdrafts are suited for short-term, emergency cash needs despite their higher fees.

Choosing the Right Option for Your Financial Needs

Choosing between an overdraft, line of credit, and credit card depends on your financial needs, spending habits, and repayment ability. An overdraft provides short-term access to funds linked directly to your checking account, ideal for covering unexpected expenses or occasional cash flow gaps. A line of credit offers a flexible borrowing limit with lower interest rates, suitable for ongoing or larger expenses, while credit cards are convenient for everyday purchases but tend to carry higher interest rates if balances are not paid in full.

Frequently Asked Questions: Overdraft vs Line of Credit

Overdraft and line of credit both provide short-term borrowing options but differ in structure and cost; overdrafts allow you to spend beyond your account balance up to an approved limit with interest typically charged daily, while lines of credit offer a pre-approved borrowing limit with flexible repayment and often lower interest rates. Your choice depends on how frequently you need access to funds and the fees associated with each option, as lines of credit usually have maintenance fees and overdrafts can include overdraft fees. Understanding these differences helps you manage cash flow effectively and avoid unexpected financial charges.

Infographic: Overdraft vs Line of Credit

relatioo.com

relatioo.com