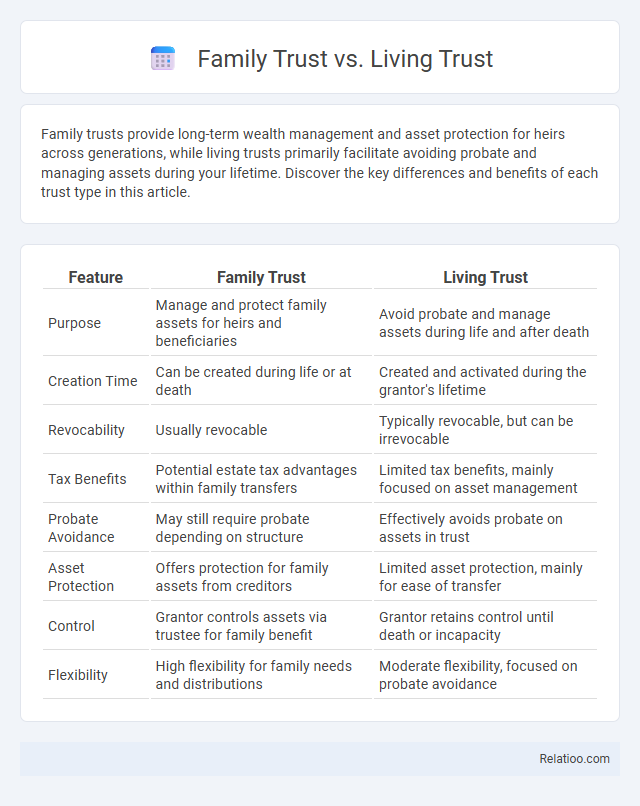

Family trusts provide long-term wealth management and asset protection for heirs across generations, while living trusts primarily facilitate avoiding probate and managing assets during your lifetime. Discover the key differences and benefits of each trust type in this article.

Table of Comparison

| Feature | Family Trust | Living Trust |

|---|---|---|

| Purpose | Manage and protect family assets for heirs and beneficiaries | Avoid probate and manage assets during life and after death |

| Creation Time | Can be created during life or at death | Created and activated during the grantor's lifetime |

| Revocability | Usually revocable | Typically revocable, but can be irrevocable |

| Tax Benefits | Potential estate tax advantages within family transfers | Limited tax benefits, mainly focused on asset management |

| Probate Avoidance | May still require probate depending on structure | Effectively avoids probate on assets in trust |

| Asset Protection | Offers protection for family assets from creditors | Limited asset protection, mainly for ease of transfer |

| Control | Grantor controls assets via trustee for family benefit | Grantor retains control until death or incapacity |

| Flexibility | High flexibility for family needs and distributions | Moderate flexibility, focused on probate avoidance |

Understanding Family Trusts: Definition and Purpose

A Family Trust is a legal arrangement designed to manage and protect your family's assets, ensuring seamless inheritance and tax benefits. Living Trusts are established during your lifetime to avoid probate and provide flexibility in asset management, while Family Trusts specifically emphasize safeguarding wealth for current and future generations. Understanding these distinctions helps you choose the right trust to secure your family's financial legacy effectively.

Overview of Living Trusts: Key Features

Living trusts offer a flexible estate planning tool that allows individuals to manage assets during their lifetime and outline distribution after death while avoiding probate. Key features include revocability, enabling the grantor to modify or cancel the trust, and privacy, as living trusts are not public records. Unlike family trusts, living trusts can hold various asset types and provide continuity of management in case of incapacity.

Family Trust vs Living Trust: Core Differences

Family Trusts primarily protect family assets and ensure seamless wealth transfer across generations, while Living Trusts focus on avoiding probate and managing assets during your lifetime. Your Family Trust often includes specific provisions for beneficiaries and may offer stronger creditor protection, whereas a Living Trust provides more flexibility for asset management and can become effective immediately upon creation. Understanding these core differences helps you choose the trust type that best safeguards your estate and meets your financial goals.

Advantages of Establishing a Family Trust

Establishing a Family Trust offers significant advantages, including enhanced asset protection, streamlined estate management, and potential tax benefits that safeguard your family's wealth across generations. Compared to a Living Trust, a Family Trust often provides more comprehensive control over asset distribution and privacy, avoiding probate while preserving family intentions. You can ensure your loved ones receive financial stability and seamless inheritance through a well-structured Family Trust, minimizing legal complications and preserving family legacy.

Benefits of a Living Trust for Estate Planning

A living trust offers significant benefits for estate planning by allowing assets to bypass probate, ensuring faster and more private distribution to beneficiaries. Unlike a family trust, which may focus on managing wealth within a family over generations, a living trust provides flexibility during the grantor's lifetime, including asset management in case of incapacity. Utilizing a living trust helps avoid court supervision, reduces estate settlement costs, and can simplify asset transfer upon death.

Tax Implications: Family Trusts vs Living Trusts

Family Trusts and Living Trusts differ significantly in tax implications, with Family Trusts often offering more flexibility for income splitting and estate tax planning, potentially reducing overall tax liability for your beneficiaries. Living Trusts primarily serve to avoid probate and provide seamless asset management during your lifetime, but they typically do not offer significant tax advantages compared to Family Trusts. Understanding these distinctions is crucial for optimizing your estate plan's tax efficiency and protecting your family's financial future.

Probate Avoidance: Which Trust Is More Effective?

A Family Trust and a Living Trust are often used interchangeably, but the key difference lies in their specific purposes and structure, with both designed to avoid probate by holding assets in trust during the grantor's lifetime and distributing them according to the trust terms upon death. Probate avoidance is most effectively achieved through a Revocable Living Trust, which allows assets to bypass the probate process entirely, ensuring privacy and faster distribution. While Family Trusts can be tailored for asset protection and estate tax benefits, they must be carefully structured to fully avoid probate, making the Living Trust generally more efficient for this specific goal.

Asset Protection: Family Trust Compared to Living Trust

A Family Trust offers stronger asset protection compared to a Living Trust by shielding your assets from creditors, lawsuits, and divorce settlements. Unlike a Living Trust, which primarily focuses on avoiding probate and ensuring smooth asset transfer, a Family Trust provides more comprehensive control and safeguards for your wealth during your lifetime and after death. Your estate benefits from enhanced privacy and security with a Family Trust, making it a preferred choice for long-term asset protection.

Choosing the Right Trustee: Factors to Consider

Choosing the right trustee for your Family Trust or Living Trust involves evaluating fiduciary experience, trustworthiness, and the ability to manage complex financial matters effectively. Consider how well the trustee can handle family dynamics, maintain impartiality, and communicate transparently with beneficiaries to prevent conflicts. Your decision impacts the smooth administration of assets and the fulfillment of your estate planning goals.

Determining the Best Trust for Your Family’s Needs

Choosing the best trust for your family's needs depends on factors such as asset protection, privacy, and control over distribution. A Family Trust consolidates family assets for collective benefit, while a Living Trust offers flexibility and avoids probate by managing assets during the grantor's lifetime. Evaluating estate size, tax considerations, and long-term goals helps determine whether a Family Trust or Living Trust aligns better with your family's financial and legal priorities.

Infographic: Family Trust vs Living Trust

relatioo.com

relatioo.com