A mortgage broker acts as an intermediary connecting borrowers with multiple mortgage lenders to find the best loan options, while a mortgage lender directly provides funds for home loans. Discover detailed differences and how to choose the right professional for your needs in this article.

Table of Comparison

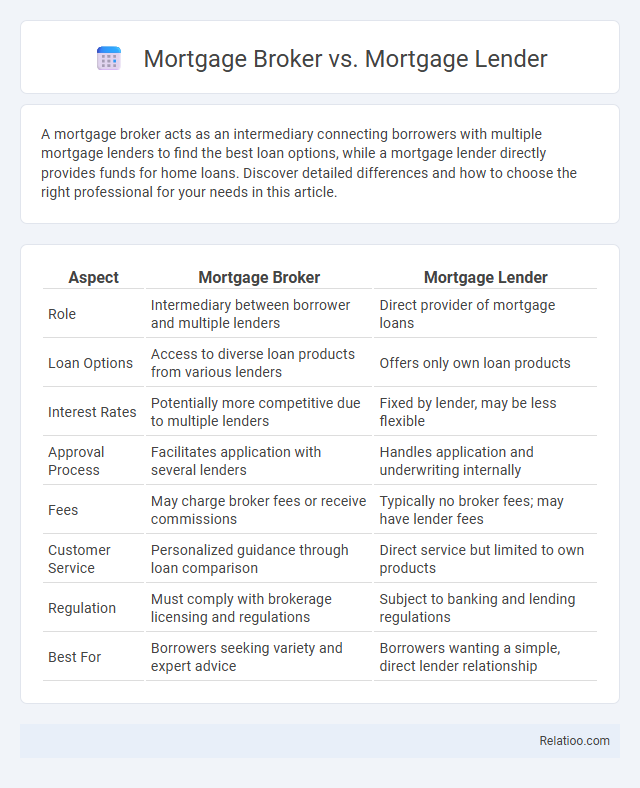

| Aspect | Mortgage Broker | Mortgage Lender |

|---|---|---|

| Role | Intermediary between borrower and multiple lenders | Direct provider of mortgage loans |

| Loan Options | Access to diverse loan products from various lenders | Offers only own loan products |

| Interest Rates | Potentially more competitive due to multiple lenders | Fixed by lender, may be less flexible |

| Approval Process | Facilitates application with several lenders | Handles application and underwriting internally |

| Fees | May charge broker fees or receive commissions | Typically no broker fees; may have lender fees |

| Customer Service | Personalized guidance through loan comparison | Direct service but limited to own products |

| Regulation | Must comply with brokerage licensing and regulations | Subject to banking and lending regulations |

| Best For | Borrowers seeking variety and expert advice | Borrowers wanting a simple, direct lender relationship |

Introduction: Mortgage Broker vs Mortgage Lender

Mortgage brokers act as intermediaries who connect You with multiple mortgage lenders to find the best loan options tailored to Your financial needs. Mortgage lenders are institutions or individuals that directly provide funds for home loans and manage the loan process from application to closing. Understanding the roles of both helps You make informed decisions when securing a mortgage.

What is a Mortgage Broker?

A mortgage broker acts as an intermediary connecting borrowers with multiple mortgage lenders to find the best loan options tailored to the borrower's financial situation. Unlike mortgage lenders who provide the actual funds for home loans, brokers facilitate the application process, negotiate terms, and gather paperwork from various lending institutions. Mortgage brokers offer access to diverse loan programs, improving approval chances and potentially securing lower interest rates compared to direct lender applications.

What is a Mortgage Lender?

A mortgage lender is a financial institution or individual that provides funds to borrowers to purchase or refinance real estate, typically secured by a mortgage loan. You work directly with the lender to secure the mortgage, which involves evaluating your creditworthiness, income, and financial situation to determine the loan terms and interest rates. Unlike a mortgage broker who acts as a middleman connecting you with multiple lenders, the mortgage lender is the actual source of your loan funds.

Key Roles and Responsibilities

Mortgage brokers act as intermediaries who connect You with multiple lenders, helping to find the best loan terms and rates based on Your financial profile. Mortgage lenders provide the actual funds for the loan, underwrite the application, and set the terms of repayment, carrying full responsibility for loan approval and disbursement. The mortgage itself is a legal agreement that secures the loan with the property as collateral, outlining Your repayment obligations and lender protections.

Pros and Cons of Using a Mortgage Broker

Mortgage brokers act as intermediaries connecting borrowers with multiple lenders, offering access to a wide range of mortgage products and potentially better rates. They save time and provide personalized advice but may charge fees or have limited control over the loan approval process. Borrowers should weigh the broker's expertise and variety against costs and transparency compared to directly working with mortgage lenders or banks.

Pros and Cons of Working with a Mortgage Lender

Working with a mortgage lender offers direct communication and potentially faster loan approvals since they control the funds. You may benefit from lower interest rates and streamlined processes but might face less flexibility in loan options compared to mortgage brokers. The cons include limited lender comparison and possibly stricter qualification criteria, which could reduce your chance of securing the best mortgage deal.

Cost Differences: Fees and Commissions

Mortgage brokers typically charge fees or receive commissions from lenders, which can increase your overall mortgage cost but may offer access to competitive loan options. Mortgage lenders set interest rates and borrower fees directly, often resulting in more transparent cost structures but less variety in loan products. Understanding these distinctions helps you evaluate the true cost differences beyond just interest rates, including application fees, underwriting fees, and broker commissions.

Which Is Better for Your Situation?

Choosing between a mortgage broker, lender, and mortgage depends on your financial situation and preferences. A mortgage broker offers access to multiple lenders and loan options, helping you compare rates, while a mortgage lender provides funds directly and may offer faster approval but fewer choices. Your best option hinges on whether you value personalized comparisons and flexibility (broker) or quicker, simpler transactions (lender) tailored specifically to your credit and financial goals.

Key Questions to Ask Before Choosing

Key questions to ask before choosing between a mortgage broker, lender, or mortgage include understanding the differences in their roles: a mortgage broker acts as an intermediary connecting borrowers with multiple lenders, while a mortgage lender provides funds directly to borrowers. Verify the interest rates, fees, and loan options each offers, and inquire about their approval timelines and customer service responsiveness. Assess whether you prefer a broader range of mortgage products via a broker or potentially faster processing through a direct lender to match your financial needs and goals.

Conclusion and Final Recommendations

Choosing between a mortgage broker, mortgage lender, and direct mortgage depends on Your financial needs and preferences for service. A mortgage broker offers access to multiple lenders and loan options, while a mortgage lender provides funds directly, often with stricter qualifying criteria. For personalized advice and a broader range of loan products, a mortgage broker is typically recommended, but if speed and a straightforward process are priorities, working directly with a mortgage lender might be more suitable.

Infographic: Mortgage Broker vs Mortgage Lender

relatioo.com

relatioo.com