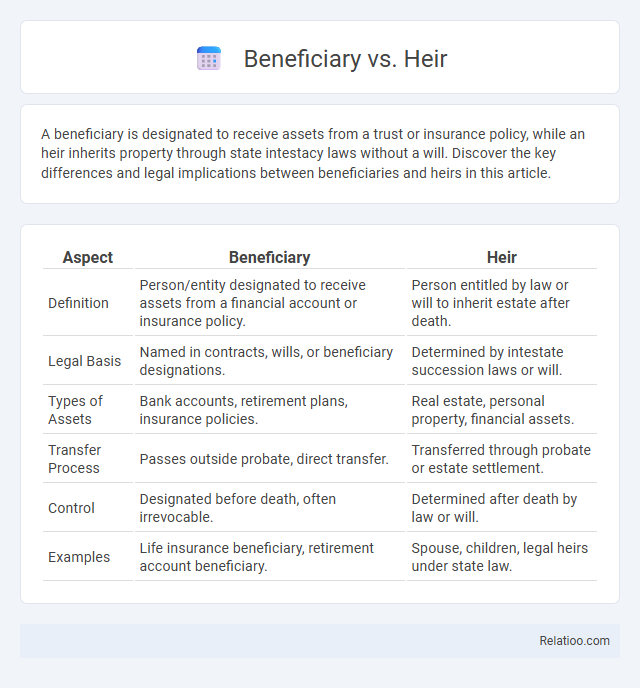

A beneficiary is designated to receive assets from a trust or insurance policy, while an heir inherits property through state intestacy laws without a will. Discover the key differences and legal implications between beneficiaries and heirs in this article.

Table of Comparison

| Aspect | Beneficiary | Heir |

|---|---|---|

| Definition | Person/entity designated to receive assets from a financial account or insurance policy. | Person entitled by law or will to inherit estate after death. |

| Legal Basis | Named in contracts, wills, or beneficiary designations. | Determined by intestate succession laws or will. |

| Types of Assets | Bank accounts, retirement plans, insurance policies. | Real estate, personal property, financial assets. |

| Transfer Process | Passes outside probate, direct transfer. | Transferred through probate or estate settlement. |

| Control | Designated before death, often irrevocable. | Determined after death by law or will. |

| Examples | Life insurance beneficiary, retirement account beneficiary. | Spouse, children, legal heirs under state law. |

Understanding the Basics: Beneficiary vs Heir

A beneficiary is an individual or entity designated to receive assets from a will, trust, insurance policy, or retirement account, whereas an heir is someone legally entitled to inherit property under state intestacy laws if there is no valid will. Your understanding of these distinctions ensures proper estate planning and asset distribution according to your wishes. Beneficiaries are specifically named in legal documents, while heirs are identified by default based on familial relationships.

Legal Definitions: Who Is a Beneficiary?

A beneficiary is a person or entity designated to receive assets or benefits from a trust, will, insurance policy, or retirement account, defined by legal documents specifying entitlement. An heir typically refers to a relative designated by state intestacy laws to inherit property when no will exists, emphasizing legal kinship rather than explicit designation. Unlike heirs, beneficiaries have a legally recognized right to inherit as named in a formal legal instrument, making the distinction crucial in estate planning and probate proceedings.

Heirs Explained: Who Qualifies as an Heir?

Heirs are individuals legally entitled to inherit property or assets from a deceased person, typically determined by state intestacy laws when no valid will exists. Qualifying heirs usually include spouses, children, parents, and sometimes siblings or more distant relatives, depending on jurisdictional statutes. Unlike beneficiaries designated in a will or trust, heirs inherit based on lineage and legal priority rather than explicit testamentary instructions.

Key Differences Between Beneficiaries and Heirs

Beneficiaries are individuals or entities explicitly named in a legal document, such as a will or trust, to receive assets or benefits, while heirs are those entitled to inherit property under state intestacy laws when no will exists. Beneficiaries have a specific, designated claim based on the grantor's instructions, whereas heirs have a general claim established by law, often including spouses, children, or close relatives. The key difference lies in legal designation: beneficiaries gain assets through explicit bequests, heirs inherit by default succession rules.

How Are Beneficiaries Designated?

Beneficiaries are designated through legal documents such as wills, trusts, or beneficiary designations on financial accounts, ensuring specific assets are transferred according to the owner's wishes. Heirs receive property based on state intestacy laws when no valid will or beneficiary designation exists, typically prioritizing close relatives like spouses or children. The clear designation of beneficiaries overrides intestate succession, providing a more direct and personalized distribution of assets.

Inheritance Rights: What Heirs Are Entitled To

Heirs are legally entitled to inherit a portion of an estate according to state intestacy laws when there is no valid will, typically including spouses, children, and close relatives. Beneficiaries, named explicitly in a will or trust, receive specific assets or sums designated by the decedent, which can vary widely beyond the default heir distributions. Understanding your status as an heir or beneficiary is crucial for navigating inheritance rights, as heirs have statutory claims, whereas beneficiaries' rights depend on the decedent's testamentary documents.

Beneficiary Types: Primary vs Contingent

Beneficiary types include primary and contingent, where primary beneficiaries are first in line to receive assets from a will or trust, and contingent beneficiaries become eligible only if the primary beneficiaries cannot inherit. Your designation of primary versus contingent beneficiary ensures clear asset distribution in estate planning, avoiding probate delays or disputes. Understanding these distinctions helps secure your estate and protect your heirs' rights effectively.

Probate Process: Impact on Beneficiaries and Heirs

During the probate process, beneficiaries with designated assets in a will often receive their inheritance more directly compared to heirs who may inherit through intestate succession if no will exists. Probate validates the decedent's will and oversees asset distribution, which can delay or complicate the receipt of assets for both beneficiaries and heirs. Understanding the distinctions between beneficiaries named in a will and heirs entitled by law is essential for managing expectations and ensuring efficient estate settlement.

Changing or Contesting Beneficiaries and Heirs

Changing or contesting beneficiaries and heirs involves distinct legal processes that affect the distribution of your estate. Beneficiaries are designated in specific contracts such as life insurance policies or retirement accounts, allowing you to update or change them easily through a written beneficiary designation form. Heirs, determined by state probate laws or a will, may require a formal contest in probate court to challenge or modify their inheritance rights.

Making Informed Estate Planning Decisions

Understanding the distinctions between beneficiary, heir, and legatee is crucial for making informed estate planning decisions. A beneficiary is anyone designated to receive assets from an estate, often named in wills, trusts, or insurance policies, while an heir is typically a legal relative entitled to inherit under state intestacy laws. Properly identifying and categorizing these roles ensures clear asset distribution, minimizes legal disputes, and aligns with the testator's wishes for effective estate management.

Infographic: Beneficiary vs Heir

relatioo.com

relatioo.com