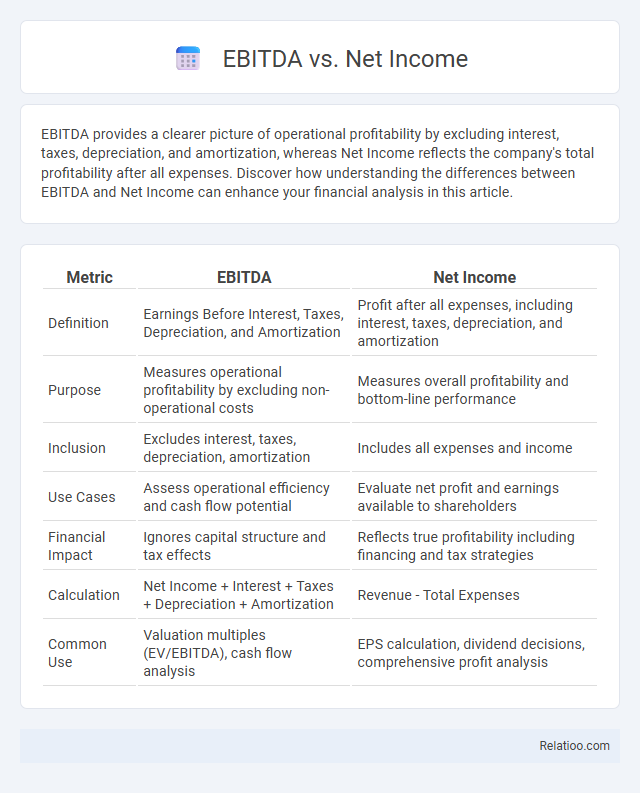

EBITDA provides a clearer picture of operational profitability by excluding interest, taxes, depreciation, and amortization, whereas Net Income reflects the company's total profitability after all expenses. Discover how understanding the differences between EBITDA and Net Income can enhance your financial analysis in this article.

Table of Comparison

| Metric | EBITDA | Net Income |

|---|---|---|

| Definition | Earnings Before Interest, Taxes, Depreciation, and Amortization | Profit after all expenses, including interest, taxes, depreciation, and amortization |

| Purpose | Measures operational profitability by excluding non-operational costs | Measures overall profitability and bottom-line performance |

| Inclusion | Excludes interest, taxes, depreciation, amortization | Includes all expenses and income |

| Use Cases | Assess operational efficiency and cash flow potential | Evaluate net profit and earnings available to shareholders |

| Financial Impact | Ignores capital structure and tax effects | Reflects true profitability including financing and tax strategies |

| Calculation | Net Income + Interest + Taxes + Depreciation + Amortization | Revenue - Total Expenses |

| Common Use | Valuation multiples (EV/EBITDA), cash flow analysis | EPS calculation, dividend decisions, comprehensive profit analysis |

Introduction to EBITDA and Net Income

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) measures a company's operating performance by excluding non-operational expenses, providing insight into core profitability. Net Income represents the total profit after all expenses, taxes, and interest are deducted, reflecting the company's bottom-line profitability. Both metrics are crucial components of financial statements, aiding investors and analysts in evaluating financial health and operational efficiency.

Definition of EBITDA

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) measures a company's operational profitability by excluding non-operating expenses and non-cash charges, providing insight into core business performance. Net Income represents the total profit after all expenses, including interest, taxes, depreciation, and amortization, reflecting the company's bottom-line profitability. Financial statements, such as the income statement, balance sheet, and cash flow statement, present comprehensive data on a company's financial health, with EBITDA often extracted from the income statement to evaluate operational efficiency.

Definition of Net Income

Net Income represents the total profit of a company after all expenses, taxes, and costs have been deducted from total revenue and is a key indicator of financial health in financial statements. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) focuses on operational profitability by excluding non-operational expenses and non-cash charges, whereas Net Income reflects the bottom line including all financial activities. Financial statements provide comprehensive reports, with Net Income prominently featured in the income statement as a measure of overall profitability.

Key Differences Between EBITDA and Net Income

EBITDA measures a company's operating performance by excluding interest, taxes, depreciation, and amortization, providing insight into cash flow potential. Net income reflects the company's profitability after all expenses, including non-operating costs and taxes, are deducted from total revenue, providing a comprehensive view of financial health. Financial statements, such as the income statement, detail both EBITDA and net income, allowing investors to analyze operational efficiency versus overall profitability.

Calculation Methods for EBITDA and Net Income

EBITDA is calculated by adding back interest, taxes, depreciation, and amortization to net income, providing a clearer view of operational profitability by excluding non-operational expenses. Net income is derived by subtracting all expenses, including interest, taxes, depreciation, and amortization, from total revenue, reflecting the company's overall profitability after all costs. Understanding these calculation methods on your financial statement helps you evaluate performance from different perspectives: operational efficiency with EBITDA and net profitability with net income.

Pros and Cons of Using EBITDA

EBITDA offers a clear view of your company's operational performance by excluding non-operational expenses like interest, taxes, depreciation, and amortization, enhancing comparability across firms and industries. However, it ignores critical costs such as capital expenditures and changes in working capital, potentially overstating financial health when used alone. Net income provides a comprehensive bottom-line measure, reflecting all expenses and revenues, but can be influenced by accounting choices that EBITDA deliberately omits for clarity in operational profitability; leveraging both metrics alongside the full financial statement gives a balanced understanding of your business performance.

Pros and Cons of Using Net Income

Net Income reflects a company's total profitability after all expenses, including taxes and interest, making it a comprehensive measure for assessing financial performance in financial statements. A major advantage of using Net Income is its inclusion of all revenue and costs, providing a clear bottom-line figure for investors and stakeholders. However, its reliance on accounting policies and non-cash items can obscure true operational efficiency, which is better captured by EBITDA.

Impact on Financial Analysis and Decision Making

EBITDA provides a clearer view of operational profitability by excluding interest, taxes, depreciation, and amortization, aiding analysts in evaluating core business performance independent of financing and accounting decisions. Net income reflects the company's overall profitability after all expenses, including non-operational and one-time items, impacting decisions related to dividend policies and earnings quality assessment. Financial statements integrate these metrics, offering comprehensive data that influence strategic planning, investment evaluation, and risk assessment in financial analysis.

Common Misconceptions and Pitfalls

EBITDA often gets confused with net income, but it excludes interest, taxes, depreciation, and amortization, which can mislead your understanding of a company's profitability. Net income reflects the bottom line after all expenses, providing a clearer picture of financial health, yet many mistakenly treat EBITDA as a complete measure of earnings. Financial statements contain both metrics, but relying solely on EBITDA without considering net income and other statement components can result in inaccurate assessments of business performance.

Choosing the Right Metric for Business Evaluation

Choosing the right metric for business evaluation depends on Your specific goals and the nature of Your industry. EBITDA highlights operational profitability by excluding non-operational expenses, making it ideal for comparing companies with different capital structures. Net income provides a comprehensive view of overall profitability, including taxes and interest, and is essential for understanding the true bottom line reflected in financial statements.

Infographic: EBITDA vs Net Income

relatioo.com

relatioo.com