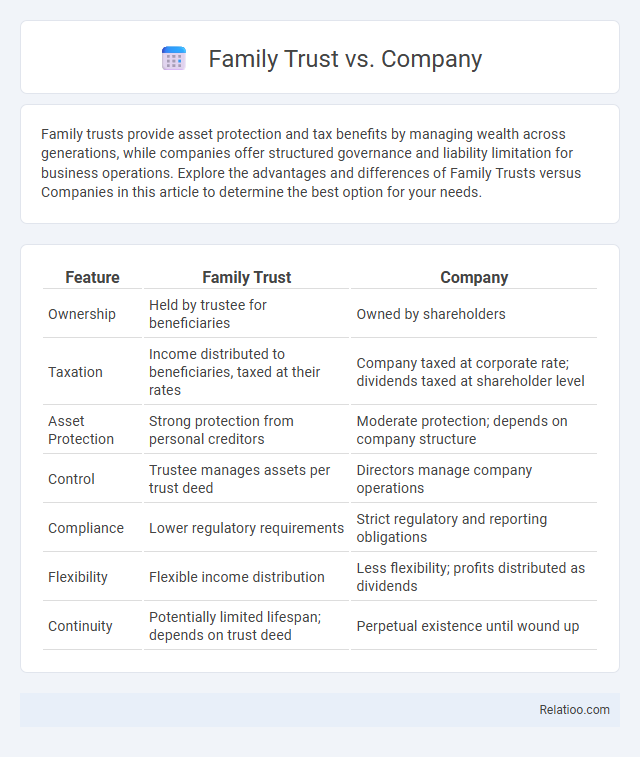

Family trusts provide asset protection and tax benefits by managing wealth across generations, while companies offer structured governance and liability limitation for business operations. Explore the advantages and differences of Family Trusts versus Companies in this article to determine the best option for your needs.

Table of Comparison

| Feature | Family Trust | Company |

|---|---|---|

| Ownership | Held by trustee for beneficiaries | Owned by shareholders |

| Taxation | Income distributed to beneficiaries, taxed at their rates | Company taxed at corporate rate; dividends taxed at shareholder level |

| Asset Protection | Strong protection from personal creditors | Moderate protection; depends on company structure |

| Control | Trustee manages assets per trust deed | Directors manage company operations |

| Compliance | Lower regulatory requirements | Strict regulatory and reporting obligations |

| Flexibility | Flexible income distribution | Less flexibility; profits distributed as dividends |

| Continuity | Potentially limited lifespan; depends on trust deed | Perpetual existence until wound up |

Understanding Family Trusts: Key Features

A Family Trust offers key features such as asset protection, tax planning flexibility, and control over wealth distribution to beneficiaries, distinguishing it from companies that focus on operational business activities and shareholder equity. Unlike companies, Family Trusts do not issue shares and provide privacy since the trust deed is not publicly registered, protecting family wealth across generations. Trusts also allow for income splitting among beneficiaries, optimizing overall tax liabilities, which is less flexible in corporate structures.

What is a Company Structure?

A company structure is a separate legal entity that provides limited liability protection to its shareholders and separates personal assets from business risks. It offers flexible ownership through shares, centralized management by directors, and regulatory obligations such as annual reporting and tax filings. Understanding your company structure helps optimize asset protection, tax efficiency, and business continuity within your overall family trust and corporate planning.

Asset Protection: Family Trust vs Company

A Family Trust offers robust asset protection by legally separating your personal assets from business liabilities, shielding them from creditors and legal claims. In contrast, a Company structure exposes business assets to potential risks but provides limited liability protection for shareholders, which may not fully safeguard personal wealth. Choosing the right structure depends on your priorities for asset protection, control, and tax planning.

Tax Implications Compared

Family trusts offer flexible income distribution, potentially minimizing tax liabilities by allocating income to beneficiaries in lower tax brackets, while companies face a flat corporate tax rate, currently 25% in many jurisdictions, with profits taxed before dividends are distributed and possibly subjected to shareholder tax. Compared to family trusts, companies provide limited tax planning options but benefit from retained earnings being taxed at the corporate rate rather than higher personal rates. Family partnerships combine elements of both, allowing profits to be split among partners for tax purposes, but lack the asset protection and succession benefits typically found in family trusts.

Succession Planning and Inheritance

Family trusts provide flexible succession planning by allowing control and assets to be passed to beneficiaries without probate, minimizing estate taxes and preserving wealth across generations. Companies offer structured governance and clear ownership transfer through shares, which can simplify business control but may face complex tax implications and less privacy. Combining a family trust with a company enhances inheritance strategies, leveraging trusts for asset protection and tax benefits while using corporate entities for operational control and streamlined succession.

Setup and Ongoing Costs

Setting up a Family Trust typically involves legal fees ranging from $2,000 to $5,000, with ongoing administration costs including accounting and tax compliance fees averaging $1,000 to $3,000 annually. Establishing a Company often requires registration fees around $400 to $1,000 plus ASIC charges, with ongoing costs such as annual review fees and bookkeeping expenses potentially exceeding $2,000 per year. Compared to a Family Trust, a Discretionary Family Trust may have higher setup costs due to complex deed preparation but can offer tax efficiency, while ongoing costs depend heavily on distribution complexity and compliance requirements.

Control and Management Differences

Family trusts offer centralized control by trustees who manage assets on behalf of beneficiaries, ensuring flexible distribution and protection from creditors. Companies provide structured management through directors with legal obligations, allowing shareholders limited influence unless they are also directors. Combining a family trust with a company enables enhanced control by appointing the company as trustee, which centralizes decision-making while maintaining asset protection and tax planning benefits.

Flexibility in Distribution of Profits

Family trusts offer significant flexibility in profit distribution by allowing trustees to allocate income among beneficiaries based on their individual tax situations, minimizing overall tax liabilities. Companies distribute profits as dividends to shareholders, which are less flexible since dividends must be proportionate to shareholdings, often resulting in uniform distribution. Combining a family trust with a company provides enhanced control, enabling the trust to own company shares and decide on dividend distribution, balancing flexibility and asset protection.

Compliance and Regulatory Requirements

Family trusts must adhere to the Australian Trusts Act and regularly file tax returns with the ATO, ensuring beneficiary distributions comply with trust deeds and taxation laws. Companies face stricter regulatory compliance under the Corporations Act 2001, requiring annual ASIC reporting, maintaining corporate governance standards, and meeting employee and tax obligations. While combining family trusts with companies can optimize asset protection and tax benefits, it increases regulatory complexity, necessitating meticulous record-keeping and compliance with both trust law and corporate regulations.

Choosing the Right Structure for Your Family and Business

Choosing the right structure for your family and business often hinges on factors like asset protection, tax efficiency, and control over wealth distribution. Family trusts offer strong asset protection and flexible income distribution but require careful management to avoid complex taxation, while companies provide limited liability and easier access to capital yet face stricter regulatory compliance. Evaluating your long-term goals, risk tolerance, and estate planning needs is essential in determining whether a family trust, a company, or a hybrid structure best supports your financial and familial objectives.

Infographic: Family Trust vs Company

relatioo.com

relatioo.com